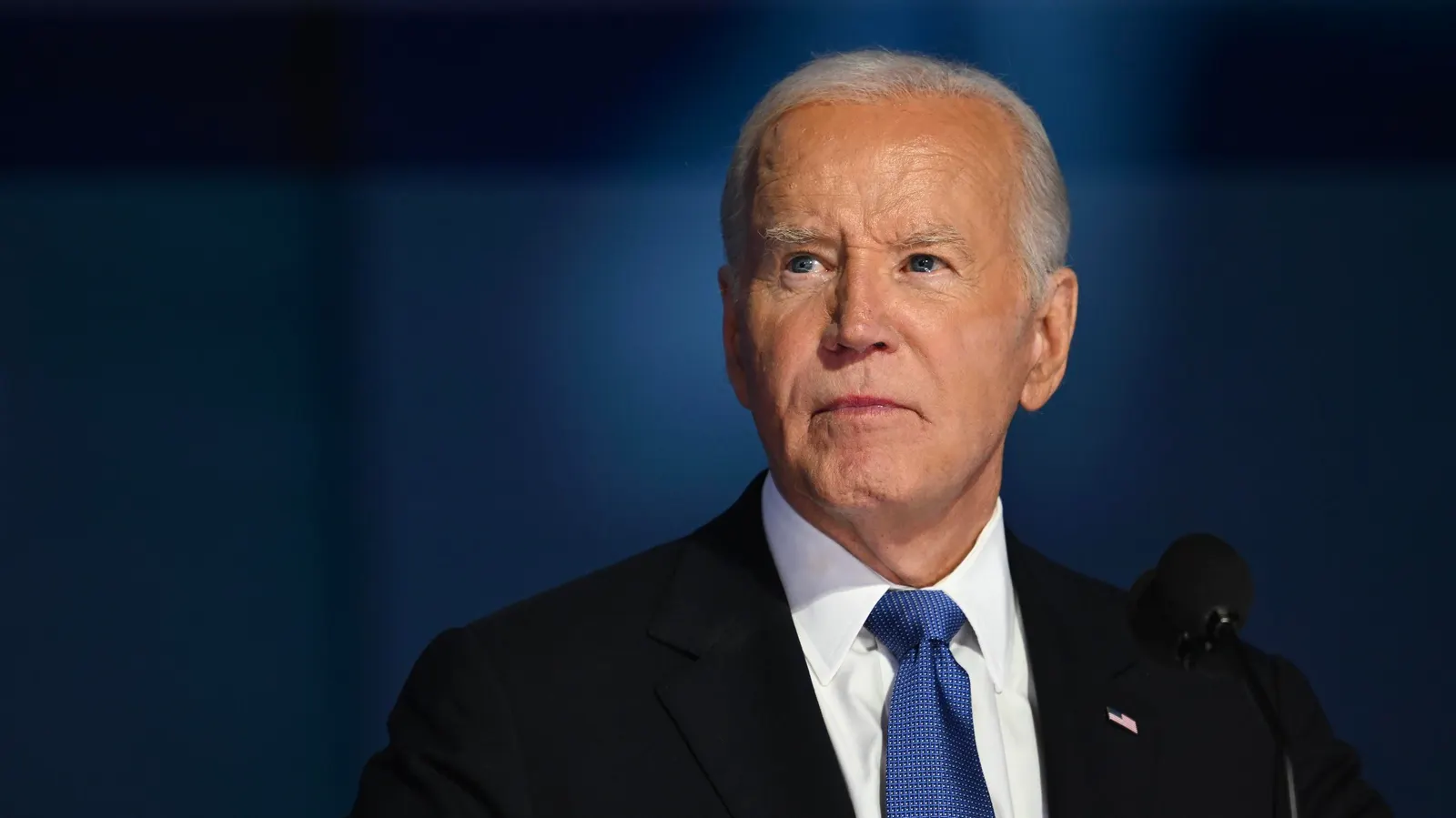

President Joe Biden’s administration has delivered another wave of student loan forgiveness, erasing $4.5 billion in debt for 261,000 borrowers. This initiative marks the latest step in addressing the student loan crisis, providing significant relief to those who qualify under specific programs. Here’s everything you need to know about the eligibility criteria and how to check your status.

Who Is Eligible for Forgiveness?

This round of forgiveness focuses on borrowers under two key programs: the Public Service Loan Forgiveness (PSLF) Program and the Income-Driven Repayment (IDR) Plan Adjustment.

- Public Service Loan Forgiveness (PSLF):

- Borrowers working in public service roles, including government agencies, schools, and nonprofit organizations, qualify.

- Eligibility requires 120 qualifying monthly payments made while employed in a public service position.

- Recent changes to the PSLF program allow borrowers to count more types of payments toward their total.

- Income-Driven Repayment (IDR) Plan Adjustment:

- Borrowers who have been making payments under an IDR plan for 20–25 years may now see their remaining balances forgiven.

- The adjustment also credits time spent in forbearance or deferment (such as economic hardship) toward forgiveness.

These changes aim to correct administrative errors and ensure borrowers receive credit for payments they’ve already made, even if those payments weren’t properly tracked in the past.

How to Check If You Qualify

Borrowers can verify their eligibility through the following steps:

- Log into StudentAid.gov: Access your account to check your loan status and any recent updates regarding forgiveness eligibility.

- Contact Your Loan Servicer: If you’re unsure whether you qualify, reach out to your loan servicer for clarification.

- Certify Employment for PSLF: If you work in public service, submit a PSLF certification form to confirm your eligibility.

Borrowers who qualify will typically receive a notification from the Department of Education. Payments are automatically processed, so there’s no need to submit additional applications if you’ve already met the requirements.

How This Fits Into Biden’s Broader Student Loan Relief Efforts

This $4.5 billion forgiveness is part of a larger plan to alleviate student debt. The Biden administration has already forgiven over $127 billion in loans for more than 3.6 million borrowers since 2021.

This relief effort focuses on fixing past mismanagement within loan forgiveness programs. Many borrowers were unfairly denied credit for payments due to administrative errors, which this initiative aims to correct.

What Borrowers Should Know Moving Forward

- Stay Updated: Check for notifications about your loan status or potential eligibility.

- Verify Records: Ensure your payments and employment history are accurately documented, especially if you’re part of PSLF or IDR programs.

- Advocate for More Relief: While this program helps many, millions of borrowers still face significant debt. Additional relief measures could be announced in the future.

Final Thoughts

Biden’s latest wave of student loan forgiveness is a game-changer for 261,000 borrowers, offering critical financial relief. If you think you might qualify, act quickly to confirm your eligibility and ensure your records are in order.