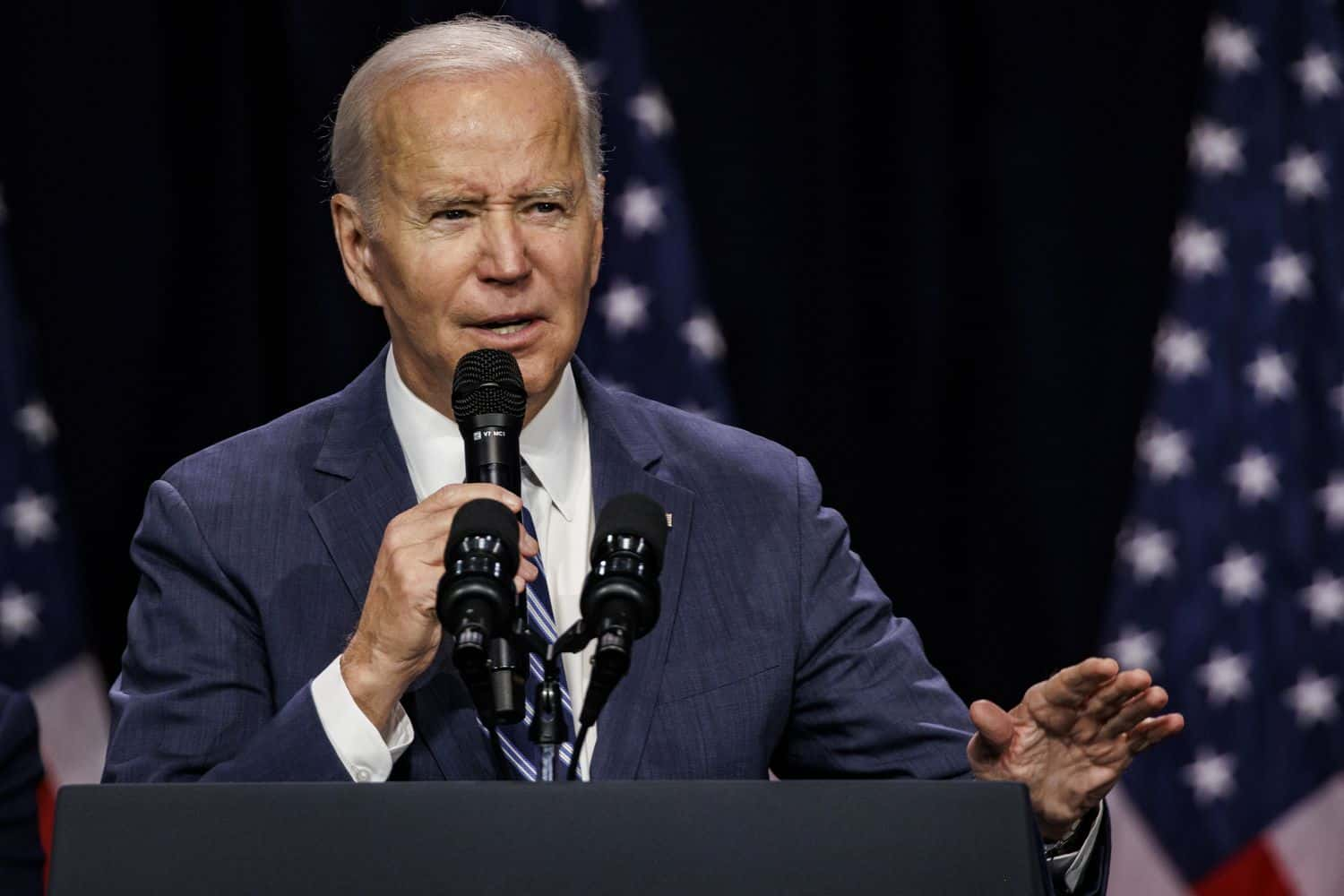

With approximately 44 million Americans burdened by mass student loans totaling over $1.6 trillion, President Joe Biden has taken steps to alleviate this crisis.

Mass student loan forgiveness faced a setback in the Supreme Court last summer, but there’s still a chance for significant relief

Biden has already wiped out $127 billion in student debt for more than 3.5 million borrowers, setting a record among all presidents. Leveraging previously inaccessible programs, he’s made strides in offering relief. Several forgiveness initiatives related to mass student loans are approaching crucial deadlines. Quick action is necessary to benefit from these programs. Some programs will kick off in 2024, necessitating early awareness and planning. To ensure maximum benefit, a comprehensive list of critical dates has been compiled.

For those with loans not held by the Department of Education such as FFEL, school-held Perkins loans, or HEAL loans a loan consolidation into a new Direct Consolidation Loan by December 31 is essential. This step is crucial for credit under the Income-Driven Repayment (IDR) account adjustment, potentially altering payment crediting for mass student loan forgiveness.

Public service workers must submit the necessary forms and applications for mass student loan forgiveness by the end of 2023. Nearly 855,000 borrowers are set to receive relief under this temporary program, amounting to $42 billion, as announced by the White House.

Automatic forgiveness might not apply universally, but the IDR account adjustment moves borrowers closer to repayment completion

Enrolling in an IDR plan, usually spanning 20 to 25 years of consistent payments, can facilitate eventual forgiveness. Recertification, typically an annual process, might be crucial for payment adjustments after the payment pause.

Undergraduate loan repayments could be reduced by half, and borrowers with various loan types will pay a weighted average based on original principal balances. Those who consolidate loans will receive credit for payments toward forgiveness based on the principal balance. Delinquent borrowers during a specified period are shielded from adverse consequences, avoiding credit bureau reporting or default status. Understanding these deadlines and program details is crucial for borrowers navigating the complexities of mass student loan forgiveness.