This year, the number of stocks has increased significantly as investors have grown more optimistic about the economy. The tech-heavy Nasdaq Composite is up 29% year so far, while the broad-based S&P 500 is up 15%.

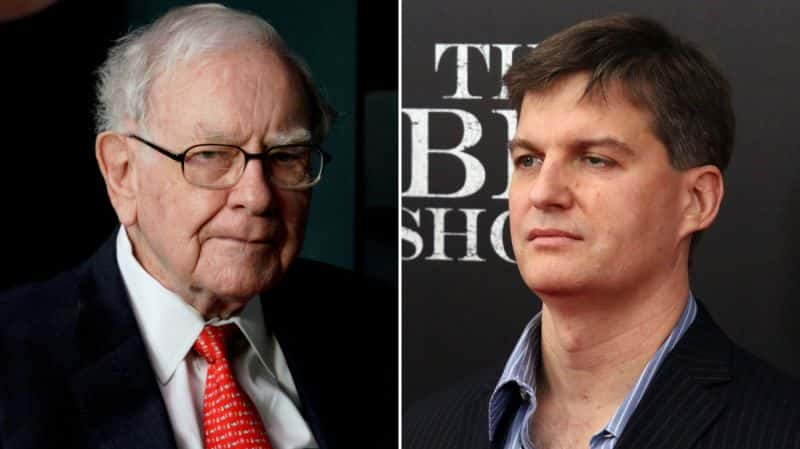

Warren Buffett and Michael Burry, two Wall Street leaders, are currently taking action to safeguard their assets against a stock market collapse, suggesting that they anticipate a payback for expensive stocks on the horizon.

Many investors follow the stocks because Warren Buffett is recognized as one of the best business brilliant minds in history. Every quarter, Berkshire Hathaway (BRK.A -0.00%) (BRK.B -0.18%) purchases and sells shares to imitate his approach and repeat some of his achievements. But a minor caution was included in the most recent quarterly Form 13F submitted to the SEC.

Throughout the first half of 2023, Berkshire bought $7.4 billion worth of equities, a significant decrease from the $57.3 billion it had bought at the same point in 2022.