The Social Security Administration provided an average monthly check of $1,836.06 to these retirees, which amounts to an annual payout of around $22,000.

In the month of May, approximately 66.7 million Americans received their Social Security Check 2023 benefits, with retired workers accounting for 49.4 million of them

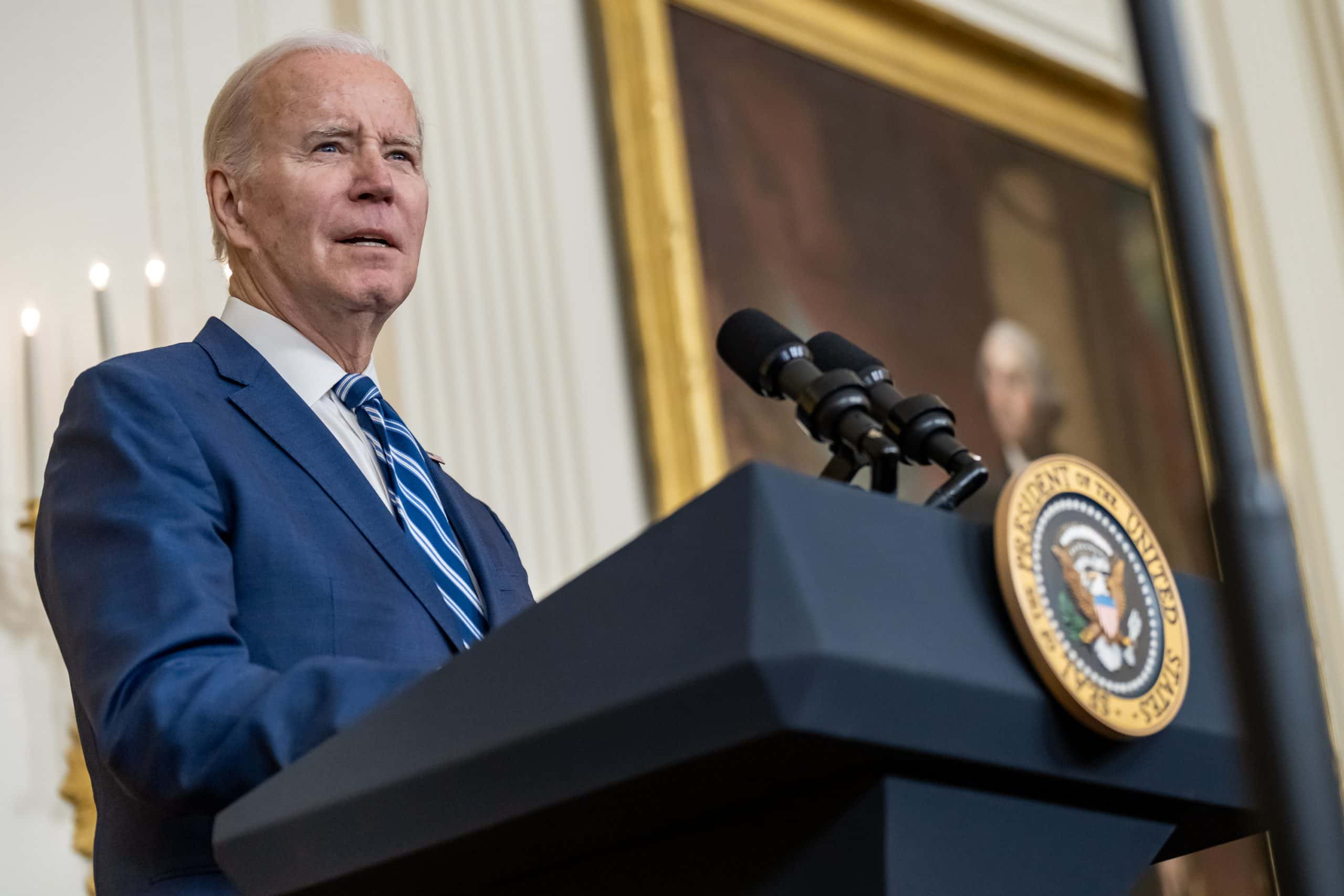

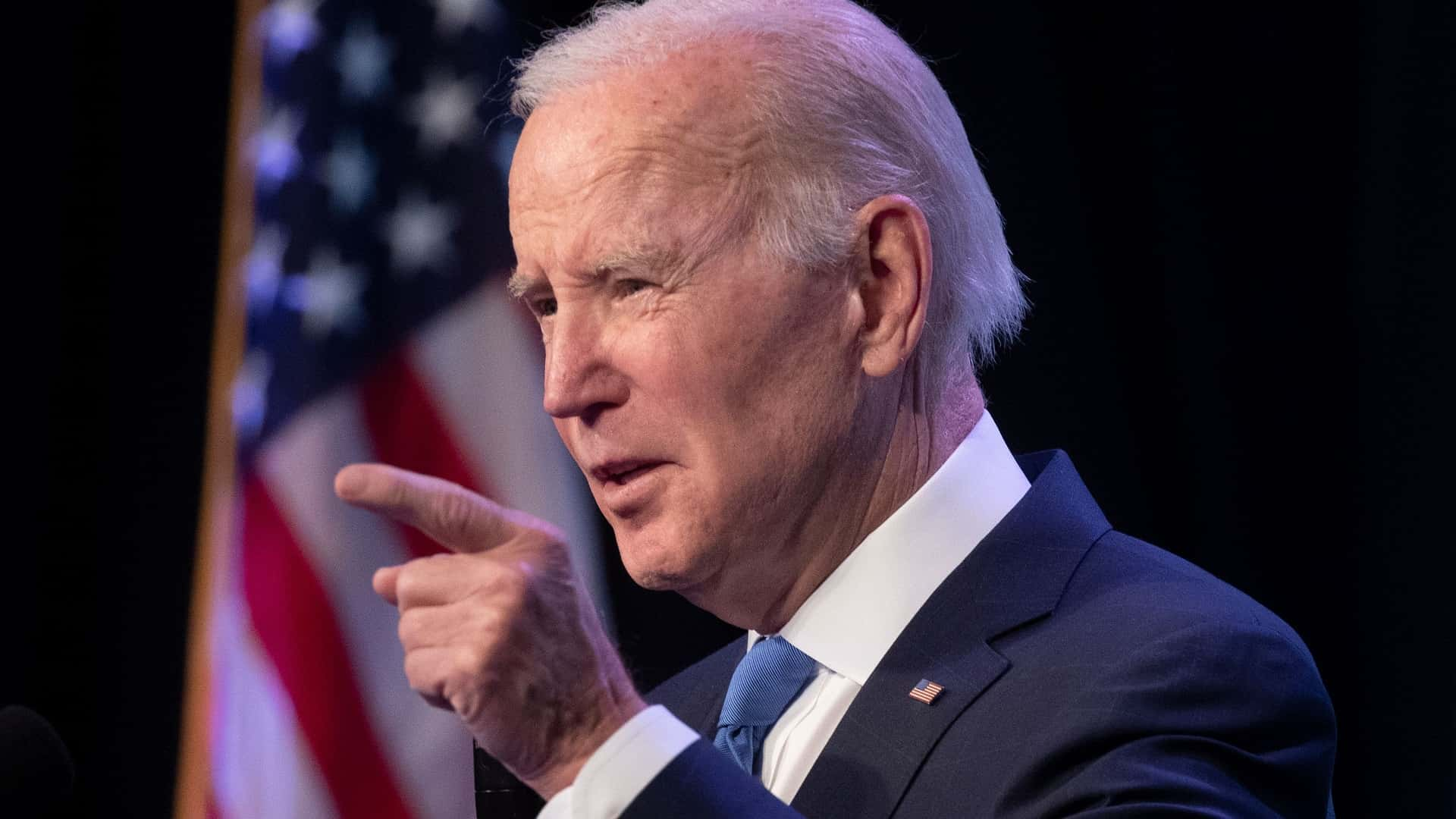

Among the recipients of Social Security Check 2023, benefits are President Joe Biden and First Lady Dr. Jill Biden. Eligibility for the retired-worker benefit requires earning a minimum of 40-lifetime work credits. It has become an unofficial tradition for presidential candidates and sitting presidents to disclose their federal tax returns for the past 50 years. As a result, the public has access to Joe Biden’s tax returns from the past 25 years, noting that he files jointly with his wife.

The Bidens’ 2022 tax returns reveal that they received $58,465 in Social Security benefits, equivalent to around $4,872 per month. President Biden individually received $3,248.42 per month, while Jill Biden received $1,623.67 per month. Notably, Jill Biden‘s benefit is approximately half of her husband’s, indicating that she likely receives spousal benefits, which are capped at 50% of the spouse’s monthly payout. While the Bidens’ monthly benefits from Social Security Check 2023 amount to a substantial sum, considering their annual earnings, it is not a major income source.

Notably, the Social Security Check 2023 program has a provision that limits the monthly benefit check for high earners. Individuals who regularly exceed the maximum taxable earnings cap in a given year will have their monthly benefits capped at full retirement age. Although the Bidens’ annual income exceeds the cap, the Social Security Check 2023 program naturally restricts the amount they can receive. Additionally, it is important to note that Social Security Check 2023 benefits may be subject to federal and/or state taxes upon retirement.

In 1983, to prevent the depletion of Social Security’s asset reserves, lawmakers implemented changes to the program through the Amendments of 1983

These amendments introduced several modifications, including an increase in the full retirement age, payroll tax rate, and the taxation of benefits. Since 1984, individuals whose AGI, plus nontaxable interest, and half of their Social Security Check 2023 benefits exceed $25,000 (or $32,000 for couples) have seen up to 50% of their benefits subject to federal income tax. In 1993, a second tier of taxation was added, whereby up to 85% of benefits became taxable at the federal level for individual filers above $34,000 (or $44,000 for joint filers).

Due to their income surpassing the threshold, the Bidens had $49,695 (85%) of their combined $58,465 in Social Security Check 2023 benefits subject to federal taxation in 2022. It is worth noting that the income thresholds for taxation established in 1983 and 1993 have never been adjusted for inflation. Consequently, as Social Security Check 2023 checks increase over time due to cost-of-living adjustments and inflation, more seniors find themselves exposed to this tax.

While many Americans are behind on their retirement savings, understanding certain “Social Security secrets” can potentially boost retirement income. Exploring strategies to maximize Social Security Check 2023 benefits can provide individuals with more confidence and peace of mind.

READ ALSO: Utah Residents To Benefit From Additional Direct Payments For SNAP, Ensuring Access To Food Stamps