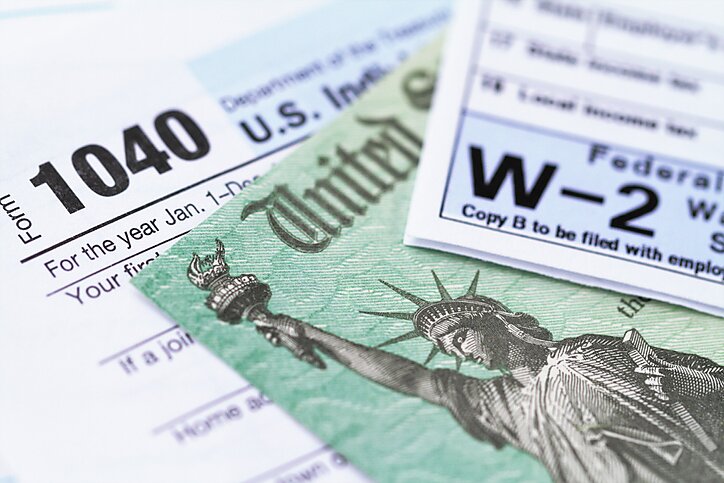

2024 Tax Refund Check-Up Unveiling the Average IRS Payout – Check It Now!

2024 Tax Season Update: IRS Disburses Over 28.9 Million Refunds, Slightly Lagging Behind Previous Year’s Pace Analyzing the Impact: Factors Behind the Variance in 2024 Tax Refund Distribution Between 2023 and 2024 According to published article of cnet, 2024 tax season unfolds the IRS is actively dispersing 2024 tax refund to eligible taxpayers albeit at…