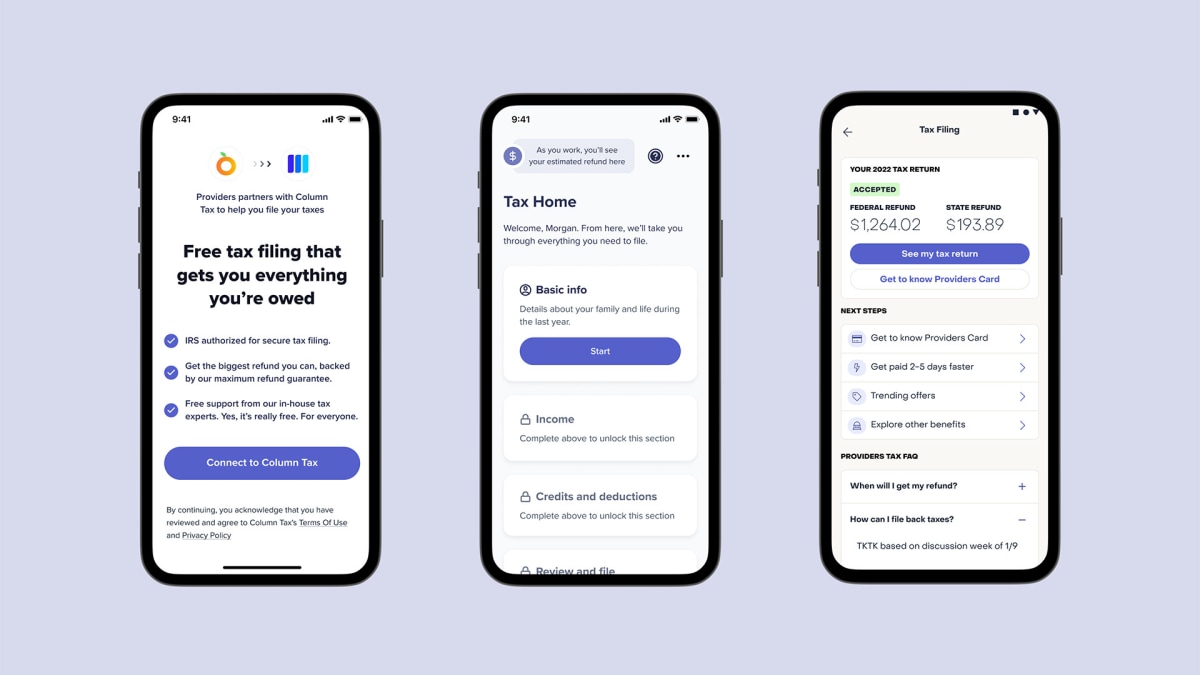

In a groundbreaking move to ease the tax-filing burden on millions of Americans, Current has announced a strategic partnership with Column Tax. The collaboration promises Current members a seamless and cost-free tax filing experience, allowing them to file directly from their phones in just 20 minutes. Moreover, the integration with Column Tax ensures expedited refunds, reaching members up to five days faster than traditional banking methods.

Current’s Vision for Streamlined Tax Filings

This week’s announcement reflects Current’s commitment to enhancing the financial well-being of its members. Recognizing the challenges faced by those juggling multiple jobs, the fintech platform has taken a significant step towards simplifying the tax filing process, making it more accessible and efficient for all.

The strategic partnership with Column Tax brings a game-changing aspect to tax filings. Current members can now enjoy free tax filing directly from their smartphones, eliminating the financial burden associated with traditional tax preparation services that often charge over $100.

Current’s Co-founder and CEO, Stuart Sopp, emphasizes the financial strain that traditional tax filing costs can impose on Americans. With the integration of Column Tax, members not only benefit from a cost-free filing process but also receive refunds up to five days faster. This accelerated timeline can significantly impact liquidity and help members navigate financial challenges promptly.

READ ALSO: COLA Social Security 2024: $4,873 Check in 24 Hours for Americans, Are you Eligible?

Empowering Millions with Financial Agility

Sopp underscores the importance of tax refunds in the current economic climate, where record credit card debt and inflation outpace wages. The partnership with Column Tax is positioned as a solution to provide millions of Americans with quicker access to valuable refund dollars, potentially alleviating financial stress.

Column Tax’s Co-founder and CEO, Gavin Nachbar, expresses enthusiasm about the partnership, highlighting how the connected tax filing via Current will empower millions of Americans with expedited access to crucial refund dollars. This is aligned with the broader goal of promoting financial resilience and agility in the face of economic uncertainties.

READ ALSO: Citibank User’s $1,500 Nightmare: Lost Mortgage Payment Sparks Frustration and Financial Panic