IRS doing all it can and issues guidance on state tax payments to help taxpayers but now the state is challenging the agency over tax refund 2023.

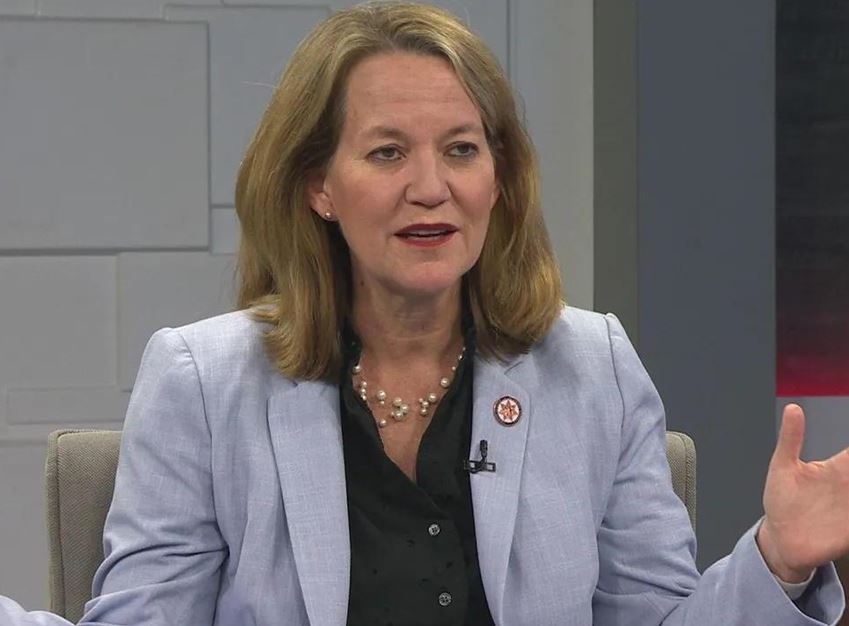

Attorney General Kris Mayes filed an IRS regarding the family Tax Refund 2023 issue in Arizona Attorney

Last Tuesday, according to Attorney General Kris Mayes, the Internal Revenue Service has no right to force 750,000 Arizona families who got a state income Tax Refund in 2023 to now pay federal taxes on the funds.

General Kris Mayes sued the IRS after they made Arizonans pay federal taxes regarding the Arizona Family Tax Refund 2023.

Calling the action of the Internal Revenue Service illegal, Attorney General Kris Mayes is asking a federal judge to block the Internal Revenue Service from taxing the proceeds of last year’s family Tax Refund 2023.

Read Also: “Arizona Stabbing Suspect Boasts To Police: Wanted For NYC Woman’s Murder”

Attorney General Kris Mayes’s Argument against IRS Family Tax Refund 2023

Attorney General Kris Mayes, in her letter to Werfel, said the IRS determination the rebates are taxable is contrary to IRS policy.

In the case filed on Feb. 21, Attorney General Kris Mayes points out that the IRS had previously concluded that Tax Refund 2023 and payments made by 17 other states to its residents up to $750 for qualified families were not subject to federal income tax.

Read Also: Adjustments To Arizona Medicaid Might Provide Health Care For 10,000 More Children