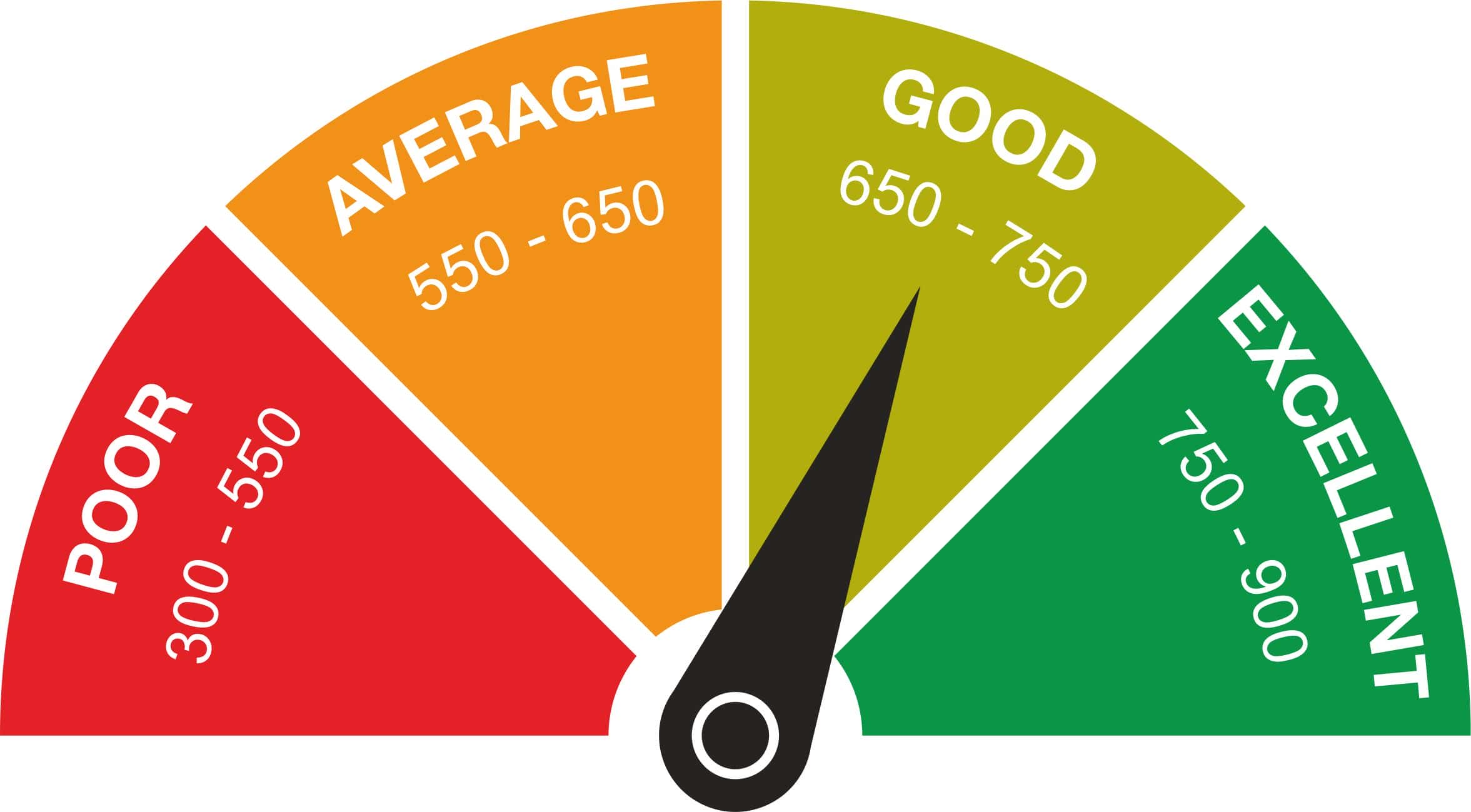

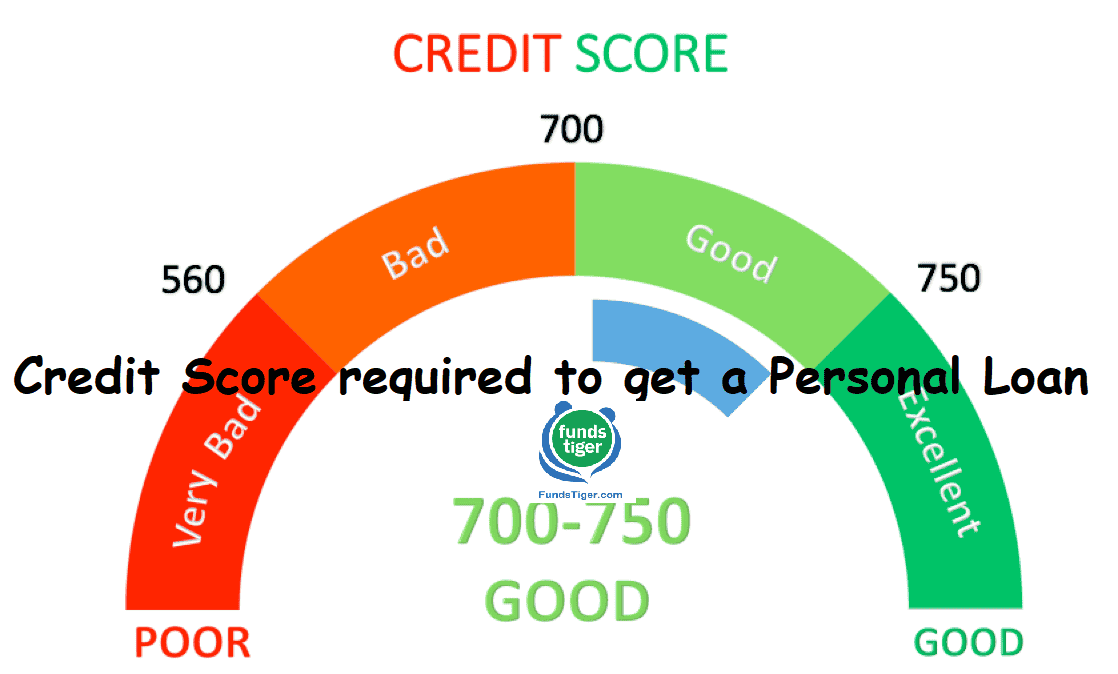

Knowing your credit score is crucial since getting a loan involves a credit check. Overall, if your overall score is at least 640, you have a better chance of getting favorable terms. There are always options available to you even though you haven’t got that credit score.

For personal loans, each lender has their requirements, such as the minimum credit score they would accept. However, having a credit score of a minimum of 640 increases your chances of being approved for the best rates.

A personal loan can still be obtained despite having a low credit score. For instance, if your credit score is as low as 580, a few lenders might still approve you for a private loan. Even lower credit score loans may be available from others, but you may need to put up security or have a co-signer.