If you like buying expensive things, traveling, or eating at expensive restaurants but running out of money? What will you do? Borrow money or take a loan with high interest?

Personal Loan with Enough Credit Score

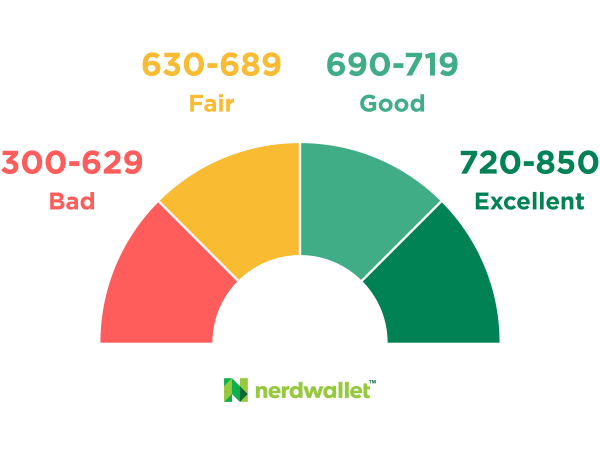

A personal loan is an easy way to apply for a loan application because it is an unsecured loan which means you don’t need to submit collateral or any documents. You need to prove that you are responsible and can pay the loan. For example, you have enough income, According to Investopedia. This is where credit score comes into play because a credit score is a 3-digit numeric summary of an individual’s history of loans.

READ ALSO: What Is a Credit Score? Definition, Factors, and Ways to Raise It

Ways To Improve Enough Credit Score:

If you’re planning to apply for a personal loan, Then it’s your time to improve your credit score.

- Paying on-time

- Increasing credit line

- Don’t close a credit card account

- Avoiding too many application loans

- Checking the errors in credit reports

Having a healthy credit score is a chance to be eligible for a personal loan. The financial instituition doesn’t want to know how you spend the money. You have the freedom to spend your money.