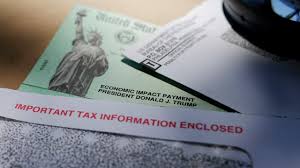

Millions of Americans are set to receive $1,200 federal payments in April 2025, offering much-needed financial relief amid rising costs. The U.S. government has announced this round of payments to assist households grappling with economic challenges like inflation and job instability.

Here’s what you need to know about eligibility, payment methods, and how to ensure you receive your deposit on time.

Eligibility

Eligibility for the payments is based on your adjusted gross income (AGI) reported in your 2024 tax return. Here’s how it breaks down:

- Single Filers: Full payments for incomes up to $75,000, with reduced amounts for those earning up to $99,000.

- Married Couples Filing Jointly: Full payments for combined incomes up to $150,000, phasing out completely at $198,000.

- Head of Household: Full payments for incomes up to $112,500, with reduced amounts for incomes up to $136,500.

Families with children under the age of 17 will also receive an additional $500 per child. If you’re a non-filer, such as a Social Security recipient, you will automatically qualify based on federal records.

How Will Payments Be Sent?

The IRS will distribute payments using the information provided on your most recent tax return. Payment methods include:

- Direct Deposit: Funds will be sent directly to your bank account, ensuring the fastest delivery.

- Paper Checks: Mailed to your address on file; delivery could take 2–4 weeks longer than direct deposits.

- Prepaid Debit Cards: Some recipients may receive payments via prepaid debit cards sent in plain envelopes.

Payment Schedule

Payments are scheduled to begin on April 15, 2025, with direct deposits arriving first. Paper checks and debit cards will follow shortly after.

How to Prepare for Your Payment

To avoid delays, ensure your personal and banking information is up to date with the IRS. Here’s what you can do:

- File Your 2024 Tax Return: Submit your return by the standard deadline to confirm eligibility.

- Verify Your Address: If you’ve moved recently, update your address with the IRS using Form 8822.

- Set Up Direct Deposit: Provide your banking details through the IRS’s online portal to receive your payment faster.

- Track Your Payment: Use the IRS “Get My Payment” tool to monitor the status of your deposit.

Why These Payments Matter

The $1,200 federal payments are part of the government’s ongoing effort to provide economic support to families and individuals facing financial strain. Previous relief payments during the COVID-19 pandemic significantly reduced poverty and helped millions cover essential expenses like rent, groceries, and utilities.

Stay Informed

For accurate updates on eligibility and payment dates, rely on official sources such as the IRS website or trusted news outlets. Avoid scams and unsolicited offers claiming to help with your payment.

These relief payments are expected to make a meaningful difference for many households in 2025. By understanding the process and ensuring your information is correct, you can receive your payment smoothly and on time.