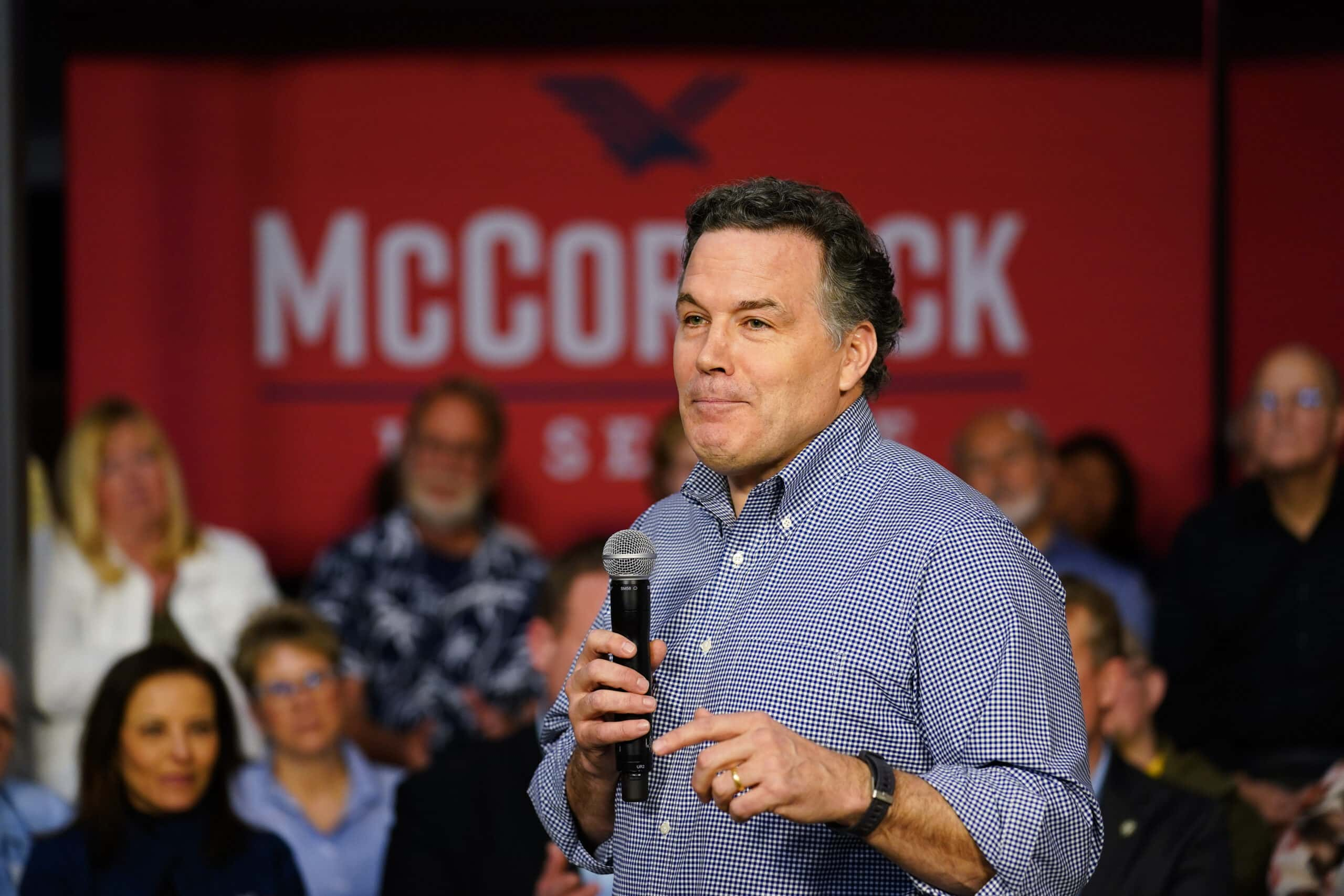

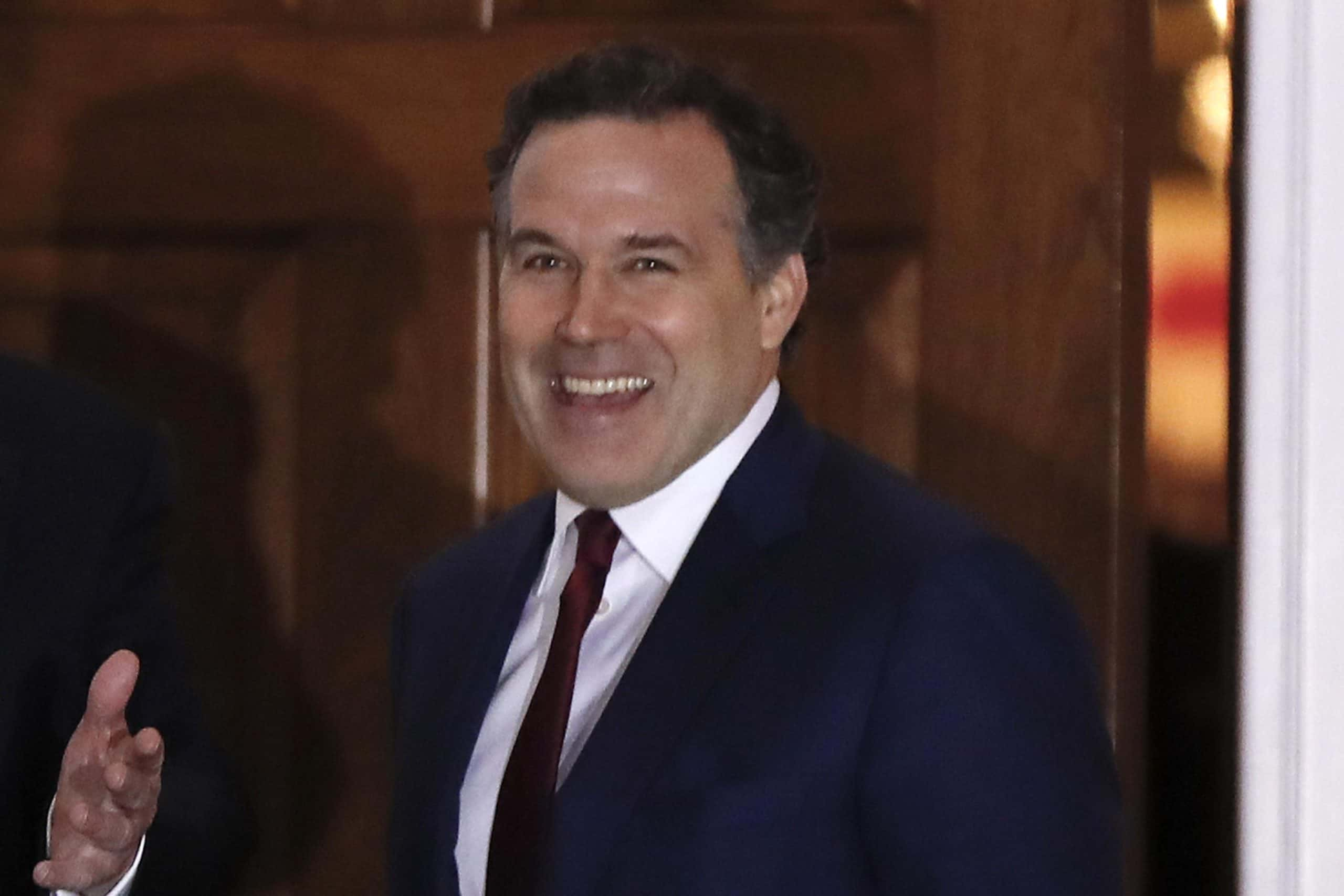

In his second bid for the US Senate in Pennsylvania, Republican candidate David McCormick has undergone a significant transformation, positioning himself as a staunch Trumpian hardliner on China.

David McCormick, the former CEO of the world’s largest hedge fund, Bridgewater Associates, is now raising concerns about US economic ties with China

A recent CNN KFile investigation reveals that during his tenure at Bridgewater, the hedge fund made substantial investments in US exchange-traded Chinese companies, contradicting David McCormick’s current anti-China rhetoric.

David McCormick, now advocating for restrictions on investments aiding the Chinese Communist Party (CCP) or the Chinese military, testified before a House select committee on China in September 2023, expressing reservations about doing business with the country. Despite his current stance, filings with the US Securities and Exchange Commission show that under David McCormick’s leadership, Bridgewater’s holdings in US exchange-traded Chinese companies skyrocketed from $1.6 million in Q2 2017 to $1.77 billion in Q4 2021—an astonishing 108,000% increase over five years.

Some of the Chinese companies in Bridgewater’s portfolio had ties to human rights violations and abuses, leading to blacklisting by the US government

David McCormick’s pivot on China aligns with the broader Republican Party‘s shift towards a more hawkish stance on the nation. David McCormick’s campaign emphasizes his plan to secure supply chains, prevent US companies from supporting the Chinese military or human rights abuses, and hold China accountable for intellectual property theft. His about-turn comes as he attempts to distance himself from his previous pro-China image. Bridgewater Associates, when contacted by CNN, did not respond. David McCormick resigned from his CEO position at Bridgewater in early 2022 to pursue political office.