This development comes as part of a bipartisan agreement to increase the national debt ceiling, which is expected to gain approval in the Senate and be signed into law by President Biden.

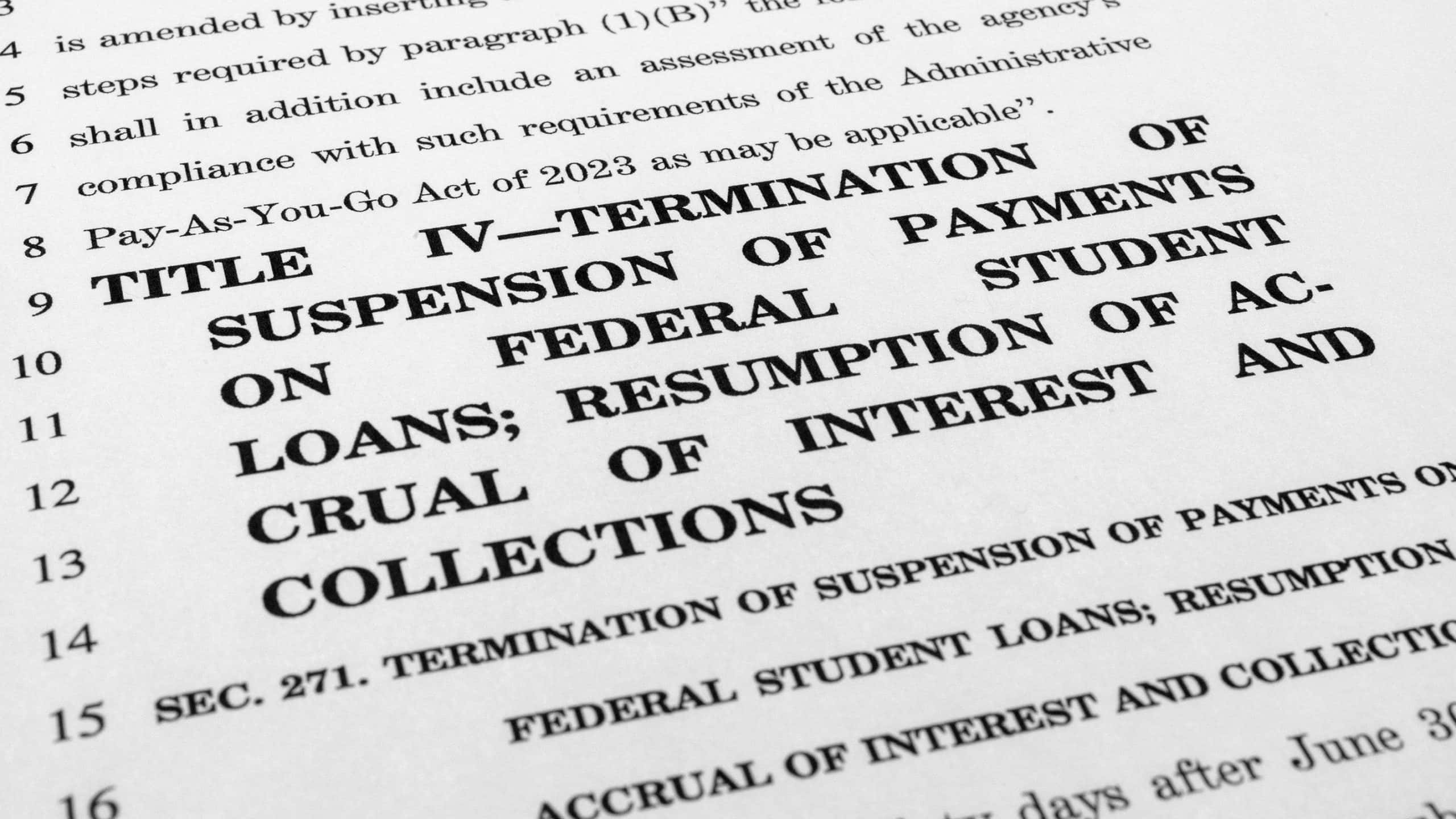

Student loan borrowers in the United States will soon have to resume their payments as the pause on federal student loan repayments and interest is set to end on August 30

Simultaneously, both the Senate and the House have voted against President Biden’s proposal to forgive up to $20,000 in student debt. However, despite the setback, the President has indicated his intention to veto the bill, ensuring the debt relief initiative remains viable.

Currently, the fate of the debt relief plan hangs in the balance as the Supreme Court deliberates on its legality. The proposal’s implementation has been put on hold until a final ruling is reached.

Once the pause on student loan payments ends, borrowers will be required to resume their repayment obligations. This development may pose a financial burden for many individuals who have relied on the temporary relief provided during the pandemic.

It is essential for borrowers to be prepared for the resumption of payments and explore available options to manage their student loan obligations effectively

The government and financial institutions may offer assistance programs or flexible repayment plans to help alleviate the burden on borrowers.

As the nation continues to navigate the economic challenges brought on by the pandemic, the future of student loan debt relief remains uncertain. The Supreme Court’s decision will ultimately determine the fate of the proposed plan, while policymakers and advocates continue to debate the best course of action for addressing the mounting student debt crisis.

READ ALSO: Massachusetts Couple File Federal Lawsuit After Kids Remove From Home Without Court Order