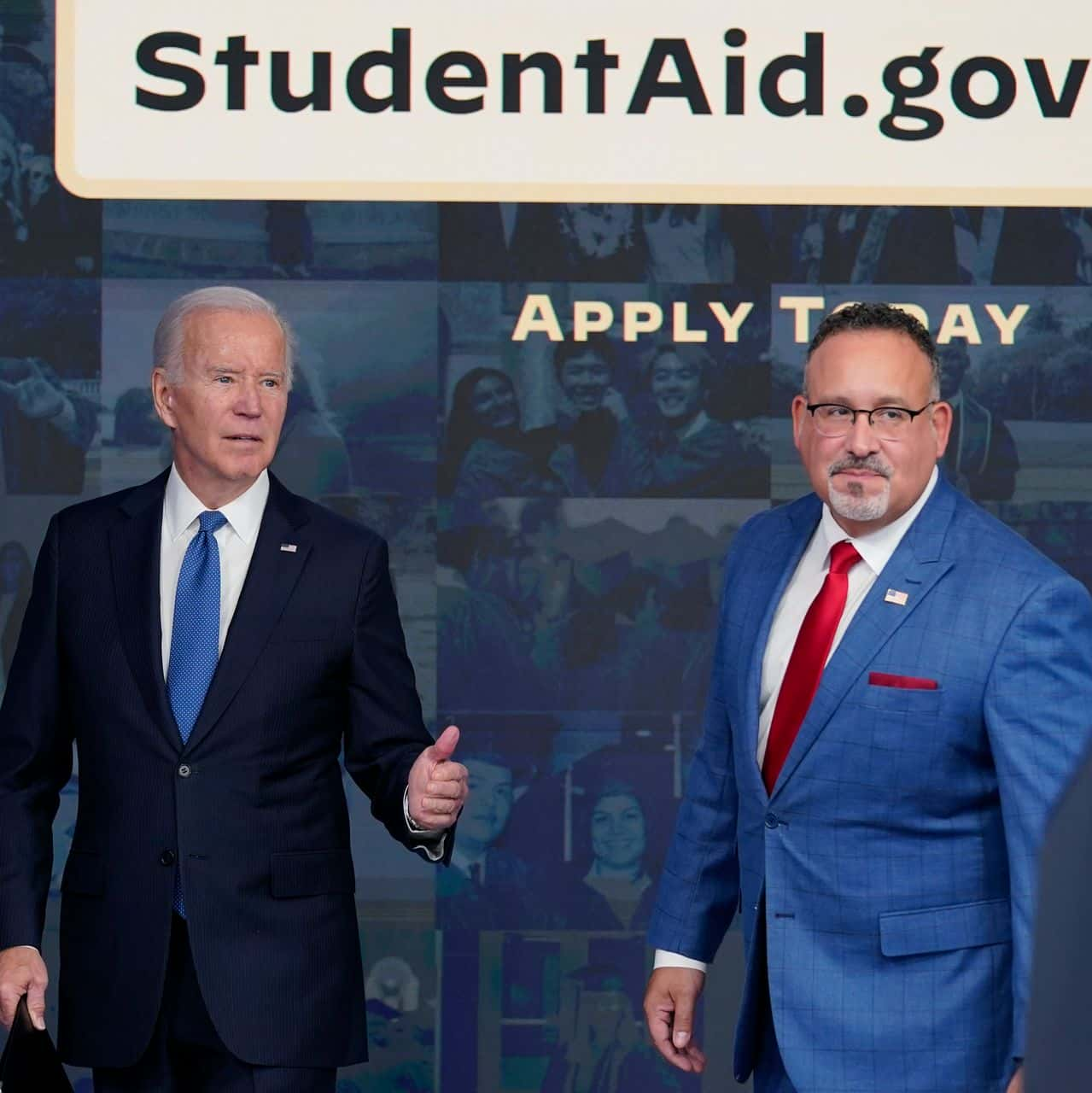

Further information on the federal government’s strategy to change the payment histories of hundreds of thousands of student loan consumers, which will bring them nearer to debt forgiveness, was made available.

This month, the Education Department provided details about which previous loans qualify for this one-time payment adjustment, the way consumers with specific loans are eligible, what defaulted consumers can anticipate, when the change will take place, as well as when repayment may start.

The change, which was introduced in April of last year, now counts some months against student loan discharge through income-driven repayment programs or IDRs. As per Federal Student Aid (FSA), the change will grant a minimum of 3 years of credit regarding loan clearance to about 3.6 million students.

The action is unique from the president’s decision to cancel up to $20,000 in student loans, which is currently on hold while the Supreme Court decides whether it is genuine. The ruling of the Supreme Court has no impact on the adjustment.