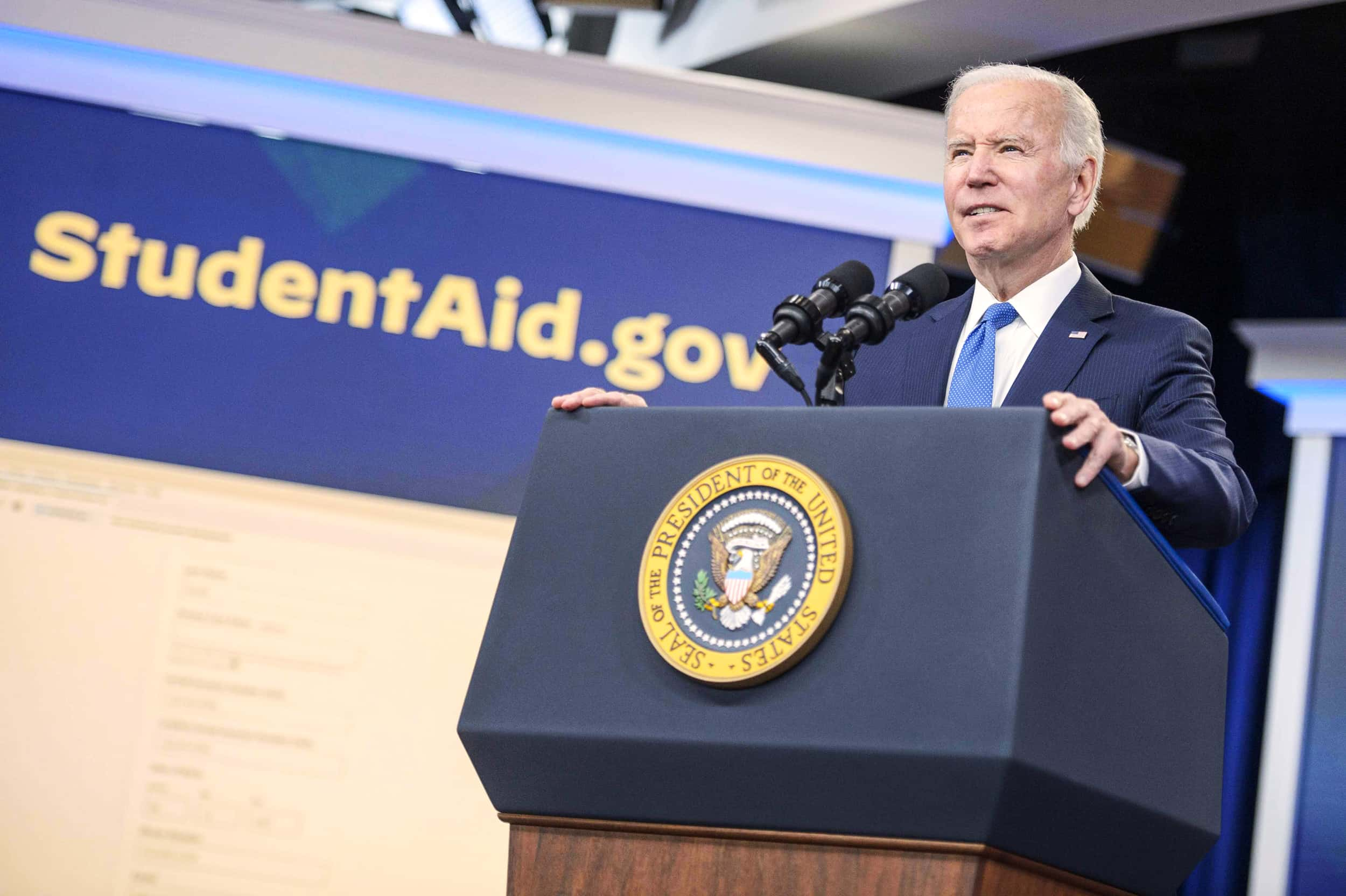

The Supreme Court’s upcoming ruling on President Joe Biden’s student loan forgiveness scheme could, at least, it would put additional attention on a huge load of student loan debt.

Borrowers are finding it harder and harder to make ends meet due to expanding debt. Lenders have a total of $1.7 trillion as of the most recent calculation.

Maintaining such a substantial sum of debt is particularly challenging for students who begin college and rarely complete their studies.

As per the National Student Clearinghouse Research Center, even if total college enrollment decreases have settled down, the percentage of students who entered college but later dropped out increased by 3.6% in the 2020–21 academic year. Over forty million youngsters are not registered in school right now.

The National Student Clearinghouse Research Center’s executive director, Doug Shapiro, stated that “increasing percentages of end-outs and fewer remaining students have played a role in the broader enrollment decreases in current years.”