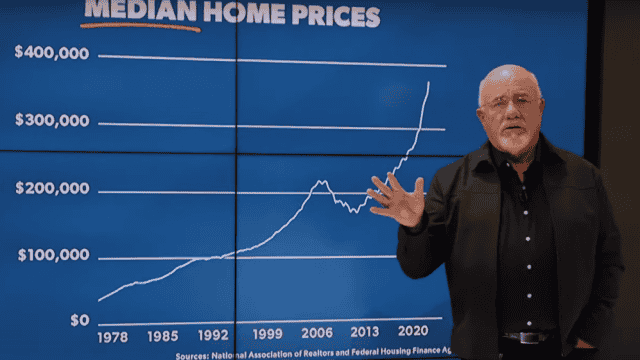

Housing market pessimists have been warning of an impending crash in the residential real estate market in the United States for years. Years of rising home prices had some analysts predicting that the real estate market was a huge bubble ready to burst even before the Federal Reserve started raising interest rates to battle inflation this past year, driving mortgage rates to a 23-year peak this month.

Nevertheless, despite a generally negative attitude in the sector, the majority of seasoned real estate professionals have refrained from asserting that home costs will decline as they did throughout the 2008 crisis that precipitated the Global Financial Crisis (GFC). And so far, it was a wise choice.

National home prices didn’t reach their high until June 2022, despite rising mortgage rates and a decline in buy applications due to the Fed’s initial hikes in interest rates. By January of this year, prices had dropped over 5 percent from their peak, but by July, they had risen again to a record high.