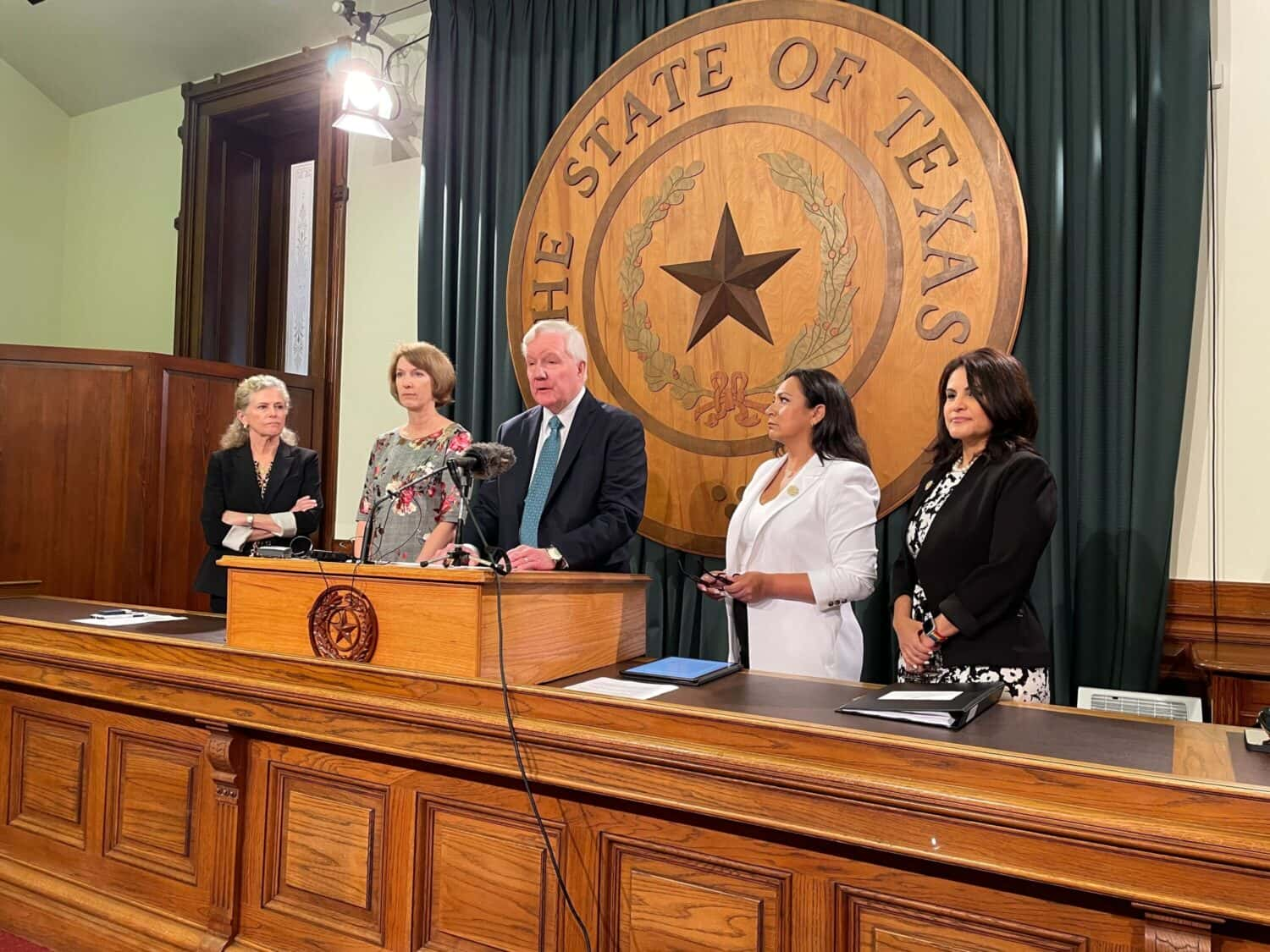

State Representative John Bryant is leading the coalition, advocating for measures that include homestead exemptions of up to $200,000, cash rebates for renters, permanent pay raises for teachers, and reductions in school district property tax rates.

Texas Democrats in the State House are proposing a comprehensive package of property tax relief measures worth $20.9 billion, surpassing any previous proposals

The Democrats argue that their plan addresses the high property tax in Texas and provides relief to the 38% of households who rent. The proposed plan grants homeowners an exemption of either $100,000 or 25% of their home’s appraised value, capped at $200,000.

In contrast, the Texas Senate supports a standard exemption of $100,000 for all homesteads. The Democratic plan also includes measures to buy down the taxes charged by school districts for maintenance and operations expenses, known as “compression.” However, Republicans, including Governor Greg Abbott, prioritize eliminating the maintenance and operations tax entirely, relying on the state to assume a greater share of the local property tax burden.

The Democrats’ proposal presents a more comprehensive approach to property tax relief, it remains to be seen how it will align with existing proposals and gain support from House leadership

Nevertheless, the Democrats emphasize the need to prioritize the well-being of Texans burdened by property taxes, particularly renters and teachers. The property tax debate in Texas continues to unfold as both parties seek viable solutions to address the issue.