It costs to fully utilize Social Security because it may serve as lifesaving for millions of senior citizens in America. Pension benefits, which are available if you’ve maintained a job and given Social Security taxes for a minimum of ten years, are something that the majority of individuals are aware of. However, you can also be eligible for extra advantages if you’re engaged separated, or widowed.

These Social Security benefits are not available to everybody, but if you are eligible, you might increase your monthly payouts by several hundred dollars.

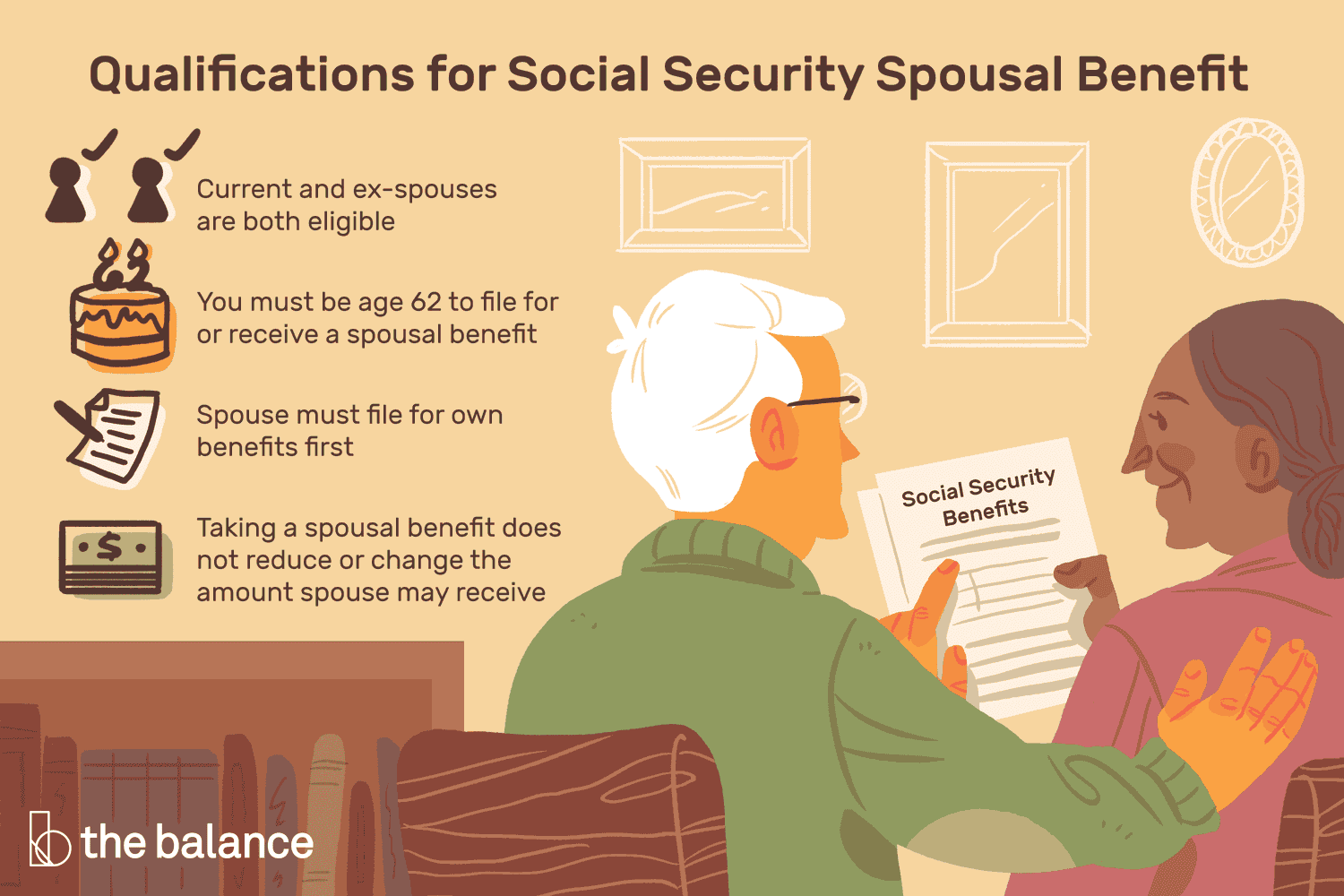

You must be engaged to a person who is eligible for pension or disability payouts to receive spousal payments. In addition, you have to be 62 years old or older to start receiving spousal advantages. However, you must wait till the full retirement age (FRA), that’s age 67 for those who were born in 1960 or after, to get the maximum amount.

50% of what your partner is eligible for at their FRA is the most you can get. So, for instance, if your spouse receives $2,000 every month in pension payments at their FRA, and you stay till your own FRA to submit, you might get $1,000 each month.