If you’re a parent or guardian, the Child Tax Credit (CTC) is a lifeline for your finances. As we step into 2025, it’s essential to know what this credit offers and how you can benefit from it. Here’s a simplified guide to help you make the most of the Child Tax Credit this year.

How Much Can You Claim?

In 2025, the Child Tax Credit offers up to $2,000 per qualifying child under 17. A portion of this up to $1,700 per child is refundable. This means even if your tax bill is less than the credit, you could get the difference back as a refund.

For instance, if you owe $1,000 in taxes and qualify for the full refundable credit, you could receive a $700 refund.

Who Qualifies?

To claim the CTC, you need to meet specific conditions:

- Age: The child must be under 17 at the end of 2025.

- Relationship: The child should be your son, daughter, stepchild, sibling, or their descendants (like a grandchild or niece).

- Residency: The child must live with you for more than half of the year.

- Income Limits: Single filers earning up to $200,000 and married couples filing jointly with an income of up to $400,000 qualify for the full credit. The amount decreases by $50 for every $1,000 above these thresholds.

- Social Security Number: Your child must have a valid SSN issued before the tax filing deadline.

When Will Payments Arrive?

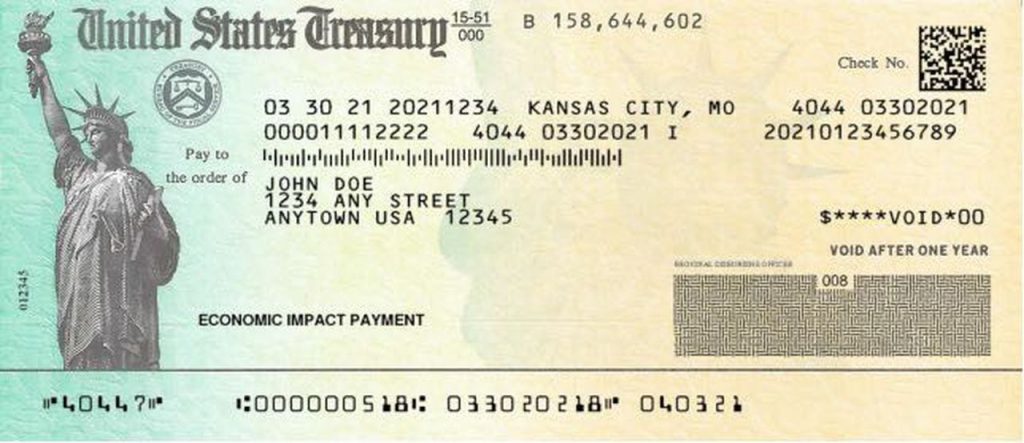

Unlike in 2021, when advance monthly payments were offered, the 2025 CTC will only be available as a lump sum after filing your tax return. Here’s what you need to know:

- File Your Taxes: Between January and April 15, 2026.

- Refund Timeline: Most refunds arrive within 21 days if you file electronically and choose direct deposit.

Any Changes Ahead?

There’s ongoing debate about expanding the credit. Some proposals aim to increase it to $5,000 per child, but as of now, no new laws have passed.

Final Thoughts

The Child Tax Credit continues to be a vital resource for families across the U.S. By knowing your eligibility and filing correctly, you can ensure you receive every dollar you’re entitled to. Keep an eye on potential legislative updates that could boost these benefits even further.

Feel free to ask any questions or share concerns this credit could make a big difference for your family in 2025!