In a move that could significantly impact the natural gas liquids market, Phillips 66, a major player in the U.S. oil refining industry, announced the acquisition of EPIC NGL for a whopping $2.2 billion. This ambitious deal promises to not only strengthen Phillips 66’s position in the natural gas liquids sector but also enhance its operations in the booming Permian Basin.

Details of the Epic Acquisition

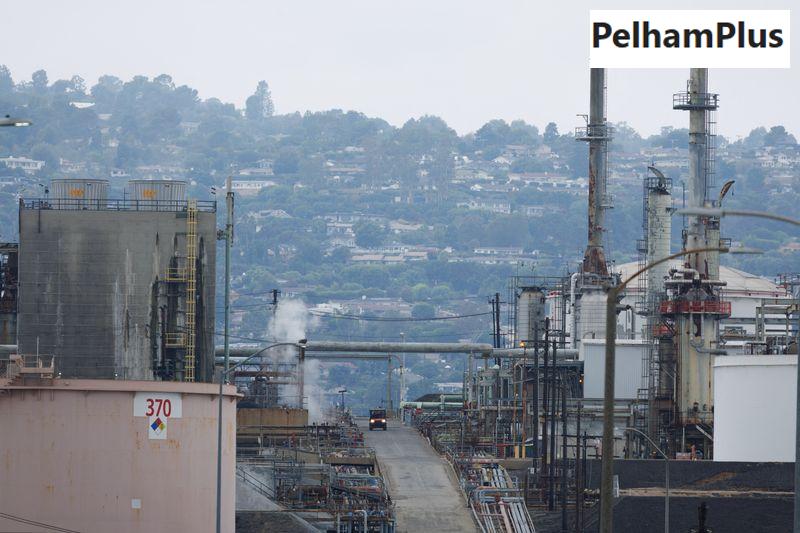

The agreement involves the purchase of extensive pipelines, fractionation facilities, and distribution systems that make up the EPIC NGL operations. These assets are crucial for transporting natural gas liquids from the rich production areas of the Permian Basin straight to the Gulf Coast. This strategic geography means that Phillips 66 will be in an optimal position to manage and distribute vital energy resources.

Boosting Earnings and Growth

According to Phillips 66 CEO Mark Lashier, this acquisition is expected to enhance the company’s earnings immediately, giving a solid boost to the earnings per share. The company also expects attractive returns that exceed their required investment hurdles, solidifying its growth trajectory as one of the leading gas liquid companies in the United States.

The Permian Basin: A Natural Resource Goldmine

The Permian Basin has become a powerhouse for oil and gas production, generating approximately 85% of U.S. natural gas liquids. This acquisition allows Phillips 66 to capitalize on the vast resources found in this region, further optimizing its natural gas liquid value chain and addressing rising energy demands.

A Continued Commitment to Growth

Phillips 66 has indicated that it does not plan to increase its capital program for 2025, which means that the company is focused on leveraging its existing operations to drive success. This approach reflects a commitment to further development and efficiency, ensuring that the investment in EPIC NGL will yield robust returns without additional strain on future budgets.

Previous Acquisitions and Future Outlook

This ambitious deal follows closely on the heels of Phillips 66’s earlier acquisition of Pinnacle Midland last year, which cost the company $550 million. With this track record of strategic acquisitions, Phillips 66 is clearly embedding itself deeper into the fabric of the natural gas liquid market, aiming to emerge as an even stronger competitor in the industry.

Conclusion

As Phillips 66 steps into this epic venture, the future looks bright for both the company and its stakeholders. By acquiring EPIC NGL’s pipeline and distribution infrastructure, Phillips 66 not only enhances its capabilities in delivering critical energy resources but also sets the stage for further achievements in the ever-evolving energy landscape.