In a significant move, the Internal Revenue Service (IRS) has announced plans to distribute approximately $2.4 billion in special payments to around one million taxpayers who did not claim the Recovery Rebate Credit on their 2021 tax returns.

Who Will Receive These Payments?

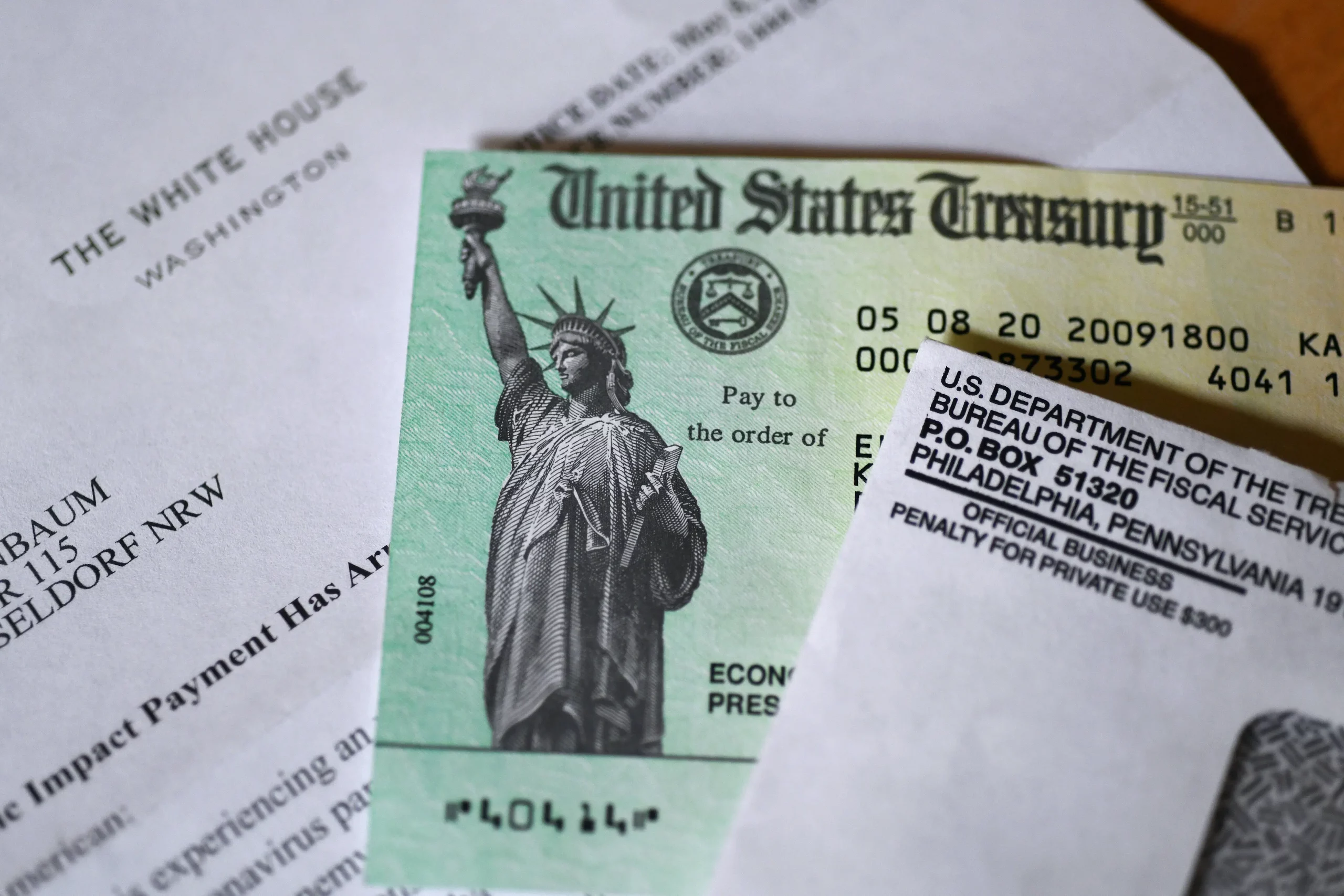

The recipients are individuals who, despite being eligible, either left the Recovery Rebate Credit field blank or entered $0 on their 2021 tax returns. These taxpayers were entitled to Economic Impact Payments during the COVID-19 pandemic but failed to claim them. The IRS has proactively identified these cases and will automatically issue payments of up to $1,400 per person.

When and How Will Payments Be Made?

The distribution process began in December 2024, with the IRS aiming to complete the payments by late January 2025. Funds will be directly deposited into the bank accounts provided on taxpayers’ 2023 returns. For those without direct deposit information on file, paper checks will be mailed to the address of record. No additional action is required from eligible taxpayers to receive these payments.

Who Is Eligible for These Payments?

To qualify for the Recovery Rebate Credit payments, individuals must meet these requirements:

- Income limits: $75,000 or less for single filers, $112,500 for head-of-household filers, and $150,000 for joint filers.

- Valid Social Security Number: Everyone included in the claim must have a valid Social Security number.

- Citizenship or Residency: Recipients must be U.S. citizens or resident aliens for 2021.

- Not a Dependent: You cannot be listed as a dependent on someone else’s tax return.

What If You Haven’t Filed Your 2021 Tax Return?

Taxpayers who have not yet filed their 2021 tax returns still have an opportunity to claim the Recovery Rebate Credit. The deadline to file and receive any eligible refunds is April 15, 2025. Filing promptly will ensure that you receive any payments due.

Stay Informed

To verify your eligibility or for more information, visit the official IRS website or consult with a tax professional. Staying informed through reputable sources will help you navigate these updates effectively.