Navigating Tax Preparation Options in New York

uidelines for Selecting a Online Tax Preparers

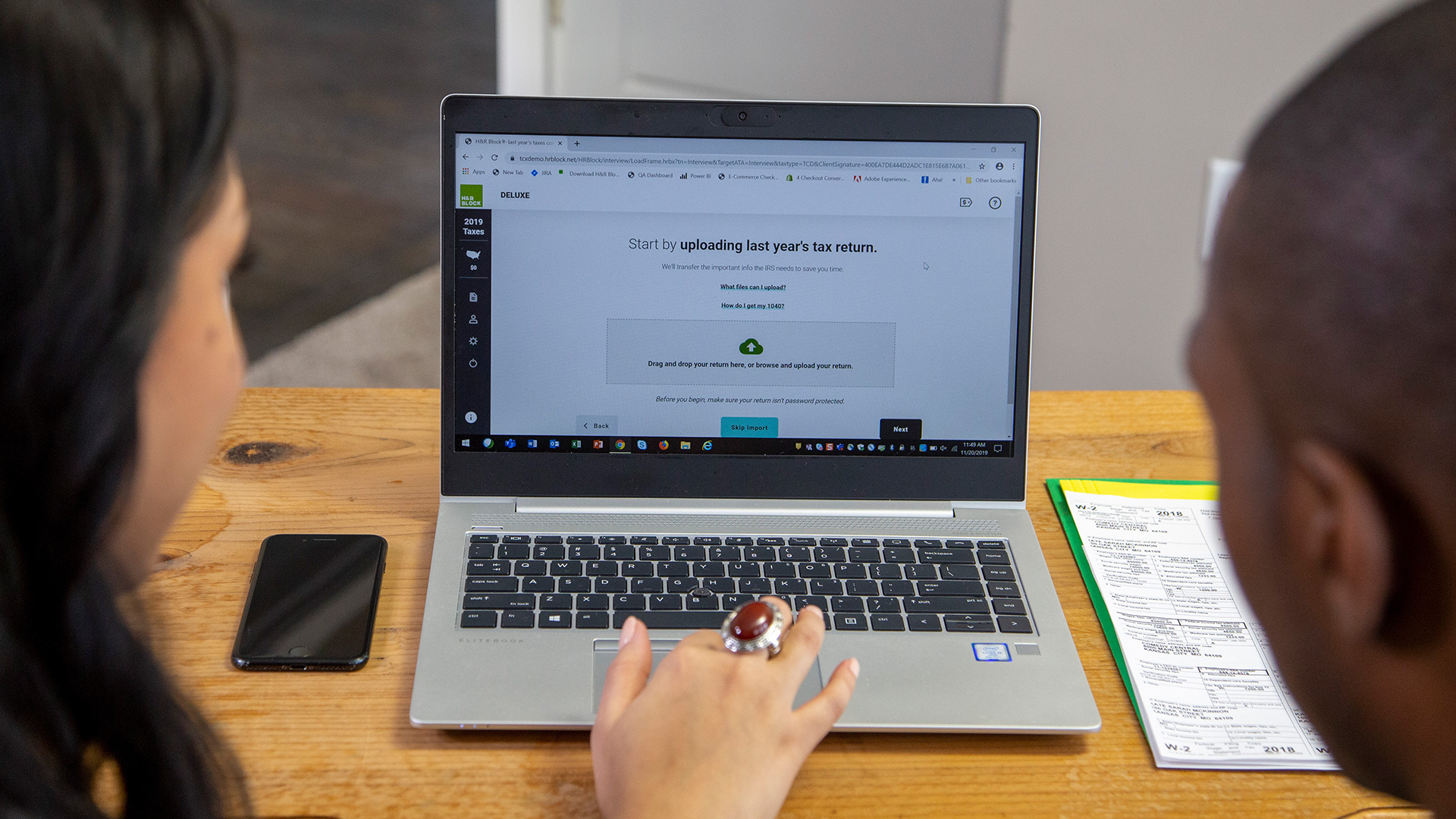

According to lohud., As tax season unfolds in New York, individuals face a spectrum of options for tax preparation services with costs varying based on the complexity of their tax situation and the level of assistance required. Online tax preparers such as Intuit TurboTax, H&R Block, and Jackson Hewitt offer a range of packages tailored to different needs. For instance, Intuit TurboTax provides a free edition for those with straightforward tax situations. At the same time, H&R Block’s offerings include free online filing for basic returns and paid versions for more complex scenarios such as rental income or small business expenses. Similarly, Jackson Hewitt offers online filing for a flat fee of $25, ensuring transparency and predictability in online tax preparers costs.

READ ALSO: $250 One-Time Rebate Could Be Sent to Seniors in Arizona

Navigating Online Tax Preparers Selection in New York: Balancing Cost with Quality and Compliance

However, for those opting for in-person assistance particularly in navigating the complexities of New York tax regulations considerations extend online tax preparers beyond cost. The New York State Department of Taxation and Finance outlines the key criteria for selecting an online tax preparers emphasizing factors such as their registration status, upfront disclosure of fees, provision of year-round support, and adherence to regulatory standards. This guidance aims to empower taxpayers to make informed choices and safeguard against potential scams or unscrupulous practices during the tax filing season. As individuals weigh their options for online tax preparers assistance, it’s essential to balance cost considerations with the assurance of quality service and compliance with state regulations. Whether utilizing online platforms or seeking in-person support, taxpayers in New York can navigate the tax filing process with confidence by adhering to best practices outlined by regulatory authorities. With tax preparers playing a pivotal role in facilitating accurate and timely filings informed decision-making is paramount to ensure a smooth and compliant tax season for all.