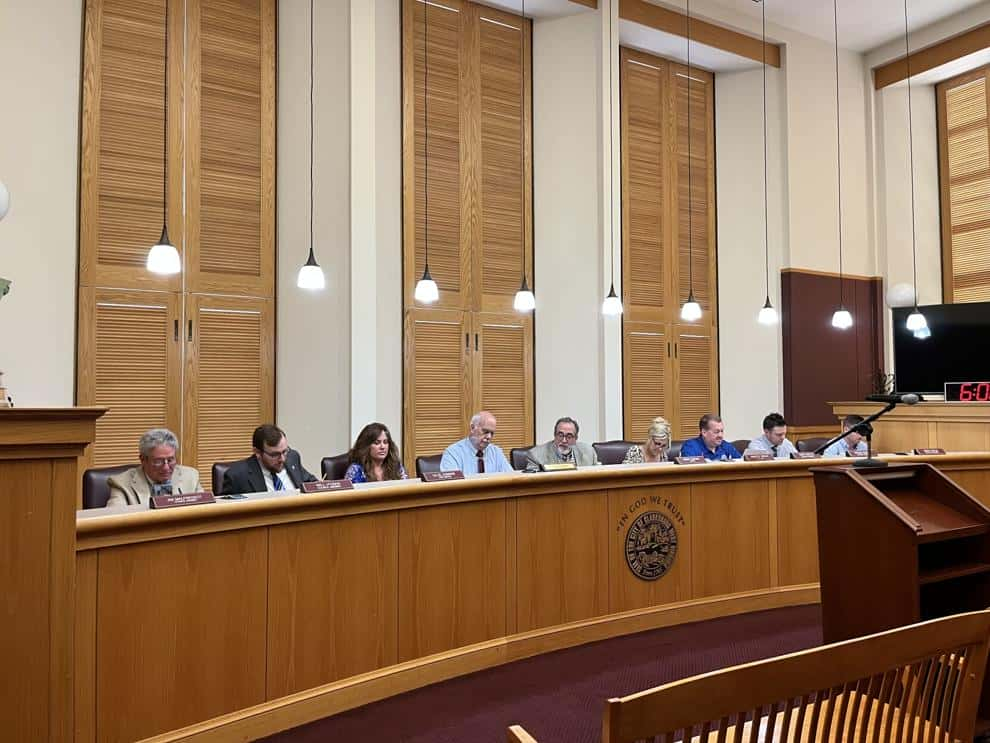

Kannapolis City Budget for 2023-24 Unveiled: No Increase in Property Taxes or Fees

The recommended budget, totaling slightly over $104 million, focuses on several key strategies. The city council was presented with the budget proposal for the 2023-24 year, revealing that there will be no increases in property taxes or fees These strategies include implementing the Imagine Kannapolis Strategic Plan, retaining current employees while also recruiting new talent,…