The decision was made during a recent Thursday meeting, with a unanimous 4-0 vote in favor of lowering the tax rate from 37.5 cents to 34.77 cents for every $1,000 of assessed property value.

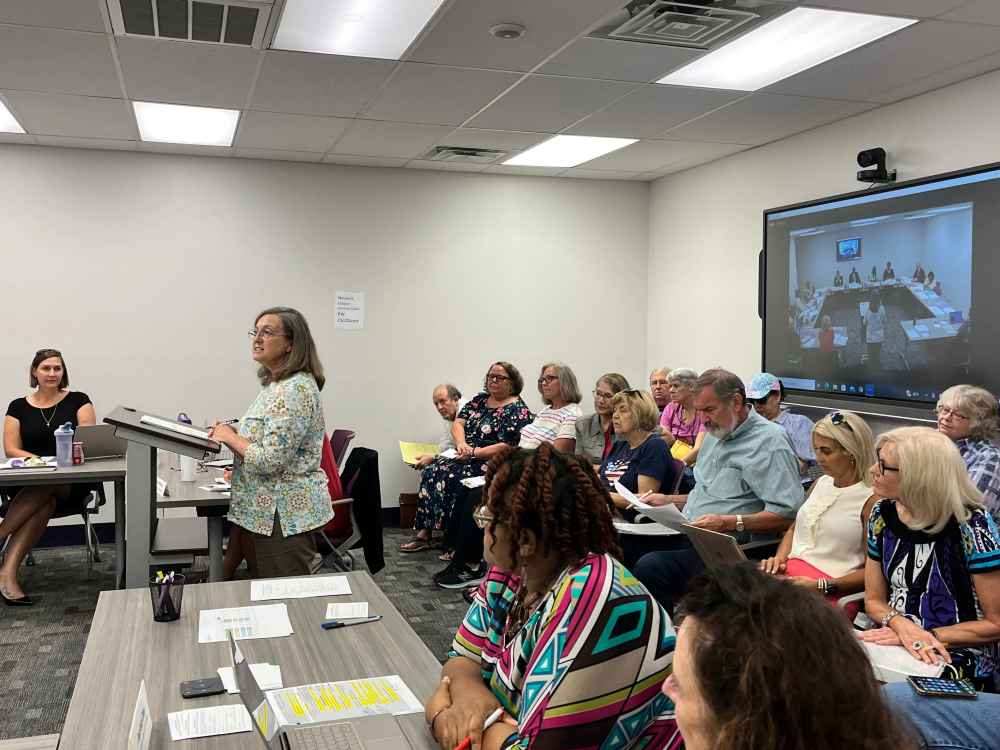

The Children’s Services Council (CSC) in Leon County responded to public concerns by voting to roll back its property-tax rate for the upcoming 2024 fiscal year

The move, a rare step for a taxing authority in Tallahassee, is expected to generate $7.63 million in revenue, which matches the current fiscal year’s amount. Paul Mitchell, the Children’s Services Council’s treasurer, and a well-known Florida lobbyist, was vocal in his support for the rolled-back rate and made the motion for its approval.

The decision came after public comments during the meeting raised concerns about the possible tax increase due to rising property values. Emily Fritz, a retiree who attended the meeting, thanked the council for choosing the roll-back rate, which was seen as a prudent decision by many attendees.

The Children’s Services Council‘s tentative budget for the 2024 fiscal year, totaling $9.63 million, was also unanimously approved by the council members.

The Children’s Services Council’s final approval for the tax rate will be subject to public hearings in September

While other local taxing authorities are pursuing property tax increases for 2024, including a nearly 10% rate hike by the City Commissioners for the Tallahassee Police Department‘s crime-fighting efforts and a 50% increase for Emergency Medical Services by County Commissioners, the Children’s Services Council’s decision reflects their responsiveness to the public’s concerns about taxation.

During the meeting, Circuit Judge Anthony Miller abstained from discussing and voting on the tax rate, adhering to Florida statutes. School Board member Darryl Jones left the meeting before the vote was taken, and two other council members, Schools Superintendent Rocky Hanna, and Tallahassee Memorial HealthCare CEO Mark O’Bryant, were absent.

In summary, the Leon County Children’s Services Council opted to roll back its property-tax rate for the 2024 fiscal year, citing public feedback and concerns about potential tax increases. This decision sets their tax rate at 34.77 cents per $1,000 of assessed property value, generating $7.63 million in revenue. The council also approved a tentative budget of $9.63 million for the upcoming fiscal year.

READ ALSO: Biden Plan: $39 Billion Student Loan Forgiveness Announced, Faces Opposition From Senator Grassley