Lieutenant Governor Dan Patrick and House Speaker Dade Phelan are clashing over dueling bills that aim to cut property taxes.

As the end of the Legislative session approaches, Texans are left in uncertainty over their property tax bill

However, they have differing views on how to execute the cut and which plan is better for the average taxpayer. While both men agree on lowering property taxes, they cannot come to an agreement on which plan is better. Political analyst Bob Stein said that it is not a political fight but rather a fight between two men with different ideas of what property tax relief should look like.

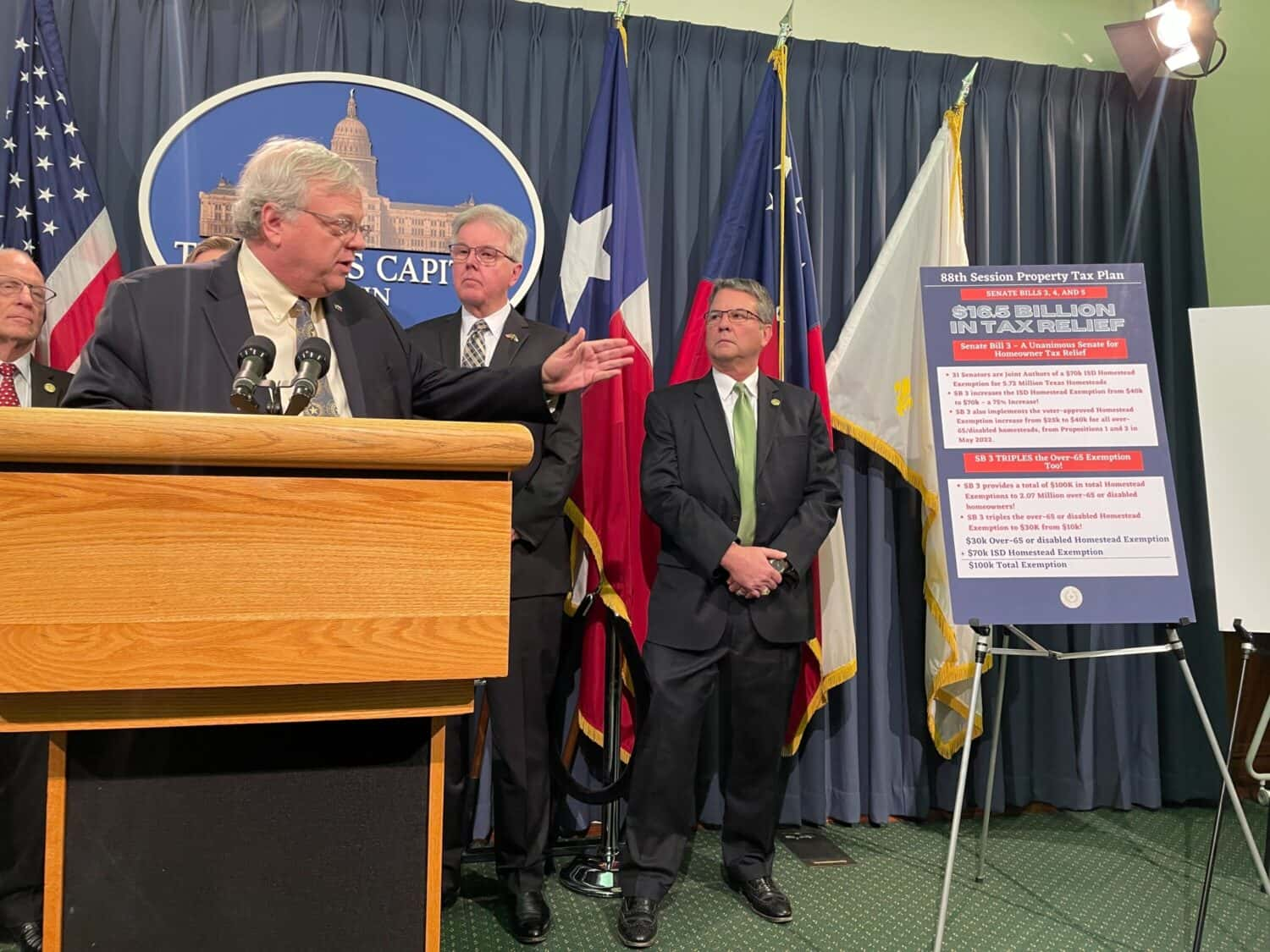

The two politicians have taken to Twitter to trade blows, with Patrick taunting Phelan by calling him “California Dade.” The clock is ticking as the deadline for a deal approaches. The House’s version aims to lower the appraisal cap from 10% to 5% on all properties, including businesses, which will save taxpayers an average of $542 in 2024 and $733 in 2025. On the other hand, the Senate’s plan calls for a $70,000 homestead exemption, resulting in an average of $756 in savings in 2024 and $798 in 2025 for most homeowners.

Seniors are promised a better deal, with a $100,000 homestead exemption, saving them an average of more than $2,000 in the first two years

While a compromise seems likely, Patrick has made it clear that he is not open to negotiation. Governor Greg Abbott has prioritized using billions of dollars in state surplus money for property tax relief this session. Stein believes that something must be done before the end of the session, as it is a cornerstone of what has been promised to Texans. The session ends on May 29.