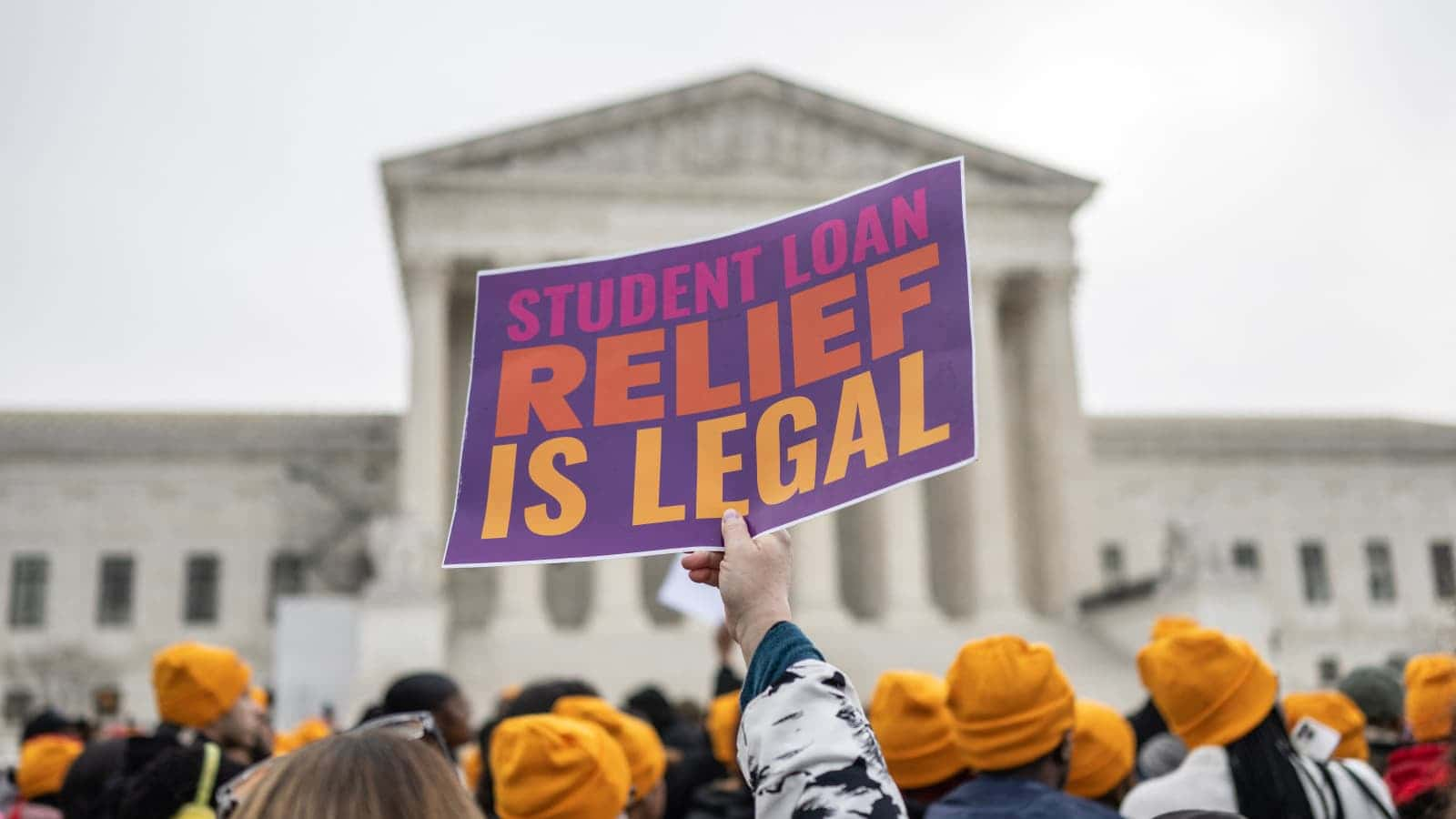

The court is currently deliberating on the matter, which would allow eligible borrowers to receive up to $10,000 in loan forgiveness, with the amount doubling to $20,000 for recipients of Pell Grants.

The fate of federal student loan forgiveness for individuals earning less than $125,000 and couples with incomes below $250,000 rests with the Supreme Court

During the period when the online application for student loan forgiveness was open, a staggering 26 million borrowers submitted their applications, out of which over 16 million were approved. However, due to the ongoing debate in the Supreme Court, no further applications are being accepted, and no relief has been provided to any applicants so far.

The next course of action is contingent upon the Supreme Court’s decision, and a few important dates are approaching. By June 30, the court is expected to render a final verdict on the loan forgiveness plan. If the justices rule in favor, borrowers could begin receiving loan forgiveness within a matter of weeks. Conversely, if the court rejects the program, the Biden administration will be compelled to reassess the situation. The student loan moratorium, extended by President Biden, is set to expire 60 days after either June 30 or the court’s ruling on the student loan forgiveness plan, whichever comes first.

In the absence of further extensions, federal student loan repayments would resume around August 30

Last year, the Biden administration introduced the IDR Adjustment, a one-time initiative that offers retroactive credit towards student loan forgiveness under income-driven repayment plans. This initiative will benefit millions of borrowers, even those who are not currently enrolled in IDR plans. The Department of Education will issue a one-time adjustment applicable to past repayment periods, contributing towards the borrower’s 20- or 25-year student loan forgiveness term. The effective date for this program, initially subject to change, is now scheduled for December 31.

While applications for the student loan relief program are currently on hold, it is crucial to gather all relevant documents by June 30, in case the Supreme Court rules in favor. Collect all available student loan debt records to support your request and ensure you meet the eligibility requirements for potential loan forgiveness.

READ ALSO: What Causes Most Social Security Beneficiaries To Receive Two Payments This Month