Nature vs. Bulldozers: Why the Florida Everglades Are at the Center of Heated Protests

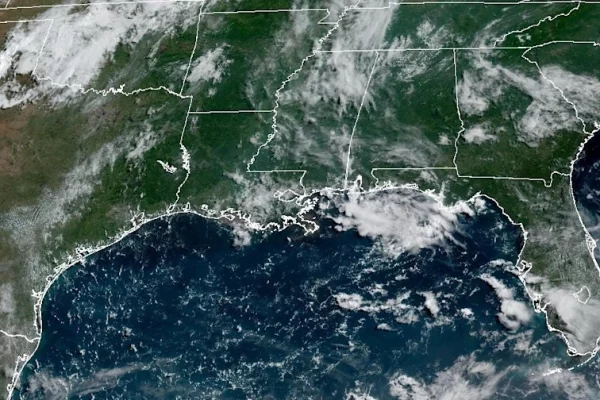

A wave of powerful protests has broken out in the Florida Everglades, as local communities, Native tribes, and environmental activists join forces to fight against what they call dangerous land development plans. The peaceful demonstrations have drawn crowds, attention, and rising pressure on state officials to take action. Protesters are demanding a full stop to…