In the new property tax rebates plan of New Jersey, homeowners who are 65 and above who make $500,000 or less will be eligible to receive up to $6,500 in property tax relief.

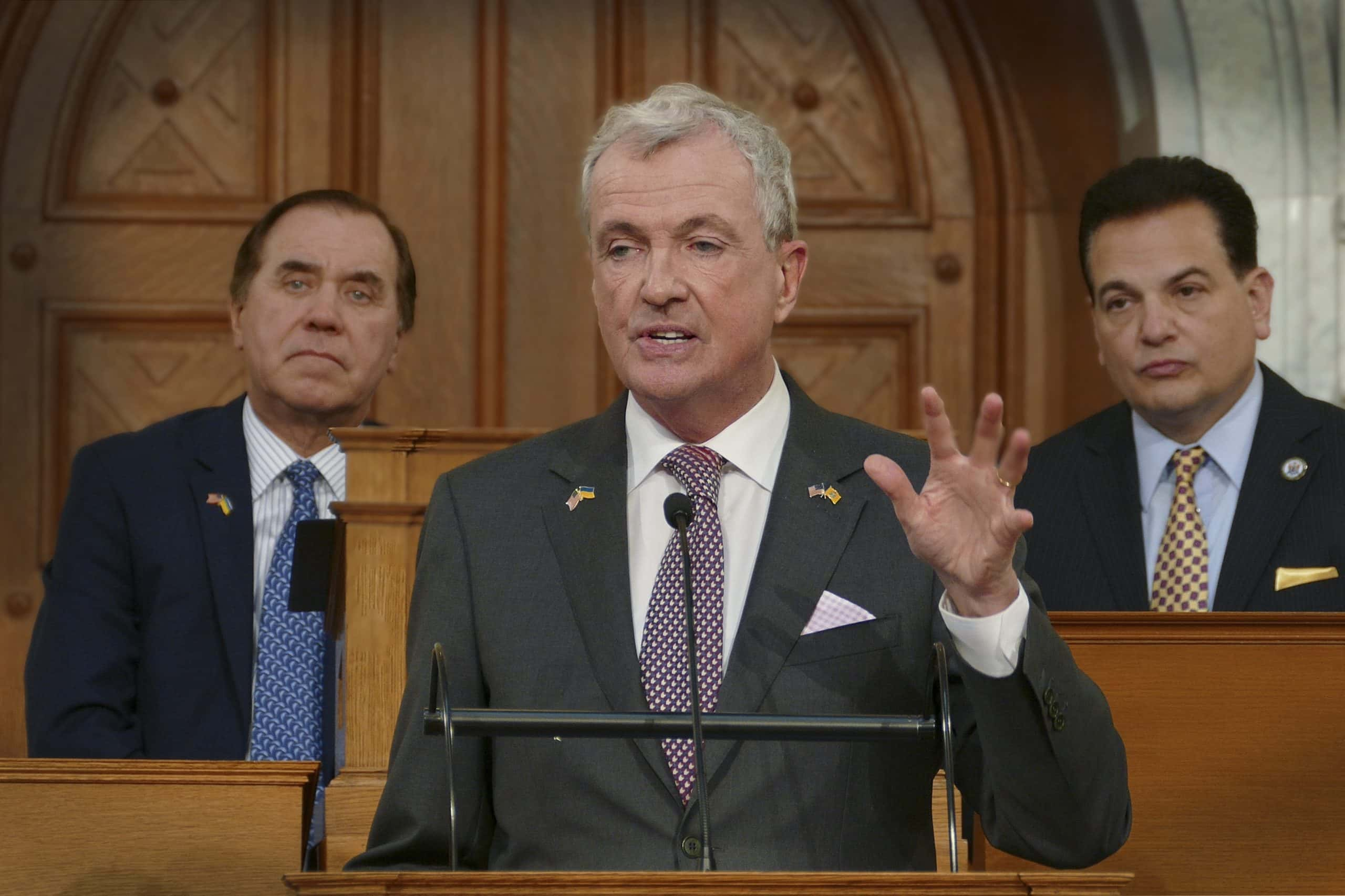

New Jersey Governor and Lawmakers announced the property tax rebates plan

New Jersey Governor and Lawmakers announced a deal last Wednesday on a property tax rebates plan after negotiations over the state’s $50 billion budget.

65 and older homeowners who make $500,000 or less will be qualified to receive up to $6,500 in property tax refunds under the new plan. Renters may be eligible to receive up to $700 in property tax rebates.

Those property tax refund benefits will take until 2026, but seniors and renters can expect to receive $250 as immediate property tax rebate relief if the plan passes.

Read Also: Tax Relief Programs Aim To Support Senior Residents In New Jersey

The property tax relief program will cost $1.2 billion once completely implemented

New Jersey care about seniors and making the state affordable for all. This will give people the opportunity to live and stay in New Jersey.

If the seniors get their property tax relied on benefits, they extend to all of the family.

Read Also: Rape Spree In Boston Represents New Type Of Criminal Through DNA: New Jersey Attorney