The state’s Taxation and Revenue Department will be distributing these payments to individuals who have filed their 2021 taxes.

New Mexico residents can expect a tax rebate payment in the month of June, with the amount reaching up to $1,000

The rebate values have been determined as $500 for single filers and $1,000 for married taxpayers filing jointly, heads of household, and surviving spouses. Governor Michelle Lujan Grisham‘s office released a statement affirming this information. Governor Grisham emphasized that despite the high cost of basic necessities nationwide, New Mexico‘s strong financial position should benefit its residents.

For taxpayers who have changed their address since filing their 2021 tax returns, there are two methods to update their information. They can utilize the Taxpayer Access Point self-service portal on the state’s Taxation and Revenue Department website or submit a change of address form directly to the department.

If a taxpayer has modified their banking information after filing their 2021 tax return, they will receive the rebate payment through mail delivery

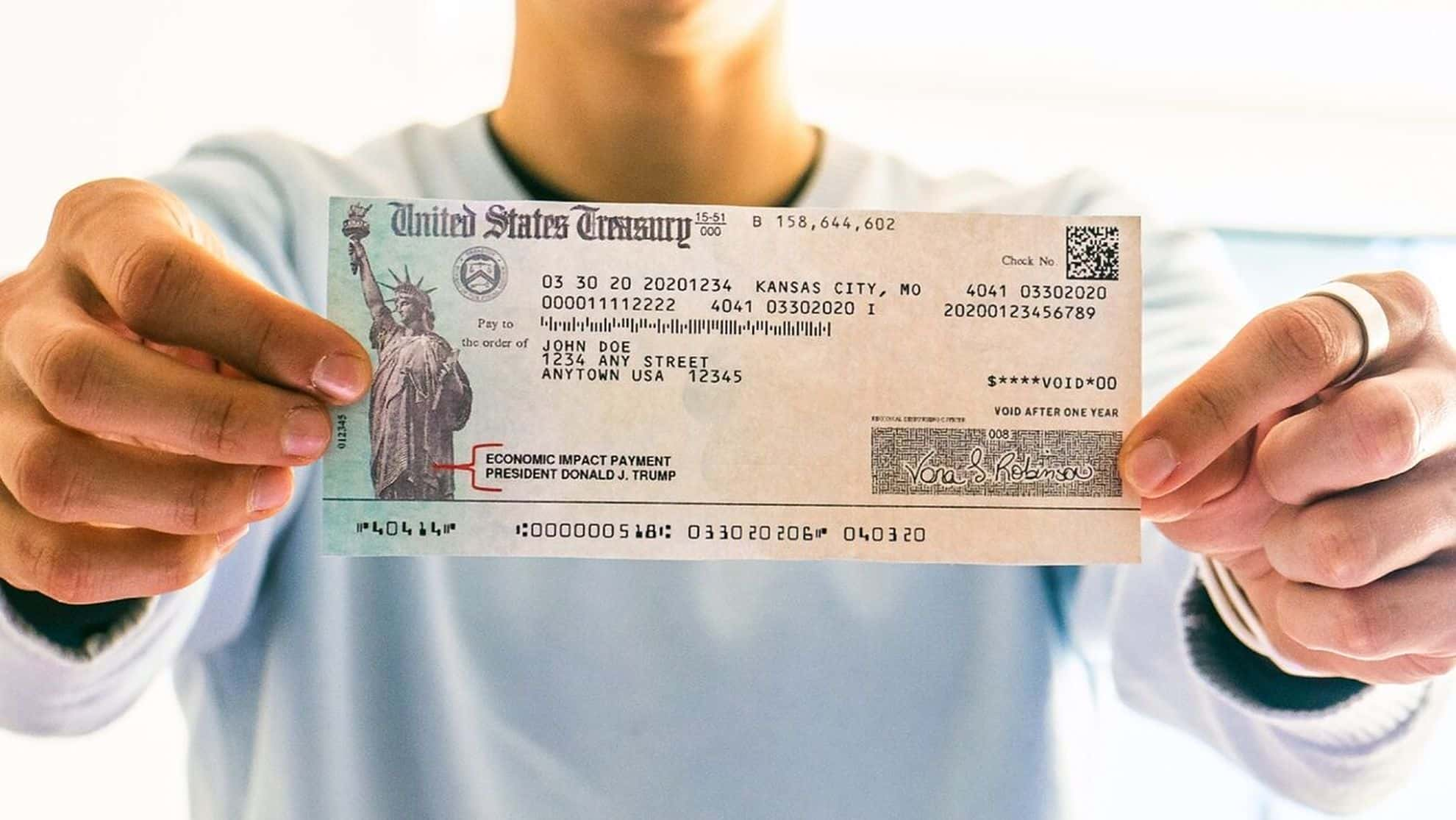

Those who received a refund via direct deposit for their 2021 returns will also receive their rebate through the same method. Individuals who did not receive their 2021 returns via direct deposit will receive a check through the mail. Direct deposits will be prioritized, with paper checks being mailed afterward. Taxpayers who have yet to file their 2021 returns have until May 31, 2024, to do so.

READ ALSO: Eligible Recipients To Get Relief Under Inflation Reduction Act