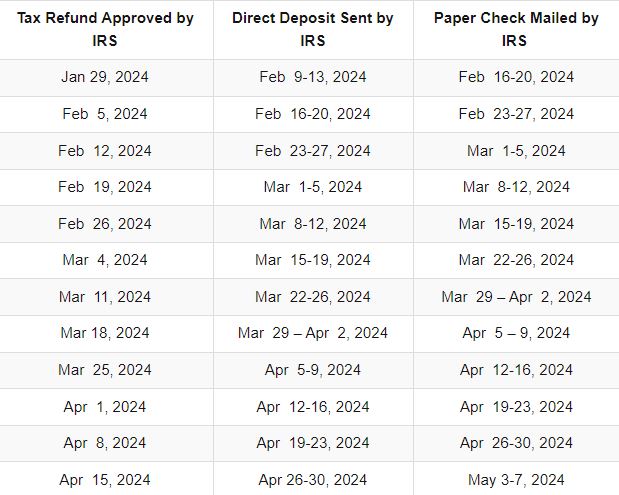

The IRS Tax Refund Calendar displays the important IRS Refund Pay Schedule 2024. Tax Refunds are expected within 21 days after electronic filing of the taxpayers. Those who filed through electronic filing by January 29, 2024, may get direct deposits or checks by February 9–13 or 16–20, 2024.

IRS Refund Pay Schedule 2024

The IRS wants a computerized method of giving tax returns in less than 21 days from 2024. The possible tax refund dates for those who filed between January 23 and January 28 are February 9–13, 2024 direct deposit, and February 16–20 checks sent by mail. Check the table of the IRS Refund Pay Schedule 2024 below.

The IRS Refund Schedule 2024 shows that you should get your refund within 21 days after filing your federal return online. It can take longer if there is a problem with your tax return or if you file on paper.

Read Also: Tax Season 2024: Frugal Tips To Maximize Your Money And Ease Financial Stress

IRS Refund Schedule 2024: IRS Tax Refund Dates

The IRS has updated the IRS Refund Schedule 2024, which is available on their official website, to assist taxpayers in understanding the crucial dates for filing tax returns. Regarding the agency, the majority of online filers will get their tax refunds in around 21 days, and they won’t have any issues with their regular tax filing process if they choose direct deposit.

Read Also: Tax Season 2024: These Are All The Documents Required For Tax Filing