The study, conducted by the HEA Group and Student Defense, a nonprofit advocating for students’ rights, found that around one-third of graduate school programs owe more on their loans than they initially borrowed five years after completing their programs.

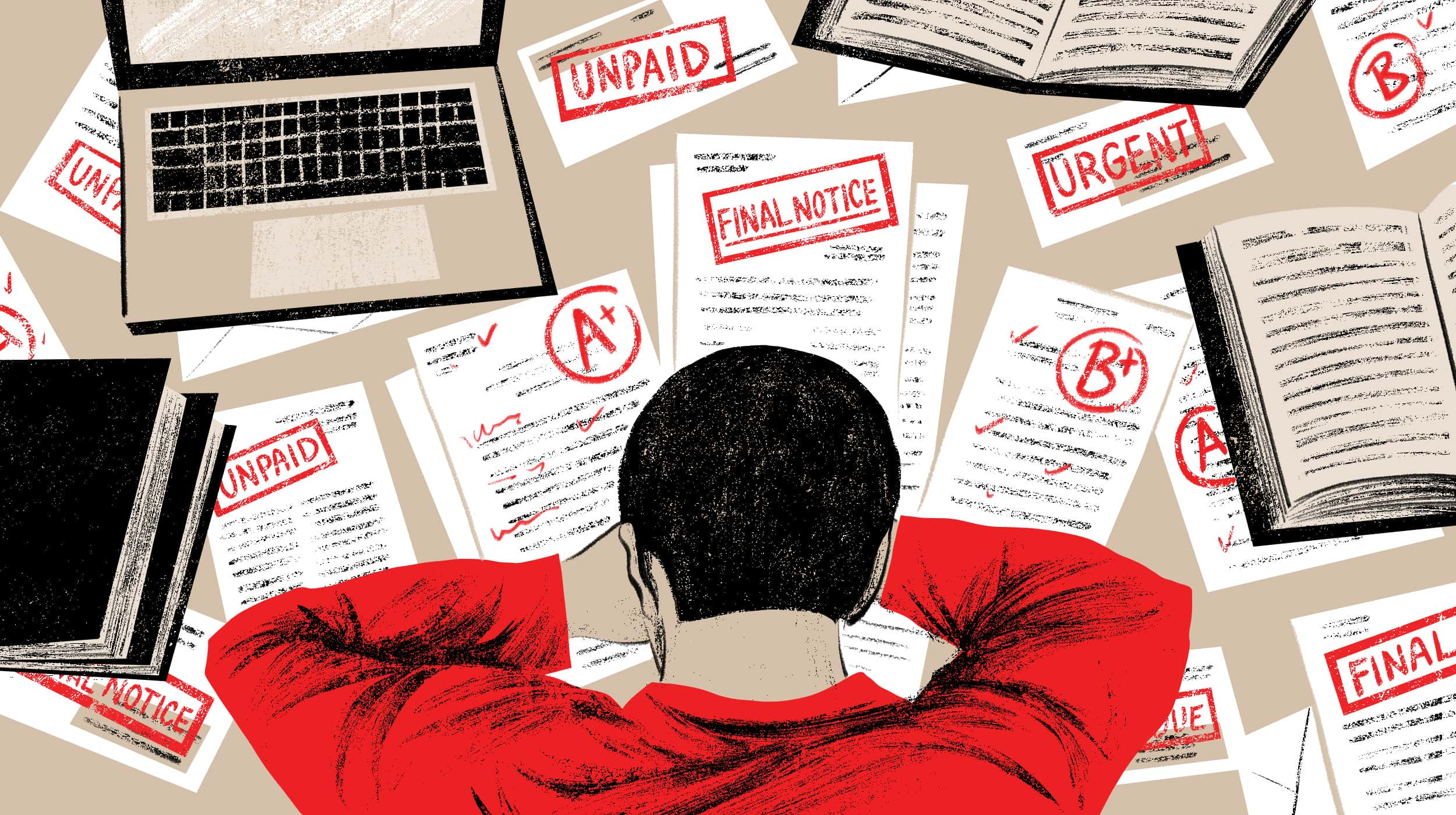

Graduate school programs have been under scrutiny due to a new analysis revealing that some students are struggling with excessive debt after graduation

While the cost of bachelor’s degrees has been a topic of concern, the study brings attention to the financial challenges faced by graduates of professional graduate school programs, such as medical and MBA degrees. Michael Itzkowitz, founder of HEA and former director of the Department of Education’s College Scorecard, emphasized the lack of accountability surrounding graduate school programs, stating that many students are drowning in debt.

To assess the situation, HEA examined 1,661 institutions and 6,371 separate graduate school programs, revealing alarming results. Among the institutions analyzed, 32% had graduated with loan balances higher than their initial borrowing amounts.

Walden University, an online for-profit institution offering master’s and Ph.D. graduate school programs, stood out as a concerning example. Graduates with psychology PhDs earned around $72,000 but carried debts of $175,000, making their debt-to-earnings ratio disproportionately high. The Consumer Financial Protection Bureau recommends that students should earn at least as much as the debt they take on to manage their loan payments effectively.

Interestingly, not only for-profit schools but also prestigious institutions like Columbia University had graduate school programs with high debt-to-earnings ratios

For instance, Columbia‘s master’s degree in film and video left graduates with nearly $164,000 in debt while earning only about $28,000 annually.

Itzkowitz emphasized that this data sheds light on programs that benefit students by ensuring they earn sufficient salaries to pay down their loans reasonably over time. With the concern raised by this analysis, there is a growing need for greater accountability and transparency in graduate school programs to help students make informed financial decisions.