The measure would cut individual and corporate income taxes to 3.99% over six years and fast-track the full exemption of Social Security benefits.

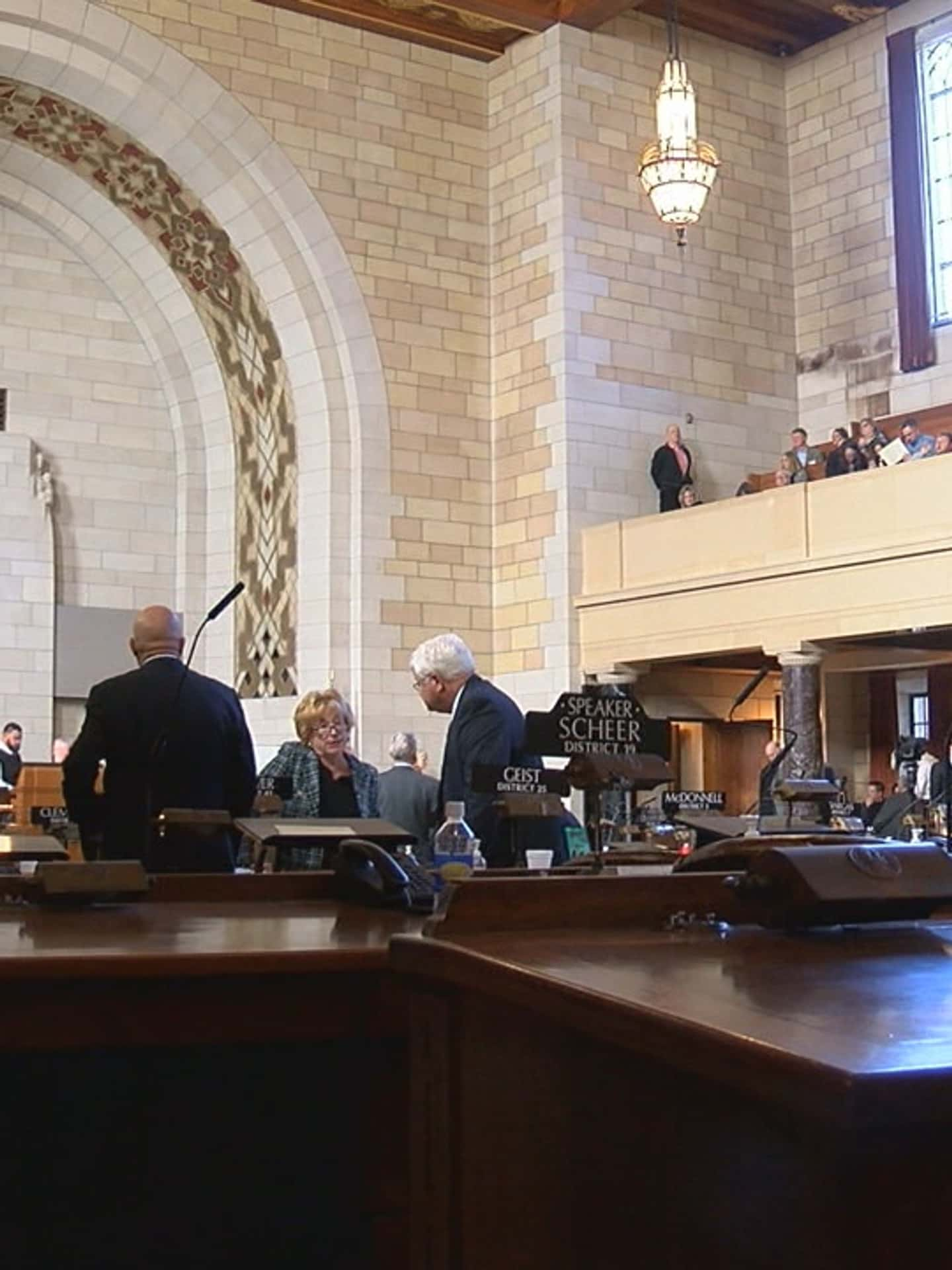

Lawmakers in Nebraska passed a bill aimed at reducing the state’s top income tax rate by almost one-third, on Thursday

The legislation would also offer tax credits for low-income parents and childcare providers. However, opponents of the bill have raised concerns over its affordability in the long term and the unequal distribution of tax cuts. Critics argued that the majority of tax cuts would benefit wealthier Nebraskans, while the lower-income brackets would receive little benefit.

Senator George Dungan noted that the lowest-paid Nebraskans would receive an average of $5 in tax cuts, while an estimated 83% of corporate tax cuts would go to non-Nebraska residents. State Sen. Lou Ann Linehan, the Revenue Committee chairwoman, put forward an amendment to narrow the bill, which originally contained more tax cuts.

The amendment reduced the bill’s cost from $558 million to $379 million over the next two years

Despite criticism, supporters of the bill argued that it would help Nebraska become more competitive in attracting people and businesses and that the state could not afford all of the income tax cuts in the original proposal. The legislation has been forwarded to the last of three rounds of consideration on a 37-4 vote.

Lawmakers have also approved offering up to $15 million a year of tax credits for parents with children in child care, $2.5 million in credits for people who donate to child care programs, and another $7.5 million in credits for child care programs and workers.