Presently, nine states across the U.S. operate without a state income tax.

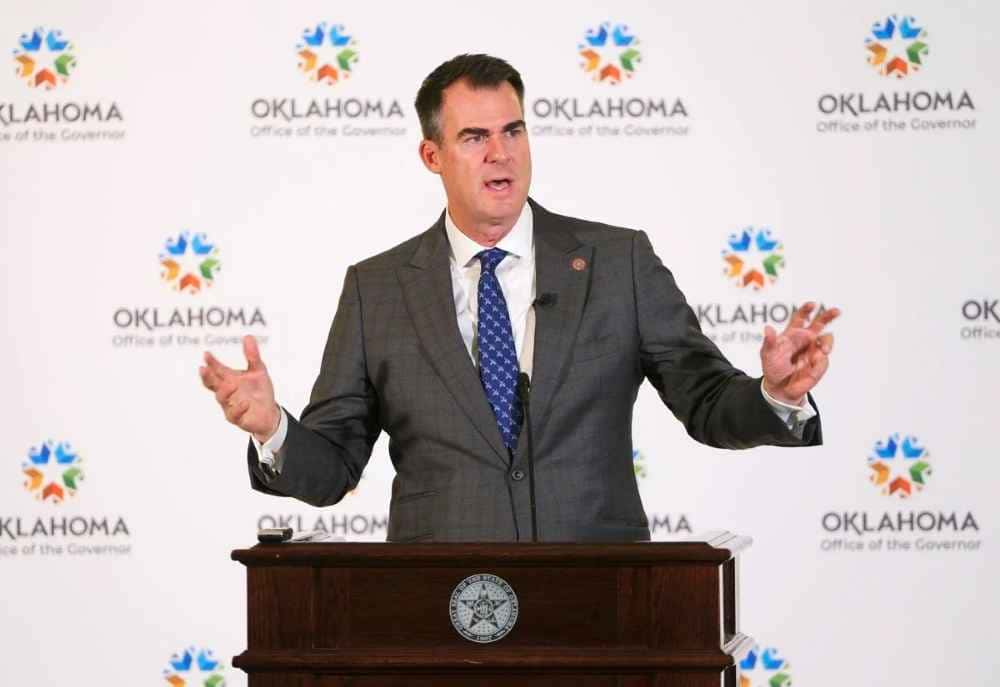

Oklahoma income tax rate might witness a historic overhaul, as Governor Kevin Stitt contemplates a bold move during the upcoming special session scheduled for October

In contrast, Oklahoma‘s existing income tax structure spans from a modest 0.25% to a peak of 4.75%, contingent on the individual’s earnings. Speaker of the House, Charles McCall, shed light on potential legislation that would usher in this transformation. Under this proposal, reaching a zero percent Oklahoma income tax rate would be a multi-stage process, with built-in triggers. These triggers would be activated as the state’s revenue experiences growth, which in turn, would lead to a proportional decrease in the Oklahoma income tax rate.

This perspective shift in tax policy holds significant implications for the citizens of Oklahoma, potentially offering a substantial reduction in the financial burden carried by residents across varying income brackets. As Governor Stitt explores this groundbreaking proposal, he joins the ranks of states like Texas, Florida, and Nevada, which have long functioned without a state income tax.

The proposal comes at a critical juncture, with economic experts and lawmakers closely monitoring the potential impact on the state’s budgetary framework

The envisioned transition towards a zero percent Oklahoma income tax rate is expected to stimulate economic activity, attracting businesses and bolstering job creation. Proponents argue that the resultant economic growth could ultimately offset any initial revenue loss, thereby ensuring the state’s fiscal stability.

However, critics express concerns about the potential challenges associated with this transformation, emphasizing the need for careful planning and monitoring of the state’s finances. Skeptics point to the experiences of other states that have attempted similar tax overhauls, urging caution in order to avoid unforeseen consequences.

As the special session approaches, all eyes are on the Oklahoma State Capitol, where discussions on the Oklahoma income tax rate are expected to take center stage. With Governor Stitt at the helm of this ambitious proposal, the potential for a zero percent Oklahoma income tax rate in the state represents a pivotal moment in Oklahoma’s fiscal history.

READ ALSO: Kentucky Holds Steady In Small Business Tax Rate Rankings