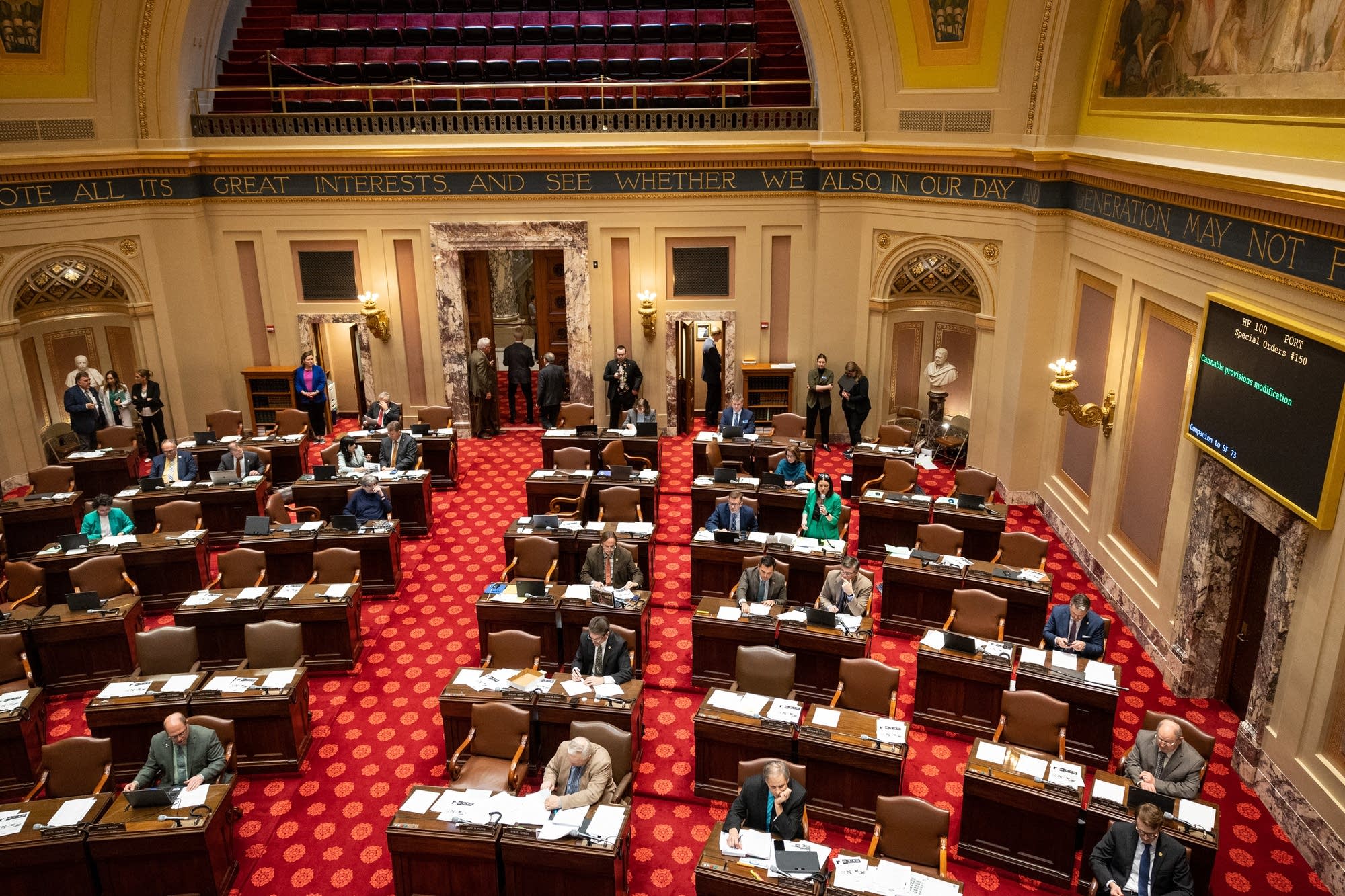

Amid Minnesota‘s legislative session, the Minnesota Senate Tax Chair, Ann Rest, remains resolute in her stance against new taxes, Minnesota Senate Tax Bill. With the state’s surplus projected at $2.4 billion, Rest’s “no new taxes” declaration signals a tight fiscal landscape for the majority of Democrats.

Rest’s Firm Stand

Rest’s unwavering stance comes at a critical juncture where fiscal responsibility is paramount. With a potential $2.3 billion “structural imbalance” looming, Rest emphasizes prudence in spending. She staunchly asserts her position to colleagues: no new spending or taxes under Minnesota Senate Tax Bill.

Rest’s assertion underscores the challenges Democrats face in garnering support for significant expenditures, given the need for 34 votes in the 67-member chamber. While proposals for new taxes will receive hearings in her committee, Rest plans to defer decisions for future sessions, maintaining fiscal caution.

Beyond her commitment to blocking new taxes, Rest remains committed to rectifying past legislative errors. She aims to swiftly address a $352 million error embedded in last year’s tax bill. However, her disinterest in amending a new 50-cent fee on deliveries over $100 reflects her firm stance against additional taxation.

READ ALSO: EV Tax Credits 2024: A Guide to Maximizing Savings on Electric Vehicles

Diverging Perspectives

While Rest remains steadfast, DFL Rep. Erin Koegel defends the delivery fee as an innovative means of funding transportation. Despite differing views, both legislators navigate the complexities of taxation and expenditure in Minnesota’s political landscape.

As the legislative session progresses, the forthcoming February forecast from Minnesota Management and Budget will provide critical insights into the state’s financial trajectory under Minnesota Senate Tax Bill. With the May adjournment deadline looming, legislators must navigate competing priorities amidst fiscal constraints.

READ ALSO: Virginia Tax Rebate: Check Your Eligibility for Up to $400 Now