In fact, the latest analysis reveals that the overall expense of this aspect of Biden‘s plan could be twice as much as initially anticipated.

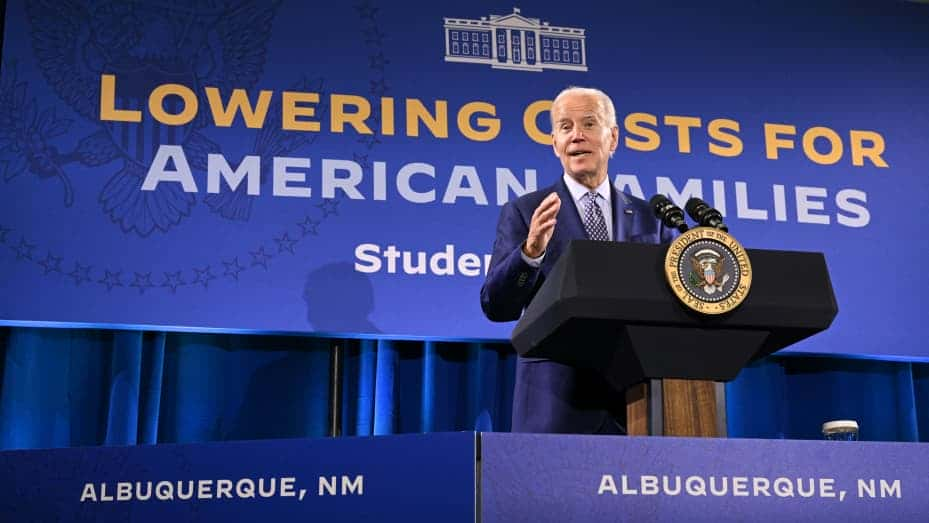

The U.S. Supreme Court’s potential rejection of President Joe Biden’s proposal to forgive up to $20,000 in federal income-based student loan repayment may not spare taxpayers from additional financial strain

Under the current system, federal income-based student loan repayment can be limited to 10 percent of a borrower’s discretionary income, defined as earnings exceeding 150 percent of the federal poverty line. Additionally, the revised rule forgives outstanding federal income-based student loan repayment balances after 10 years for borrowers with debts under $12,000 and after 20 years for others. Consequently, many federal income-based student loan repayment borrowers will experience a 50 percent reduction in their monthly payments and will need to make these smaller payments for half the previous duration before their debts are fully eliminated. This shift is likely to result in an increase in outstanding debts that borrowers will never fully repay, thereby transferring the burden to taxpayers.

The Congressional Budget Office (CBO) recently projected that the cost of implementing the revamped income-based student loan repayment rule over ten years would amount to $230 billion. If the Supreme Court blocks Biden’s initiative to cancel certain loans entirely, an additional $45 billion will be added to the overall expenditure, as more loans would fall under the new repayment rule.

The Department of Education’s estimate from last year predicted that Biden’s income-based student loan repayment plan would only cost $138 billion

However, this projection failed to consider the behavioral effects that would likely arise from reducing the number of borrowers required to repay their loans, leading to increased student borrowing. The CBO warns that these behavioral effects will drive up the final cost.

It is evident that any cost estimation for a government policy that overlooks the influence of incentives lacks credibility. Unfortunately, the Department of Education has consistently prioritized politically favorable price tags over reliable analysis. A Government Accountability Office report from 2022 uncovered that the department incurred a loss of $197 billion from various income-based student loan repayment programs between 1997 and 2021, contradicting their projected positive return of $114 billion during the same period.

Rather than addressing the underlying causes of this financial predicament, such as government subsidies inflating costs, President Biden’s approach appears to exacerbate the situation. It is highly likely that the income-based student loan repayment plan aimed at assisting struggling student loan borrowers will inadvertently encourage more students to take out loans that will ultimately remain unpaid.

READ ALSO: Debt Forgiveness Expectations Lead Student Loan Recipients To Increased Spending, Survey Finds