For a select few, there’s a surprise this October: their debt is being forgiven.

Following three and a half-year federal student loan payment pause, approximately 44 million borrowers now face resuming payments

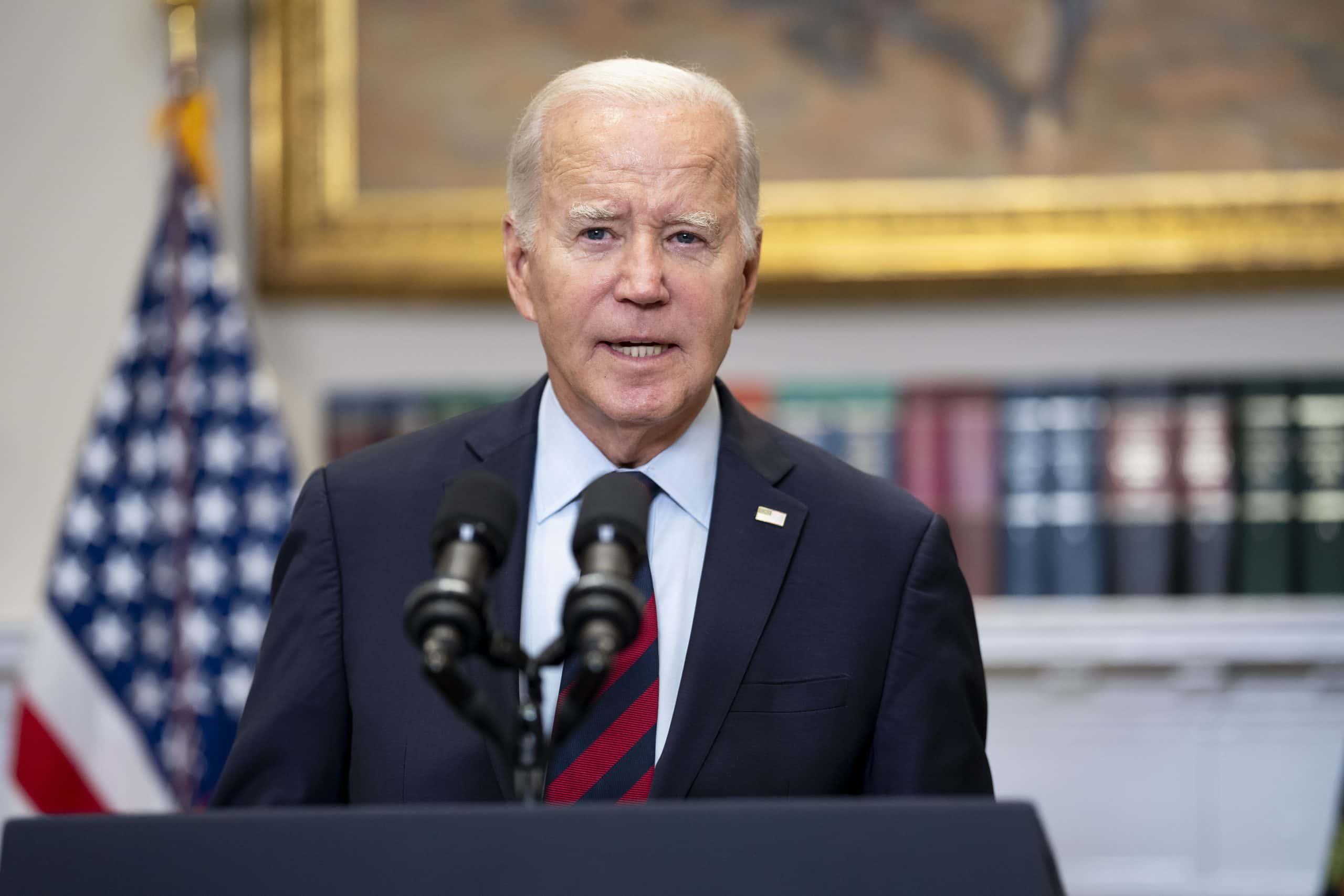

The Biden administration commits to erasing $9 billion in student loan payment pause for another 125,000 borrowers. This announcement comes after the Supreme Court rejected Biden’s $400 billion forgiveness plan earlier this summer.

Under the new policy, around 3.6 million borrowers have received approval for a total of $127 billion in debt cancellation. Those not qualifying for erasure will see payments resume this month. Washington, D.C. holds the highest average student loan payment pause at $54,856, followed by Maryland at $42,666. Georgia, Virginia, and Florida round out the top five.

Since the pause began in March 2020, the federal student loan payment pause has surged by $102 billion. Student loan debt varies by demographics including age, gender, race, ethnicity, and education level.

For those aged 24 or younger, the average debt is $14,296, doubling to $32,223 for those 25 to 34. It peaks at $45,703 for ages 35 to 39. Surprisingly, seniors aged 62 and older owe an average of $45,636. U.S. student loan payment pause has surged 66% over the last decade, exceeding $1.77 trillion.

Data from the 2020-2021 school year reveals over half of bachelor’s degree students graduated with an average debt of $29,100

Over a quarter of Americans with student loan payment pause owe $10,000 or less. Under Biden‘s now-defunct plan, nearly 20 million borrowers would have seen their debts erased. Financial expert Mark Kantrowitz advises timely payments, urging auto pay enrollment. Interest will accrue on unpaid loans, potentially exceeding the initial amount borrowed. Interest rates vary based on loan origination. For specific details, borrowers can refer to their loan service’s website or studentaid.gov, Kantrowitz suggested.

READ ALSO: SNAP Benefits Increase To Address Rising Costs And Inflation