As the Richardson City Council goes forward with its budget cycle, a date for resident feedback on the city’s proposed new tax rate has been set.

According to documents provided to the Richardson City Council, the proposed rate discussed during the meeting on August 7 is $0.56095 per $100 valuation, taking into account both the $0.34316 maintenance and operations rate, which includes general expenditure, and the $0.21779 interest and sinking rate, which includes debt servicing.

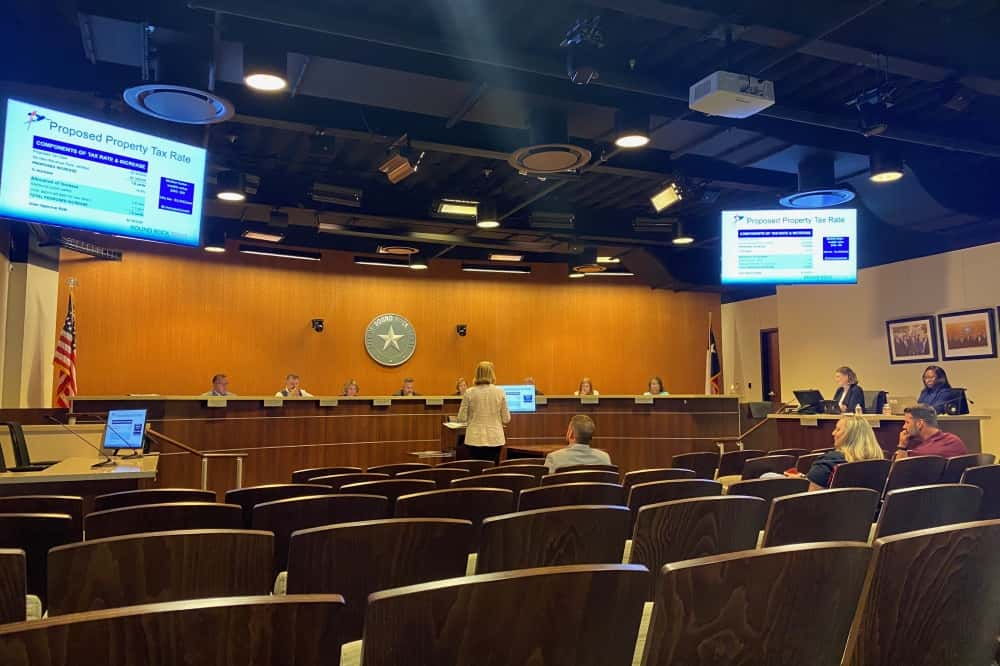

Richardson City Council will conduct a public hearing during the Aug. 21 meeting at the temporary City Hall building, which is located at 2360 Campbell Road.

According to City Manager Don Magner of Richardson City Council, the proposed rate capitalizes on unrealized revenue from prior fiscal years in property tax rates while keeping the tax rate the same as before. However, according to Richardson City Council, rising valuations mean that the average homeowner’s tax bill will rise by around $141, he said.

Digging deeper

In addition, City Manager Magner of Richardson City Council said the budget could absorb a 6% merit-based market adjustment for all staff pay, including emergency workers, by retaining the same tax rate as last year.

This includes a rise in the city’s monthly longevity pay, according to Richardson City Council, which is extra compensation provided to employees who have worked for more than a year, from $4 to $8 per month.

City Manager Magner of Richardson City Council earlier advocated a $6 per month increase in longevity compensation, as previously reported by Community Impact. Magner stated that additional cash will be available for street restoration, building and park maintenance, and equipment replacement.