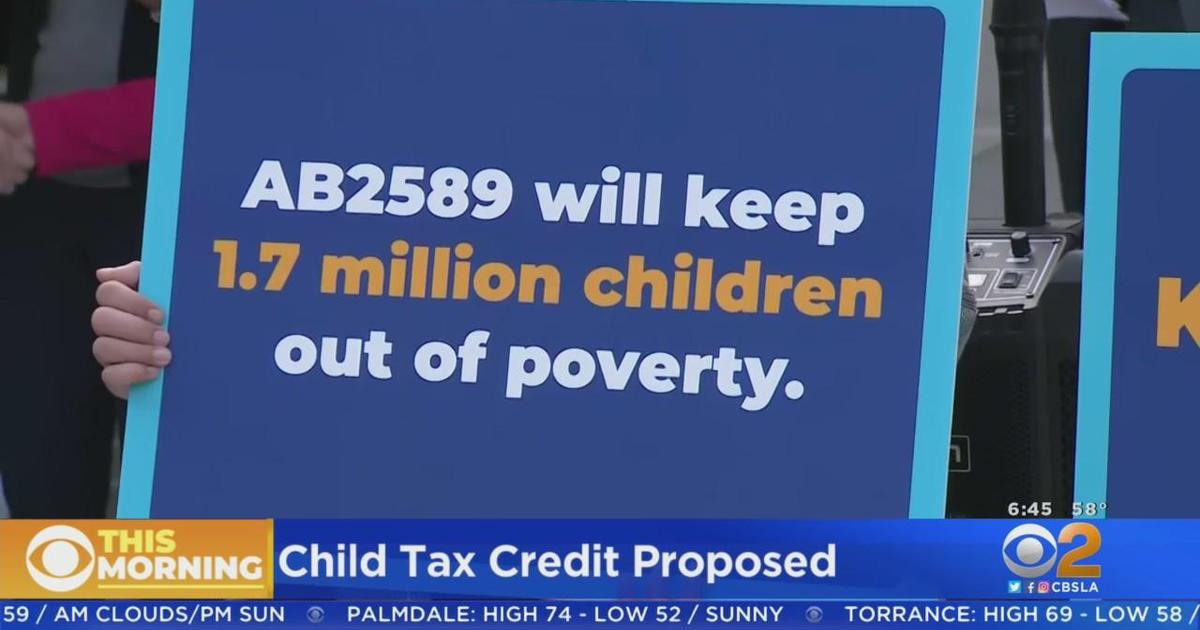

Unlock $1,700 Per Child This December! Are You Eligible for the 2025 Tax Credit?

As the 2025 tax season approaches, families across the United States are eager to understand the benefits of the Child Tax Credit (CTC) and determine their eligibility. The CTC offers significant financial relief, providing up to $2,000 per qualifying child under the age of 17. Notably, up to $1,700 of this credit is refundable, meaning…