In an effort to ensure financial support reaches all eligible Americans, the IRS has begun distributing automatic payments of up to $1,400 to taxpayers who missed out on previous pandemic-era stimulus benefits. These payments, part of the Recovery Rebate Credit (RRC), are set to reach bank accounts and mailboxes by late January 2025.

This initiative targets individuals who did not claim the credit on their 2021 tax returns. It’s a way for the government to make sure no one misses out on relief funds they are entitled to.

What Is the Recovery Rebate Credit?

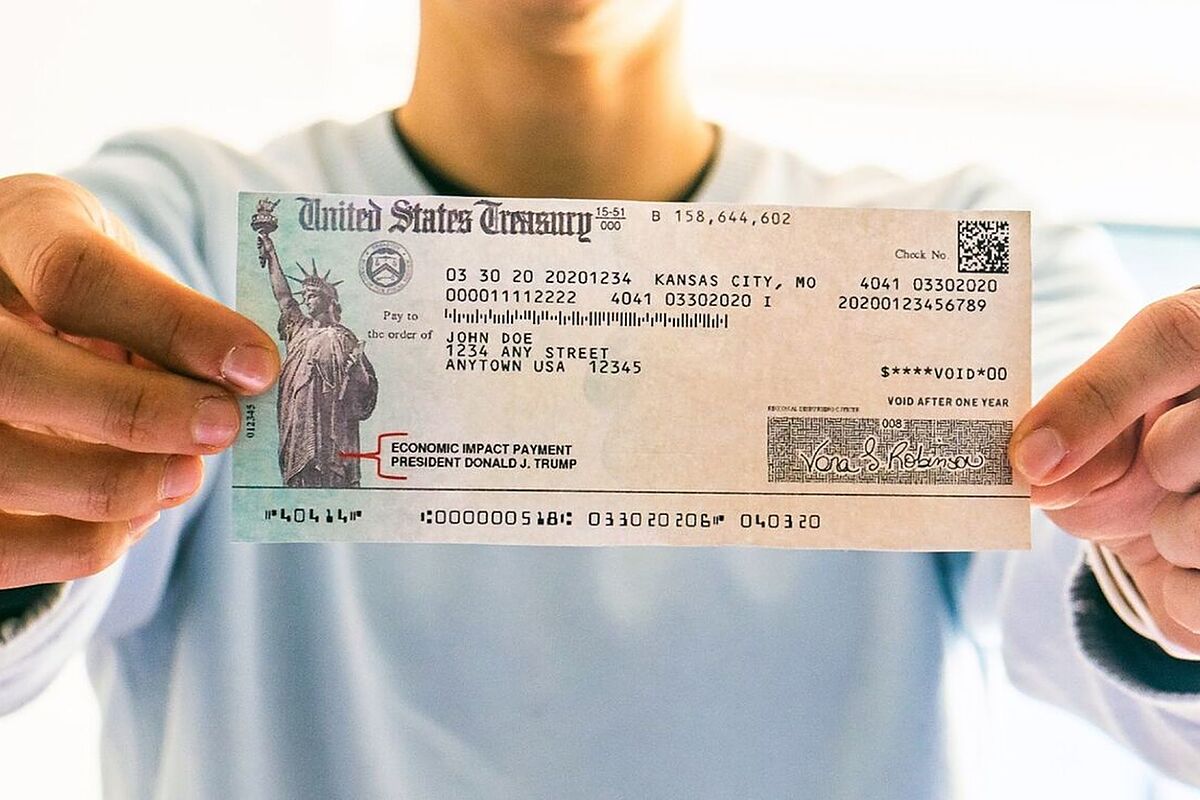

The RRC was created during the pandemic to help people who didn’t receive their full stimulus payments (also called Economic Impact Payments, or EIPs). It allowed taxpayers to claim the money they were owed on their tax returns. While millions benefited, many people either forgot or didn’t realize they qualified leaving the IRS to step in.

Now, with $2.4 billion in funds allocated for these missed payments, the IRS is automatically sending out checks or direct deposits to those who qualify.

Who Is Eligible?

The payments are automatic, but eligibility is key. Here’s what you need to know:

- Income Limits:

- Single filers earning up to $75,000 annually are eligible for the full $1,400.

- Married couples filing jointly can qualify if their combined income is up to $150,000.

- Heads of household with incomes up to $112,500 also qualify for the full amount.

For those earning slightly above these thresholds, the payments phase out gradually.

- Tax Return Requirement:

You must have filed a 2021 tax return to qualify. If you didn’t file yet, there’s still time—submit your return by April 15, 2025, to claim the RRC. - Residency Status:

U.S. residents are eligible, but nonresident aliens are not. - Dependent Status:

If someone claimed you as a dependent on their return, you’re ineligible.

No Action Needed, Here’s What Happens Next

If you’re eligible, the IRS will automatically send the payment to you. Direct deposits are being prioritized, but if your banking information isn’t available, you’ll receive a paper check in the mail. Keep an eye out for a notification letter confirming your payment, it’ll arrive shortly after the funds are sent.

Haven’t filed your taxes yet? Don’t worry! Filing your 2021 tax return will still give you the chance to claim this credit and receive the payment.

Why This Matters

This move by the IRS ensures millions of Americans receive the financial relief they deserve, particularly those who may have slipped through the cracks during the earlier rounds of stimulus payments. With many families still recovering from the financial strain of the pandemic, these funds could make a significant difference.

For more information on your eligibility or to check the status of your payment, visit the IRS website or consult a trusted tax professional.