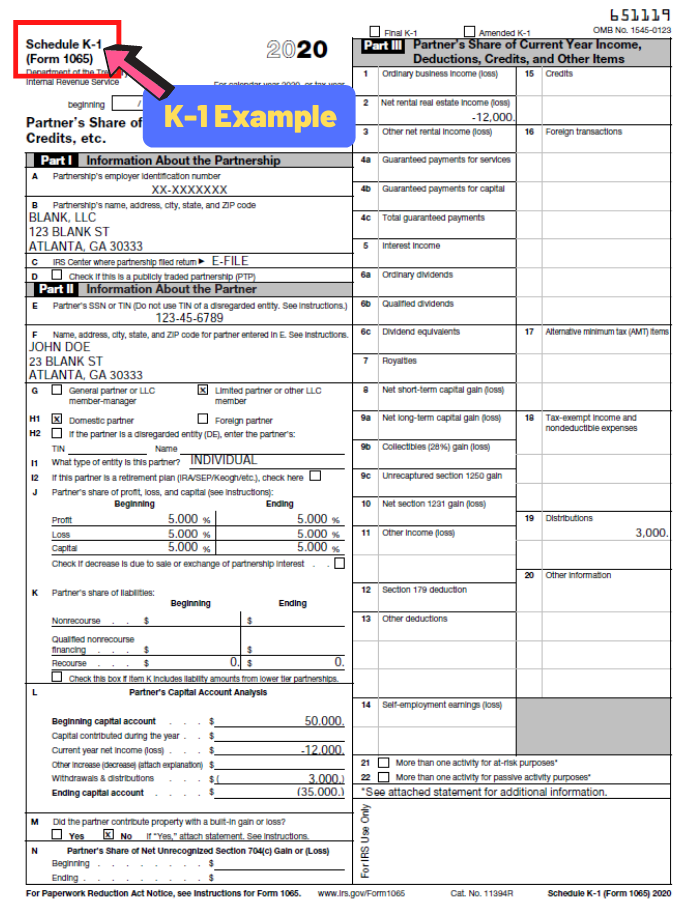

There are numerous forms that must be filed in order to pay taxes, based on what the Internal Revenue Service requires. The Schedule K1 paper is the form that will be discussed today. We are referring to a federal tax document that can be utilized to report gains, losses, and payouts for the shareholders of a S corporation or the partners in a commercial or finance entity.

The distributions of funds to recipients from trusts and estates are another common application for the K1 form. This text is intended for every important person. The partnership then submits the tax return with the activity on each partner’s K1 together with Form 1065. On form 1120-S, the S corporation summarizes its activities.

To put it briefly, there are just two ways in which a K1 can impact personal taxes. One way to do this is to make a partner’s tax responsibility higher, and another way is to provide them a tax reduction. If the K1 is linked to an income, this will probably increase their annual responsibility.

This raises the question of whether Schedule K1 counts as income as well. This kind of paper does, like a W2 or Form 1099, list taxable income. Nevertheless, this is limited to specific categories of commercial entities, including partnerships, S companies, trusts, and estates.

You may submit your Schedule K1 form with the Internal Revenue Service once you file in your Form 1065 or 1120S.