President Joe Biden’s initiative to reform the worldwide tax system may be seriously jeopardized by Canada’s promise to move forward with a special tax on American internet companies.

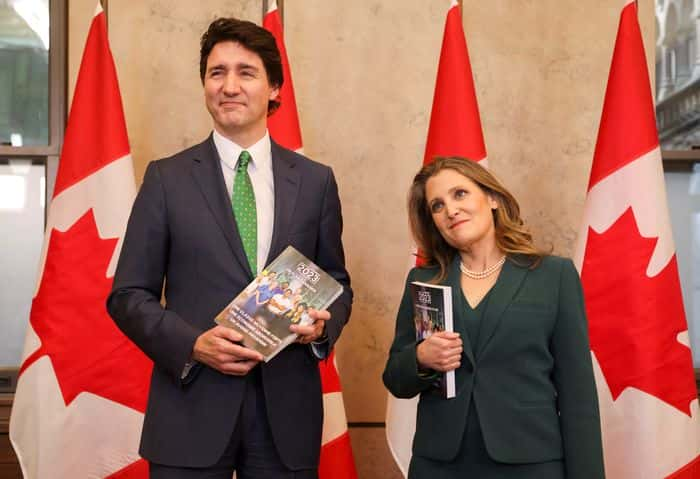

Officials are pleading Canadian counterparts to back off

A report from POLITICO said that it essentially amounts to a vote of no confidence in the protracted effort, and the administration is concerned that it would inspire other nations to do the same, unraveling years of challenging negotiations.

Officials are currently frantically pleading with their Canadian counterparts to back off, but so far with little success, according to Treasury Secretary Janet Yellen.

Consequently, we now have the spectacle of officials taking aim at one of the United States’ closest allies.

The Canadian government has been forewarned numerous times, according to Senate Finance Committee Chair Ron Wyden (D-Ore.). The Biden administration must consider all options available under the USMCA and other domestic laws to address this issue if Canada continues to pursue these discriminatory policies, and they will have my full support.

A draft of the tax plan, which officials aim to formally take up in the Parliament this fall, was issued by the government on Friday in a hint that Canada is serious about the tax.

READ ALSO: Florida State Tax Revenue Continues To Rise Following Adjustments In Total Sales Tax Collections

Administration to unite the rest of the world

It’s an unexpected turn in the administration’s efforts to unite the rest of the world in its stance on taxing massive multinational corporations.

The administration has already clashed with other nations; for instance, it revoked a tax agreement that had been in place with Hungary for 40 years because it was displeased with that nation for delaying the EU’s execution of a portion of the overall plan. Canada, however, is by far the most politically significant nation to have threatened the treaty thus far. Canada is a significant industrialized nation, a significant commercial partner, and a longtime ally.

The goal of the whole thing was to deter countries from imposing more and more “digital services taxes” on American internet firms in response to complaints that they were evading tax authorities throughout the world.

With a strategy to allocate corporate tax money from the greatest corporations in the world to nations where they sell goods and services, the effort was created to replace those, reports The Wall Street Journal.

READ ALSO: The Impact of the Employee Retention Tax Credit on Your Retirement Savings