Clarksburg City Council Approves An Ordinance Granting 10-Year Property Tax Break For New Retail Businesses

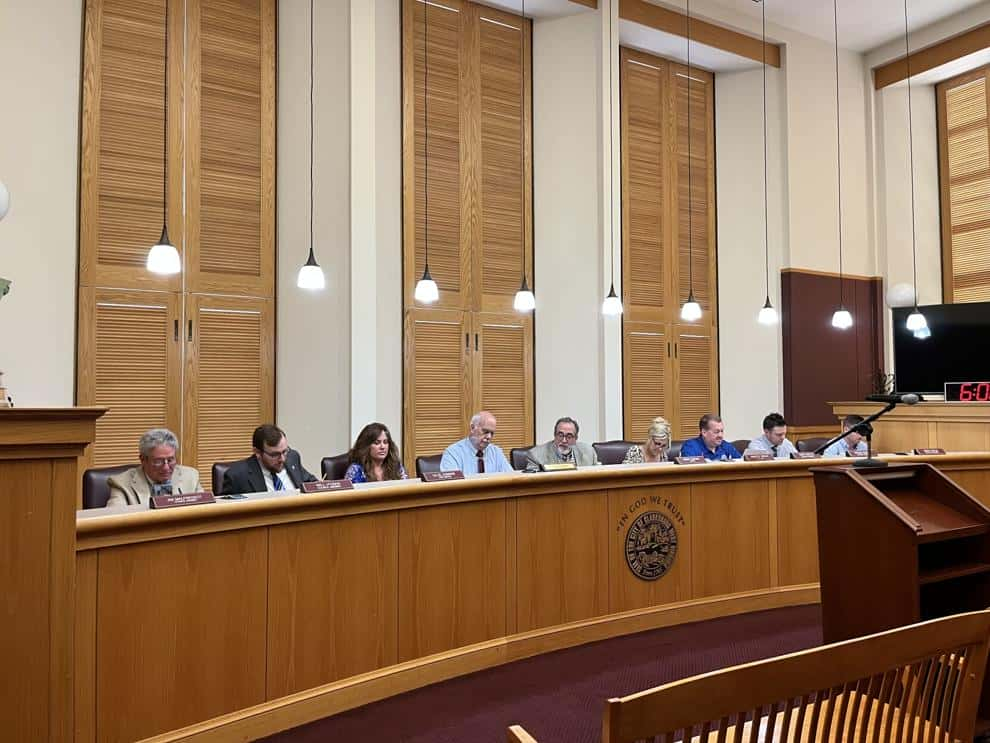

The Clarksburg City Council in West Virginia approved an ordinance granting new retail businesses located in vacant buildings downtown a 10-year business property tax break. The Clarksburg City Council in West Virginia approved an ordinance for a property tax break The Clarksburg City Council in West Virginia conducted a regular session. Before the passing…