CT Families Struggle: Permanent Child Tax Credit 2024 will Push Intensifies

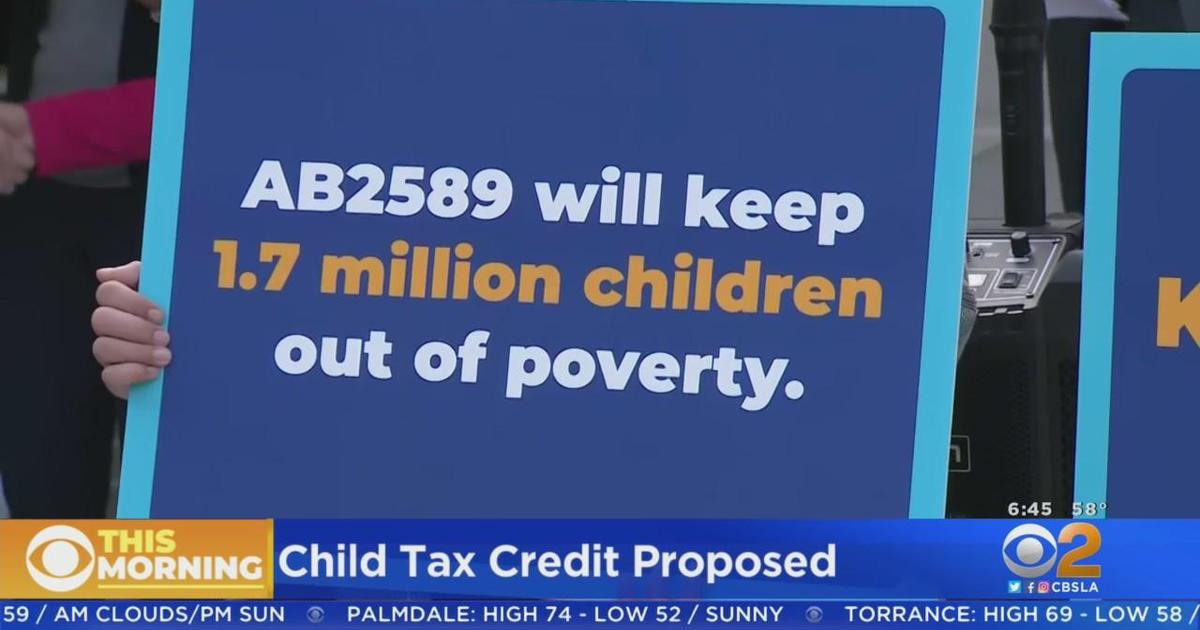

Advocating for a Permanent Child Tax Credit 2024 Addressing Economic Strain and Rising Costs According to CT, the Connecticut Nonprofit Child Tax Credit Coalition, alongside lawmakers, nonprofits, and families, convened at a news conference to advocate for a permanent fully refundable child tax credit 2024. The proposed credit would provide families with $600 per child…