Amid a rising tide of concerns about food insecurity affecting children in Nebraska, Governor [Governor’s Name] stands firm on his controversial decision to reject federal funding aimed at addressing the nutritional needs of vulnerable youngsters. This resolute stance has sparked a heated debate, as critics argue that denying these funds may exacerbate hunger-related challenges faced by children across the state. The governor’s decision unfolds against the backdrop of a broader national conversation on the responsibility of state leaders to leverage available resources for the welfare of their youngest constituents.

Controversial Rejection and Criticism

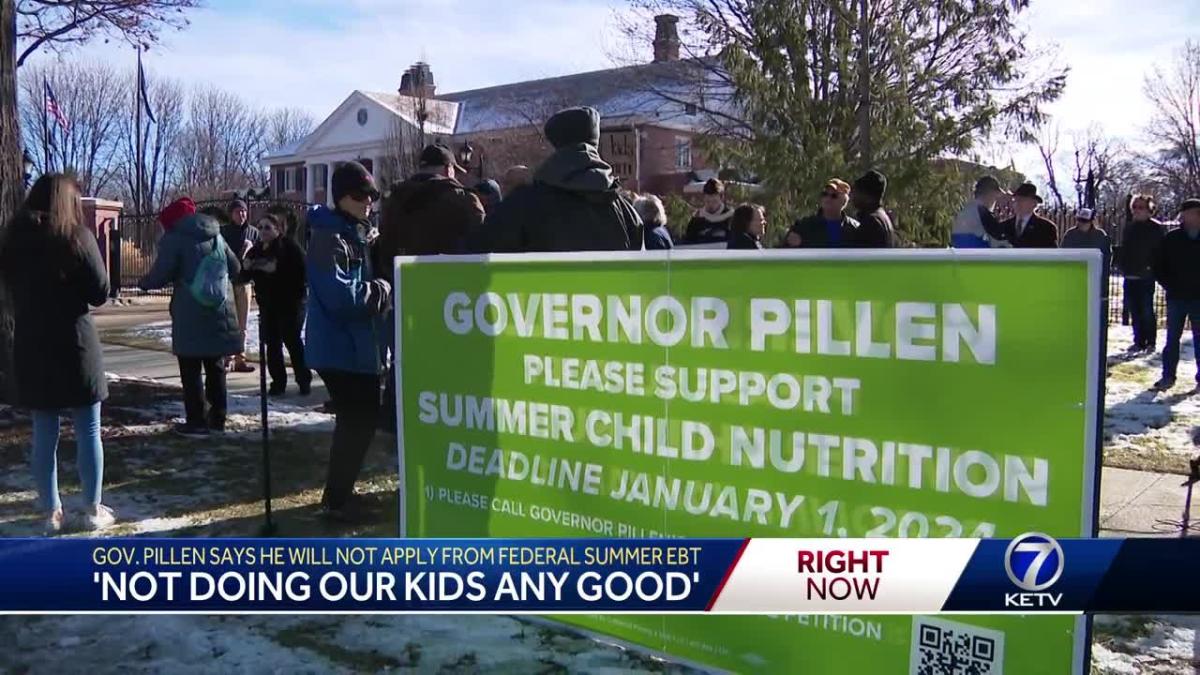

Nebraska Governor Jim Pillen remains steadfast in his refusal to accept $18 million in federal funding for the 2024 Summer Electronic Benefits Transfer for Children (Summer EBT) program.

The initiative, designed to assist children at risk of going hungry during the summer break, has drawn criticism from advocates for children and low-income families. Pillen’s decision has sparked a debate over the state’s responsibility and the termination of pandemic-era relief programs.

Governor Pillen’s rejection of the Summer EBT program, part of COVID-19 relief efforts, has ignited controversy. Advocates argue that the $18 million benefit outweighs the estimated $300,000 administrative cost to the state. Pillen’s defense, stating, “I don’t believe in welfare,” has faced backlash, with critics questioning the prioritization of political stances over addressing child hunger.

Pleas for Reconsideration and Public Outcry

Children’s advocacy group Nebraska Appleseed presented a petition with over 6,100 signatures urging the state to participate in the Summer EBT program. Signatories emphasized the program’s necessity, particularly amid rising inflation and financial strains on families.

Critics argue that on-site programs may not reach all families, especially in rural areas, highlighting the need for accessible solutions to combat child hunger.

READ ALSO: Car-Loan Borrowers Struggle as Interest Rates Rise, Impacting Negative Equity and Vehicle Values