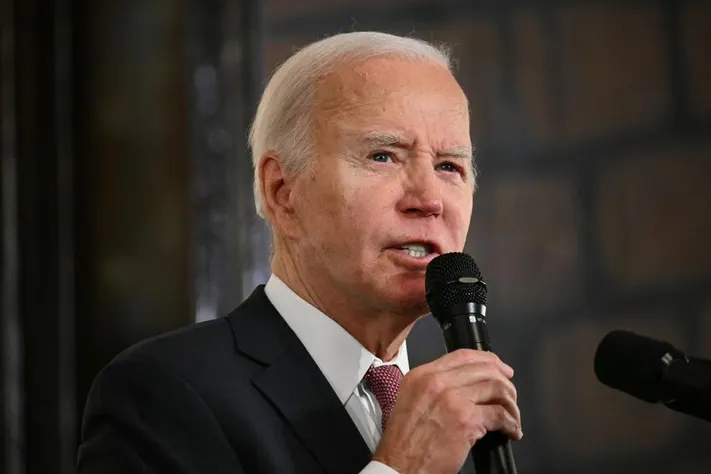

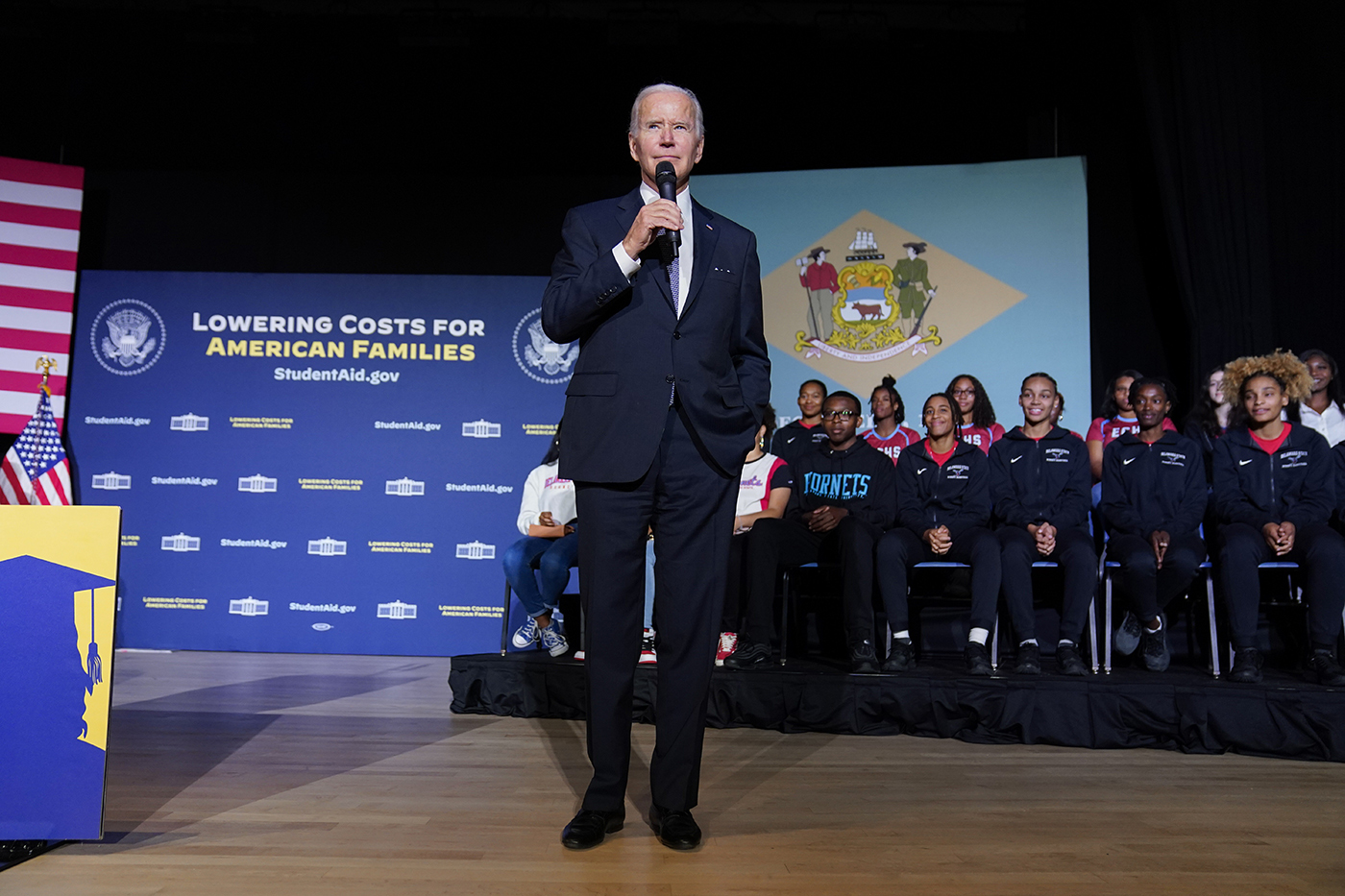

The Biden administration has been working on developing a fresh, legally sound relief package ever since the Supreme Court rejected its initial plan to cancel student loans.

This year could see the elimination of that debt. More than 10 million people might have their college debt forgiven under the alternate idea, which came to be referred to as Biden’s “Plan B.”

After attempting to eliminate student loan debt with an executive order, Biden is now utilizing the rule-making procedure.

Five categories of debtors have been defined by the U.S. Department of Education and the negotiators entrusted with deciding who will be qualified for the president’s enhanced help.

People who have more debt than they have borrowed

Individuals who have current federal student loan balances more than the amount they initially borrowed may be eligible for the cancellation.

According to Nadine Chabrier, senior policy and litigation counsel at the Center for Responsible Lending, there are several reasons why a person’s student debt can skyrocket.

Chabrier stated, “Sadly, it is very common.”

According to her, the corporations that the Education Department contracts with to manage its debt, known as student loan servicers, have a history of pressuring customers into forbearances and delays. These choices for troubled borrowers allow loans to be placed on hold for an extended period, but interest is frequently still charged.

Debtors making payments for at least 20 years

It might also help those who have been struggling with student loan debt for many years.

Such tales are typical because a large number of the Education Department’s repayment plans call for payments to be made for 20 years or longer. According to studies, millions of Americans over 60 are still making student debt payments.

“Having debt for decades can have negative effects on one’s finances and mental health, particularly when there seems to be no way to pay it off,” stated Persis Yu, deputy executive director of the Student Borrower Protection Center.