This move has been widely praised by veterans who have long advocated for such a provision.

Indiana is set to implement a new law, HEA 1034, on July 1, which will eliminate state income tax for over 34,000 active duty military personnel, Reserves, and National Guard members

Air Force Veteran Lisa Wilken emphasized the importance of providing financial relief to military personnel, stating, “Our active-duty men and women work for peanuts, and if we can give them a couple of hundred dollars a year in their pockets, that’s important for us veterans because that’s what we do.” Young servicemen and women in Indiana face financial challenges, and the elimination of state income tax is expected to alleviate some of the stress on their budgets, according to veteran Kent Morgan.

For over 14 years, veterans have been pushing for this legislation, and now their efforts have paid off. However, records indicate that Indiana will experience a $20 million annual loss in state tax revenue due to the implementation of HEA 1034.

Despite the revenue loss, veterans argue that exempting military personnel from state income tax will have long-term benefits for Indiana

Brigadier General James Bauerle highlighted the tendency of service members to switch states to avoid paying income tax. He estimated that Indiana loses between 10,000 to 25,000 citizens over a 10-year period due to this issue, which can negatively impact federal funding. Having more servicemen and women in the state could result in an additional Congressman during Census time and a significant increase in federal dollars for programs like Medicaid, education, and infrastructure.

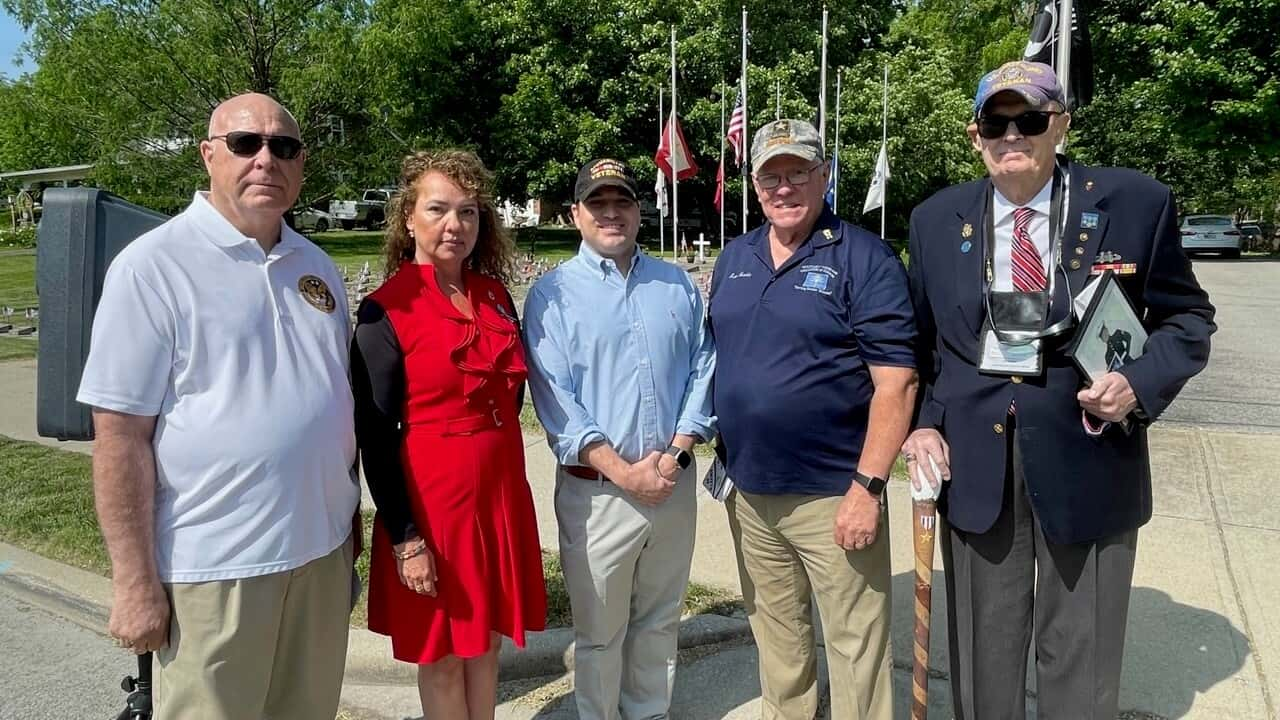

Ron Martin, chairman of the Military Veterans Coalition, stressed that the new law aims to bring Indiana’s military personnel back home. Indiana now becomes the 39th state to exempt military personnel from state income tax.

The law will automatically apply the tax exemption to eligible military personnel, requiring no additional filing. However, it’s important to note that the exemption does not extend to veterans who are no longer on active duty. The ceremonial signing of the bill took place on May 22, but some veteran advocates expressed disappointment at not being invited to the event. The Governor’s Office clarified that invitations for such ceremonies are at the discretion of the bill author, and a response is still awaited from Rep. Randy Frye, the bill’s author.

READ ALSO: Trump Appears To Have The Support He Needs In The 2024 Election