This move comes as a response to the concerns raised by homeowners, many of whom have seen their taxes steadily increase over the years.

Tarrant County homeowners can expect some relief from property taxes following a historic decision made during the commissioners’ meeting on June 6

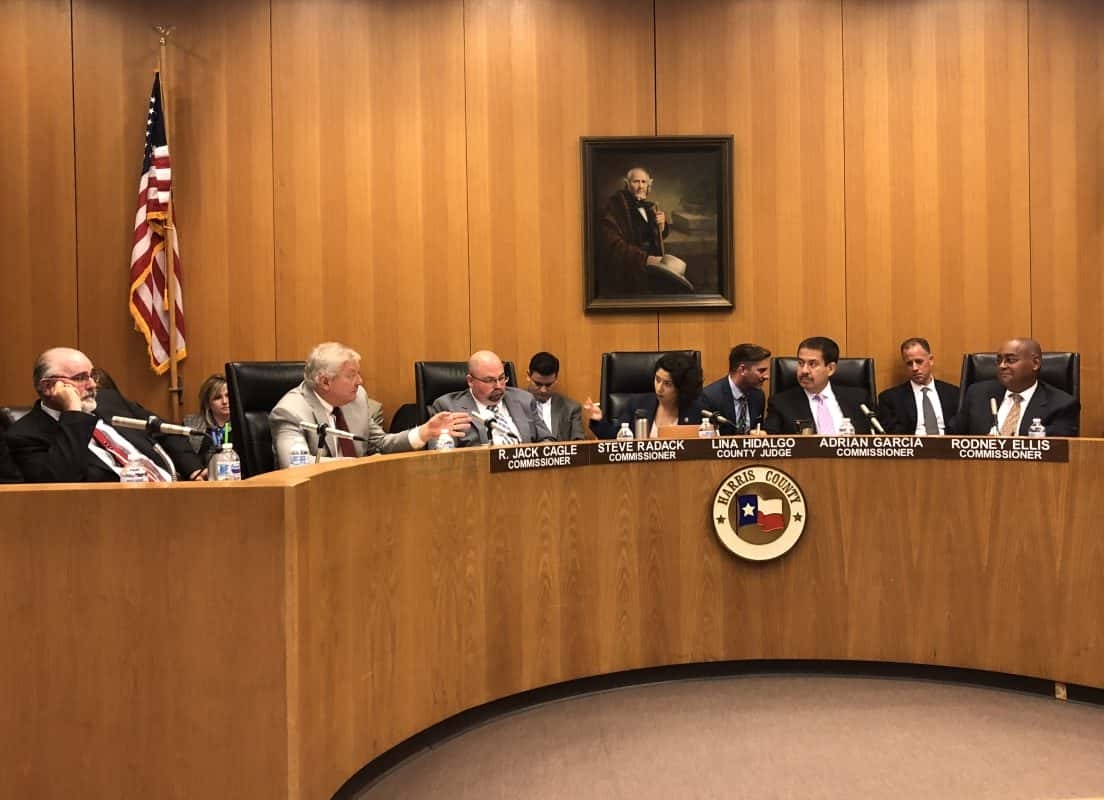

The commissioners voted in favor of implementing a 10% homestead exemption at the county level, marking the first time such a measure has been taken. County Judge Tim O’Hare, who chairs the Tarrant County Commissioners Court, expressed his commitment to providing further tax breaks for homeowners. He emphasized the importance of not burdening people, particularly those on fixed incomes such as seniors, widows, and single mothers, with excessively high taxes that could force them out of their homes.

Tarrant County Precinct 2 Commissioner Alisa Simmons echoed these sentiments, noting that other entities, including school districts, should also consider offering relief. Simmons emphasized that she, along with her fellow commissioners, are homeowners themselves and understand the concerns faced by the community.

Chandler Crouch, who has been assisting homeowners in challenging property tax increases, commended the commissioners’ decision, stating that it would address the pleas for help from homeowners struggling to afford their taxes.

Crouch estimated that homeowners in Tarrant County could save an average of $500, with the 10% homestead exemption being particularly beneficial for owners of more expensive properties

Crouch also highlighted the importance of understanding where tax payments go and encouraged homeowners to review their tax bills, identify the entities receiving the funds, and seek exemptions where applicable. Judge O’Hare pledged to advocate for homeowners during the final tax bill period in September.

Homeowners in Tarrant County, including James Aghayere, who acknowledged the inevitability of taxes, expressed their appreciation for any relief they could receive. The implementation of the homestead exemption is seen as a step toward making homeownership more affordable for many in the county.

READ ALSO: When Is A Spouse Eligible To Receive Social Security?