The IRS has begun distributing special payments of up to $1,400 to eligible taxpayers who missed out on earlier stimulus checks. This effort, which started in December 2024, is expected to provide $2.4 billion to roughly one million Americans.

Who Qualifies for These Payments?

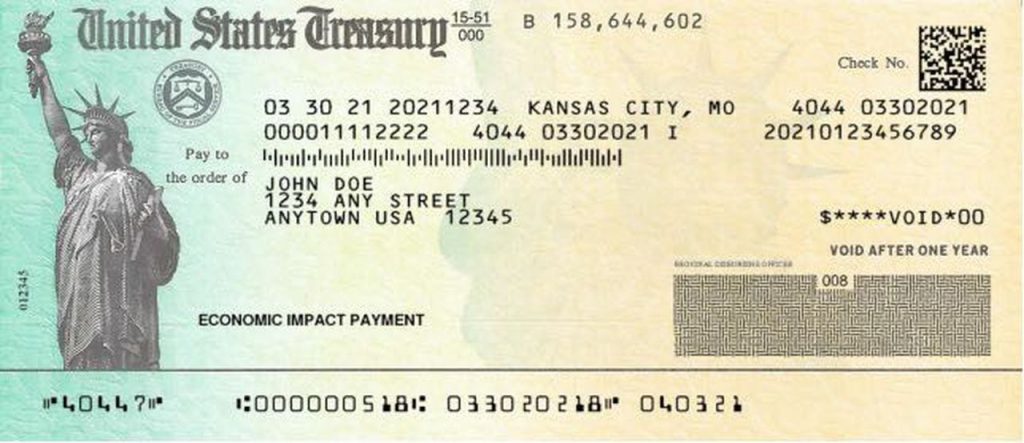

The payments target individuals who failed to claim the Recovery Rebate Credit on their 2021 tax returns. This credit is specifically for those who didn’t receive one or more of the Economic Impact Payments (stimulus checks) issued during the pandemic.

To qualify:

- Single filers must have earned less than $75,000 annually.

- Married couples filing jointly qualify with an income under $150,000.

- Heads of household are eligible with an income below $112,500.

If your income exceeds these limits, the payment amount is gradually reduced.

When Will You Receive Your Payment?

Payments began rolling out in December 2024, and most recipients will see their funds by the end of January 2025. The IRS is issuing payments via direct deposit or paper checks, depending on how taxpayers filed their most recent tax returns.

What You Need to Do

If you’re eligible, there’s good news, you don’t need to take any action. The IRS is processing payments automatically and sending letters to notify recipients. However, if you haven’t yet filed your 2021 tax return, you still have time. File before April 15, 2025, to claim the Recovery Rebate Credit. Even those with minimal or no income should file to ensure they receive their payment.

Are New Stimulus Checks Coming?

Rumors about new $1,000 stimulus checks for all Americans are circulating, but the IRS has clarified that these payments are specifically for those who missed out on prior rounds of stimulus funds. Stay cautious about misinformation and rely on official IRS updates.

Why This Matters

The IRS’s efforts to deliver these payments emphasize its commitment to ensuring financial aid reaches every eligible American. Don’t miss your chance to claim this relief if you qualify