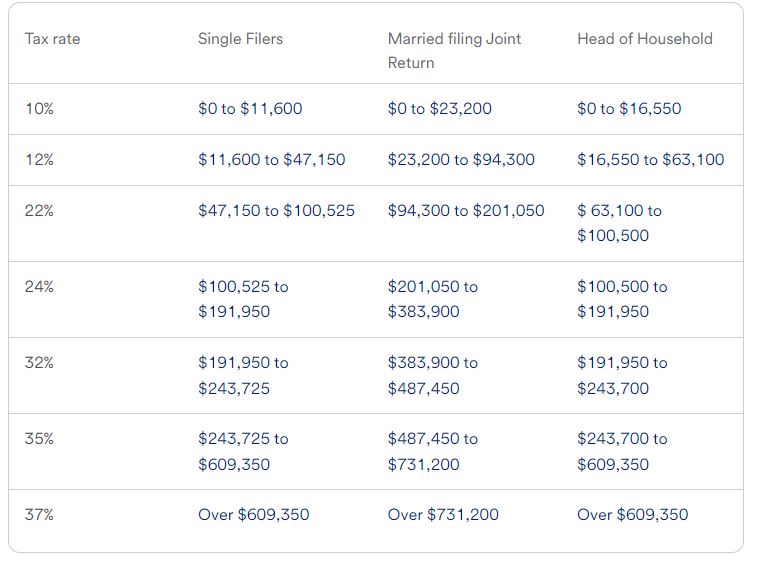

Every year, new tax laws implemented to emphasize tax brackets, standard deduction amounts, and other significant inputs to tax planning are adjusted, generally in line with changes in the cost of living and tax refunds.

The following provisions apply to your 2024 income tax return depending on your filing status based on the New Tax Laws!

In the New Tax Laws, the income is taxed on a graduated basis. For example, in the case of a married couple filing a joint return, the first $23,200 of income is taxed at the 10% federal rate. The next $71,100 (income between $23,200 and $94,300) is taxed at a 12% rate, and etc.

The IRS started the new tax filing on January 29, which means that taxpayers will have between that date and April 15 to file their returns. In the new tax laws, not everyone will get a bigger tax refund, of course. The taxpayers could end up owing this year, especially given that more people took on side gigs last year to compensate for higher costs.

Read Also: New Mexico Governor And Lawmakers Approved The 2023 Tax Rebates For New Mexico Taxpayers

The IRS has been accepting tax returns starting last January 29 and the new tax laws maximed it!

Some of them might not have paid quarterly self-employment taxes and could owe the IRS come April 15, he noted. The average tax refund was $3,167, or almost 3% less than the prior year, according to IRS statistics. By comparison, the new tax laws could typically refund checks jumped 15.5% to almost $3,300 in 2022, when taxpayers received generous tax credits like the expanded Child Tax Credit.

Read Also: New Jersey Governor And Lawmakers Announce A Deal On Property Tax Rebate Plan For Seniors