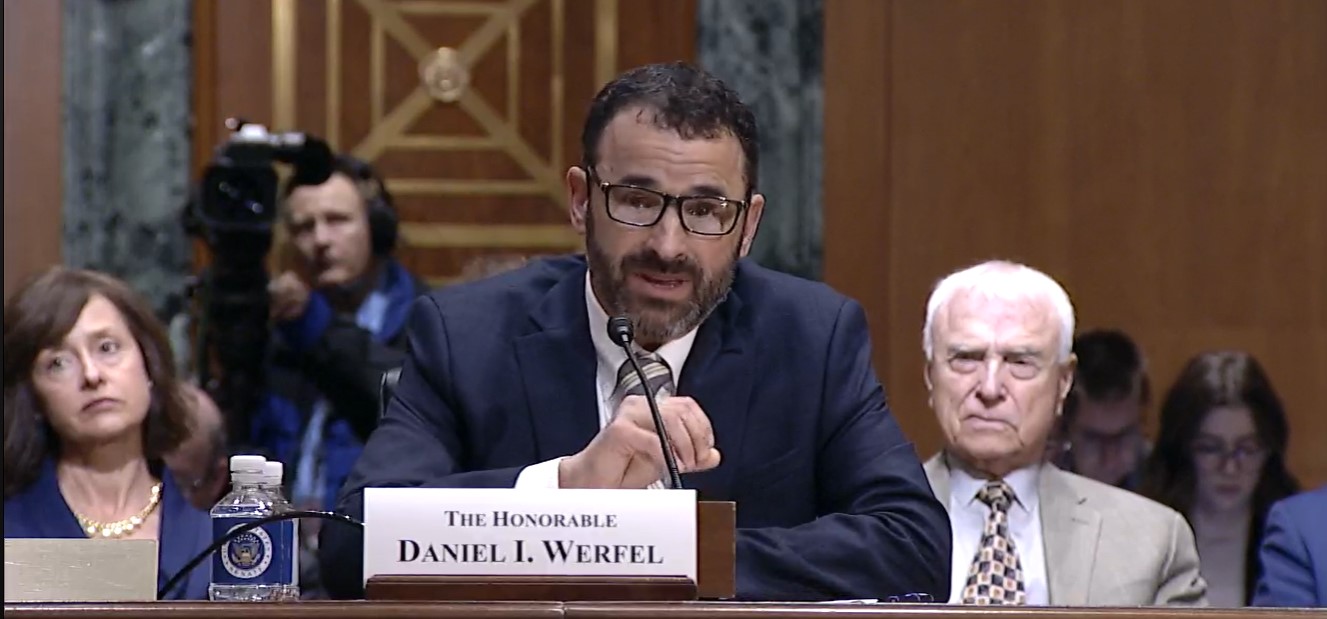

IRS Commissioner Daniel Werfel reassured taxpayers during his testimony before the House Ways and Means Committee, highlighting the agency’s efforts to address security vulnerabilities and streamline services for the upcoming tax season.

Improved Security Measures Implemented by IRS Commissioner Daniel Werfel

In his testimony, IRS Commissioner Daniel Werfel underscored the significant progress made by the IRS in rectifying security flaws that previously compromised taxpayers’ personal information. Werfel emphasized the agency’s commitment to protecting data and preventing unauthorized access to sensitive taxpayer data.

Under the leadership of IRS Commissioner Daniel Werfel, the agency has overcome operational challenges, including addressing backlogs and enhancing customer service. Werfel outlined plans to achieve an 85% level of service, demonstrating the IRS’s dedication to providing taxpayers with a smoother experience during the tax season.

IRS Commissioner Daniel Werfel assured Congress that, pending the approval of new tax legislation, the agency is prepared to expedite the distribution of child tax credit benefits to eligible families within six weeks, regardless of their tax filing status for the previous year.

READ ALSO: Collective Abundance Fund: Bringing Prosperity to Indigenous Communities

Commitment to Taxpayer Advocacy

Throughout his testimony, IRS Commissioner Daniel Werfel reiterated the agency’s commitment to prioritizing taxpayer interests. Werfel emphasized that individuals earning less than $400,000 annually need not be concerned about increased audit rates, underscoring the IRS’s focus on fairness and transparency in its operations.

Despite improving security and service delivery, IRS Commissioner Daniel Werfel acknowledged persistent challenges, including identity theft and stolen refund checks. Werfel highlighted ongoing efforts to leverage artificial intelligence responsibly and effectively, ensuring that taxpayer interactions with the IRS are efficient and equitable.

IRS Commissioner Daniel Werfel’s testimony underscores the agency’s commitment to safeguarding taxpayer data, improving service delivery, and addressing emerging challenges in tax administration. Through proactive measures and strategic initiatives, the IRS aims to instill confidence and trust among taxpayers while upholding the integrity of the nation’s tax system.

READ ALSO: Alabama Lottery Bill: A Historic Leap Towards Legalized Gambling in the Heart of the Deep South