Search results for: “homeownership”

-

Safety Insurance Homeowners Policy Offers Insufficient Coverage Following Climate Change, Natural Disasters

Safety insurance homeowners policy offered insufficient coverage following climate change and natural disasters. Safety Insurance Homeowners Policy Provides Insufficient Coverage for Risks Amidst Climate Change and Natural Disasters Safety insurance homeowners policy provides insufficient coverage for risks despite the increasing threats of climate change and natural disasters to various homes across the country, wherein safety…

-

Student Loan Borrowers Struggle to Enter Housing Market Despite 3.5 Years of Payment Relief

The extended break was intended to provide some financial relief, but it appears that the burden of student loan borrowers continues to hamper their dreams of homeownership. In a recent study, it has been revealed that student loan borrowers, who enjoyed a substantial 3.5-year respite from payments, are encountering significant hurdles in their attempts to…

-

Student Loan Forgiveness Leaves Borrowers Disappointed as Program Gets Struck Down

With $25,000 in debt, Toledo expected $20,000 to be wiped away, allowing him to pursue life plans such as buying a home and starting a family. Cesar Toledo, along with millions of other borrowers, had hoped to have a significant portion of his student loan debt forgiven under President Biden’s student loan forgiveness program However,…

-

Self-Sufficient Struggle: Study Reveals Millennials and Gen-Z Adults Struggling to Become Financially Independent

Millennials and Gen-Z adults are finding it increasingly difficult to achieve financial independence, according to a recent study conducted by credit agency Experian. The study found that a mere 28% of participants claimed to be entirely self-sufficient and not reliant on their parents for financial support More than half of the respondents acknowledged that they…

-

Exercising Financial Freedom: Unlocking the Hidden Potential of Home Equity Without Refinancing – A Brief Summary

Homeownership has long been considered a cornerstone of stability and financial prosperity. Though some might say that owning a home is a dead investment, we should also consider that financial landscapes are evolving, therefore the innovative approaches to managing our assets have immensely improved. In this article, we explore a refreshing new angle that unlocks…

-

New California Bill To Expand Affordable Housing For Low-Income Families Amidst Increasing Homelessness Rates

A new California bill will expand relief for affordable housing for low-income families amidst the increasing homelessness rates in the state. California Bill Will Provide More Funding for Low-Income Housing to Combat Homelessness Crisis With the increasing homelessness rates in the state, a new California bill aims to provide more affordable housing for low-income families,…

-

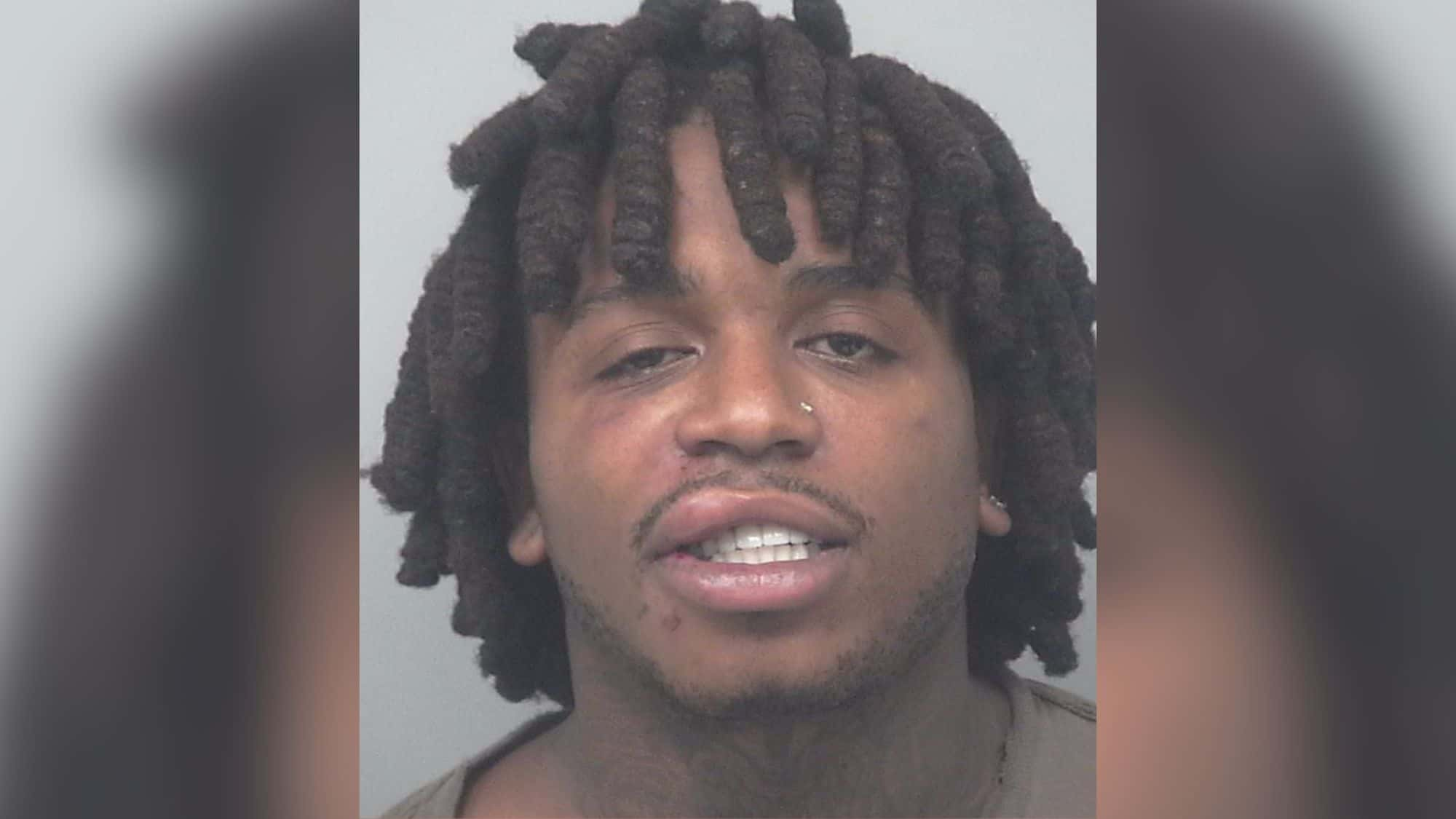

Released on a $3,700 bond, hours after R&B singer Jacquees’ Arrest

The Atlanta-based R&B singer was arrested last week in connection to his supposed role in a restaurant fight in Georgia. Facing multiple charges including obstruction of law enforcement officers and battery. Rodriguez Jacquees Broadnax, more known as, Jacquees, a popular R&B singer was arrested and charged with multiple allegations such as obstructing law enforcement officers…

-

Bipartisan Vote in House Approves Repeal of Mortgage Rule Affecting Homebuyer Costs

The House has passed a bill to eliminate a mortgage rule implemented by the Biden administration, resulting in increased rates and fees for some creditworthy homebuyers while reducing costs for those with riskier credit scores. Repeal of Mortgage Rule Approved by Bipartisan Vote With a bipartisan vote of 230-189, including support from 14 Democrats, the…

-

Increased Use Of Homeowner Vouchers Could Reduce Racial Disparities In Home Ownership

According to recent research, the racial inequality in property ownership between Black and White individuals may be significantly reduced if a homeowner voucher scheme were widely adopted. Collaboration Between Housing Authorities, Lenders, And Other Programs The Urban Institute, Urban Strategies Inc. (USI), and JPMorgan Chase funded the study, which found that more Housing Choice Vouchers…

-

Middle-Income BIPOC First-Time Homebuyers To Receive Up To $40,000 In Assistance Under New Pilot Program In San Diego

Several middle-income Black, Indigenous, and People of Color (BIPOC) first-time homebuyers expect to receive up to $40,000 in assistance under the new pilot program in San Diego. Several BIPOC First-Time Homebuyers Will Expect Relief Following the Launching of New Pilot Program Under the San Diego Housing Commission Eligible middle-income BIPOC first-time homebuyers will expect relief…